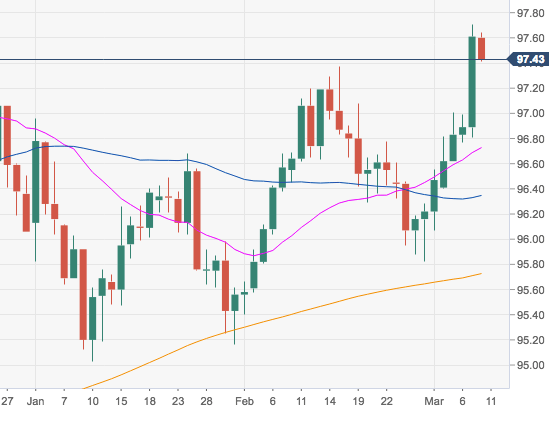

- The buying pressure around the greenback remains well and sound, although the index is partially fading yesterday’s advance to fresh 2019 highs in the 97.70/75 band.

- Further gains in DXY now targets the 98.00 neighbourhood, monthly highs seen in June 2017.

- The constructive stance in the buck should stay unchanged while above the critical 200-day SMA at 95.72.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 97.46

Today Daily change: 24 pips

Today Daily change %: -0.15%

Today Daily Open: 97.61

Trends:

Daily SMA20: 96.69

Daily SMA50: 96.29

Daily SMA100: 96.53

Daily SMA200: 95.71

Levels:

Previous Daily High: 97.71

Previous Daily Low: 96.81

Previous Weekly High: 96.61

Previous Weekly Low: 95.82

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 97.37

Daily Fibonacci 61.8%: 97.15

Daily Pivot Point S1: 97.04

Daily Pivot Point S2: 96.48

Daily Pivot Point S3: 96.14

Daily Pivot Point R1: 97.94

Daily Pivot Point R2: 98.28

Daily Pivot Point R3: 98.84