- DXY met strong resistance in the 90.70/75 band on Monday.

- Higher US yields keep fuelling the recovery of the index.

- NFIB Index, IBD/TIPP Index, Fedspeak next of note in the docket.

The greenback, when gauged by the US Dollar Index (DXY), appears to have met some important resistance in the 90.70 region at the beginning of the week.

US Dollar Index looks to yields, US politics

The index struggles to extend the recovery further north of the 90.70/75 band on turnaround Tuesday and forces the dollar to shed some ground for the first time after four consecutive daily gains.

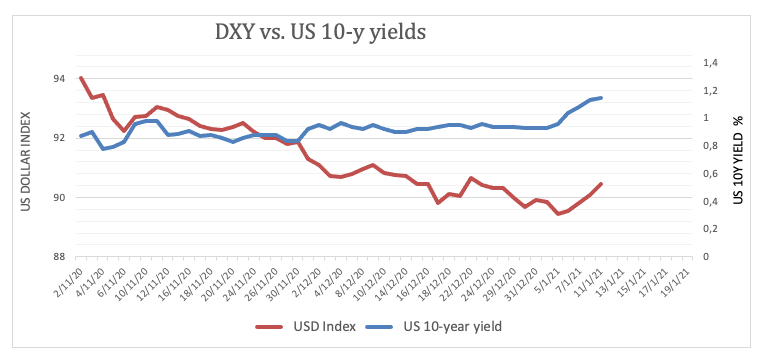

As usual in past sessions, the uptick in US yields remains the key driver behind the recent move in the greenback. It is worth recalling that yields of the key US 10-year reference navigate levels last seen in March 2020 around 1.15%.

On the political front, investors and the FX universe appear to look past the potential impeachment of President Trump, focusing instead on the likely increase of fiscal stimulus under a Biden’s administration and the impact on inflation expectations.

In the US data space, the NFIB Index is due in the first turn seconded by the IBD/TIPP Index, JOLTs Job Openings and the API’s report on US crude oil supplies. In addition, Atlanta Fed R.Bostic (voter, centrist) is due to speak followed by FOMC’s L.Brainard (permanent voter, dovish), Dallas Fed R.Kaplan (2023 voter, hawkish), Cleveland Fed L.Mester (2022 voter, hawkish) and KC Fed E.George (2022 voter, hawkish).

What to look for around USD

The index regained buying interest after bottoming out in the 89.20 area in the first trading week of the new year and managed to advance to the proximity of 90.70 so far this week. The recovery in US yields keeps lending support to the greenback as investors continue to perceive a potential pick-up in inflation pressure/expectations in response to the most likely increment in fiscal stimulus under a Democrat White House. However, the outlook for the greenback remains fragile in the short/medium-term for the time being amidst massive monetary/fiscal stimulus in the US economy, the “lower for longer” stance from the Federal Reserve and prospects of a strong recovery in the global economy.

US Dollar Index relevant levels

At the moment, the index is losing 0.11% at 90.36 and faces immediate contention at 89.20 (2021 low Jan.6) followed by 88.94 (monthly low March 2018) and the 88.25 (monthly low February 2018). On the other hand, a breakout of 90.72 (2021 high Jan.11) would open the door to 91.01 (weekly high Dec.21) and finally 91.23 (weekly high Dec.7).