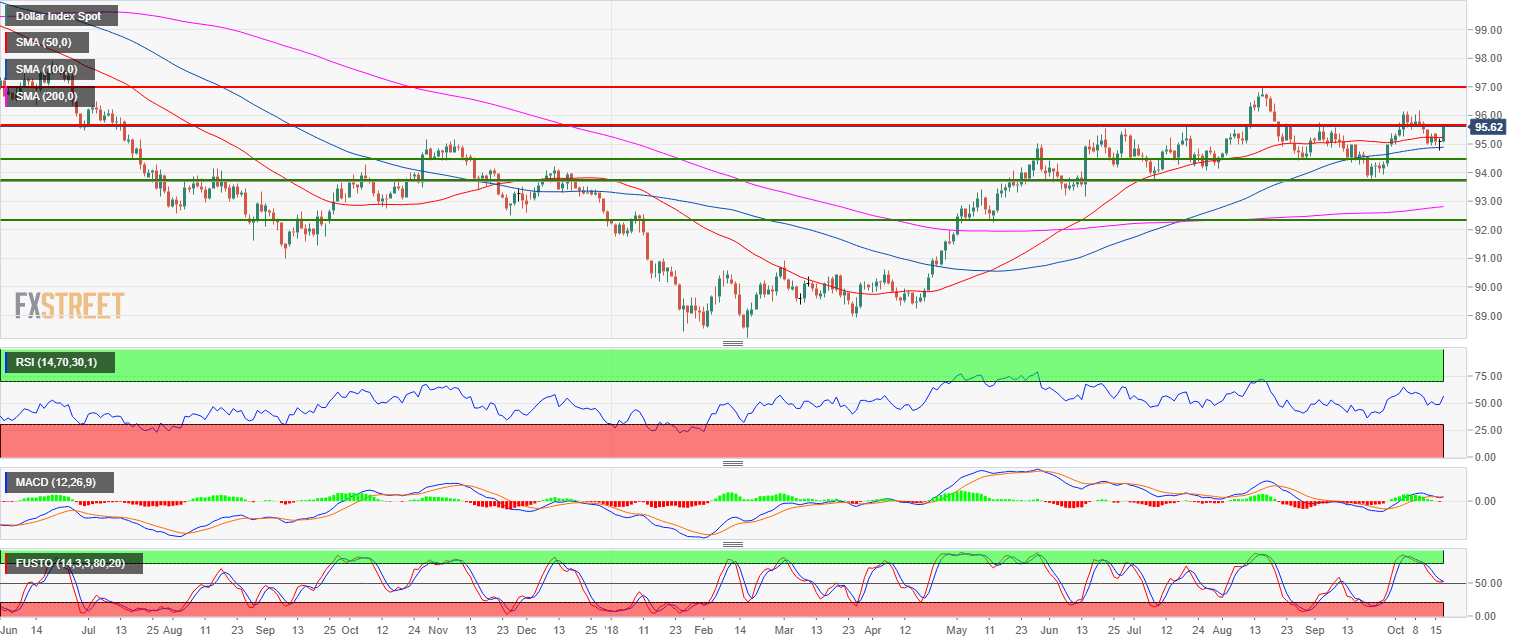

- The US Dollar Index (DXY) moved sharply higher this Wednesday as it is set to close the day just below 95.65 multi-month resistance.

- DXY is trading above its relatively flat 50, 100 and 200-period simple moving averages (SMA) while the RSI and Stochastic indicators are trading above the 50 line which is rather constructive for bulls.

- A break above 95.65 on a daily closing basis would be seen as a sign of strength by the bulls. The main target to the upside is the 2018 high at the 97.00 figure.

DXY daily chart

Spot rate: 95.63

Relative change: 0.57%

High: 95.63

Low: 95.06

Trend: Bullish

Resistance 1: 95.65 multi-month resistance (key level)

Resistance 2: 96.00 figure

Resistance 3: 96.41 August 20 high

Resistance 4: 97.00 current 2018 high

Support 1: 95.52 August 6 high

Support 2: 95.24 July 13 high

Support 3: 95.00 figure

Support 4: 94.91 July 27 high

Support 5: 94.43 August 28 swing low

Support 6: 93.81 September 21 swing low (key level)