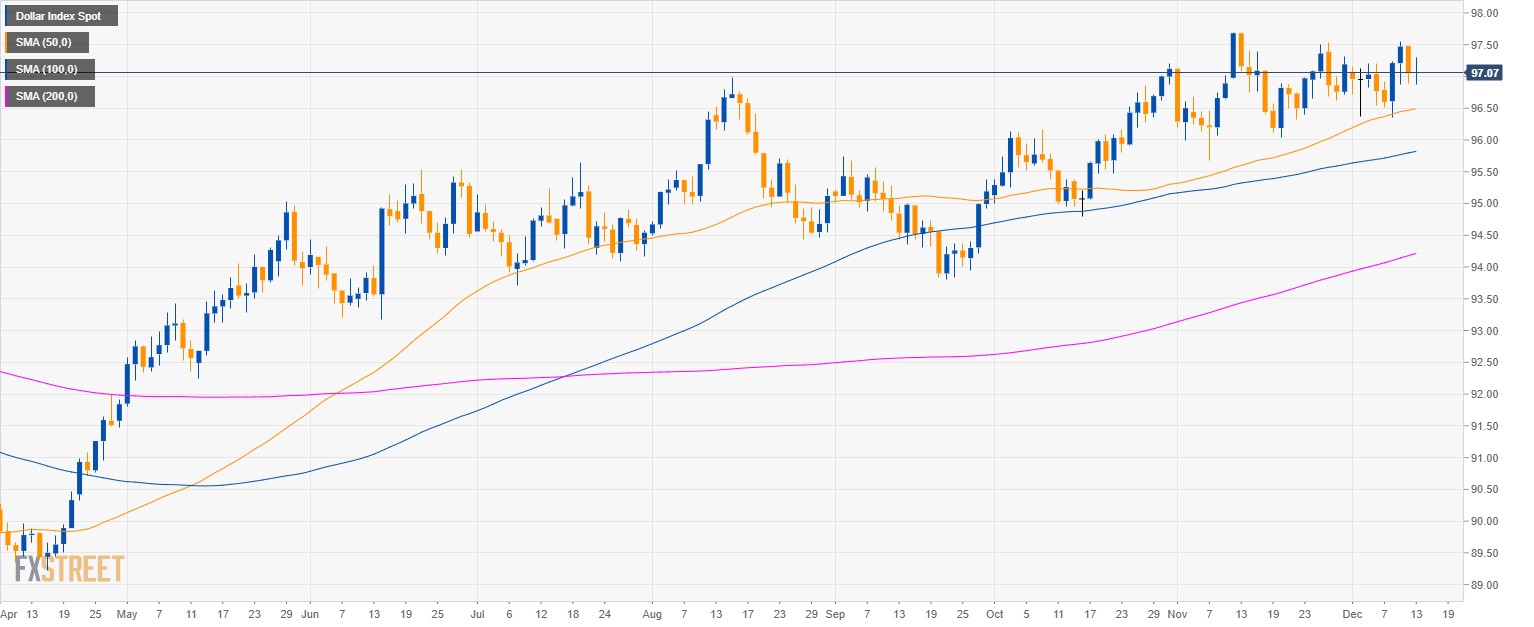

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above the 200-period simple moving average (SMA).

- DXY printed a small doji bar this Thursday, hardly a strong bullish continuation pattern.

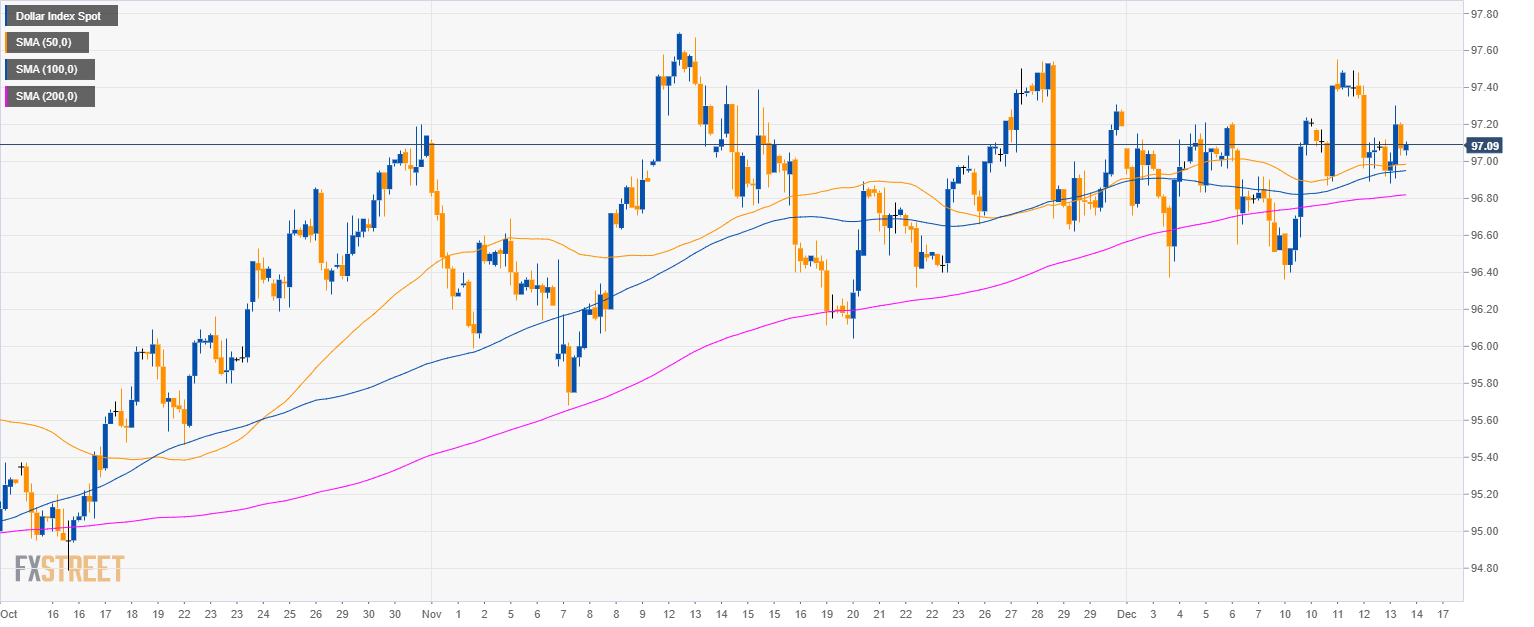

DXY 4-hour chart

- DXY is maintaining the price above the 97.00 level and the 50, 100 and 200 SMAs.

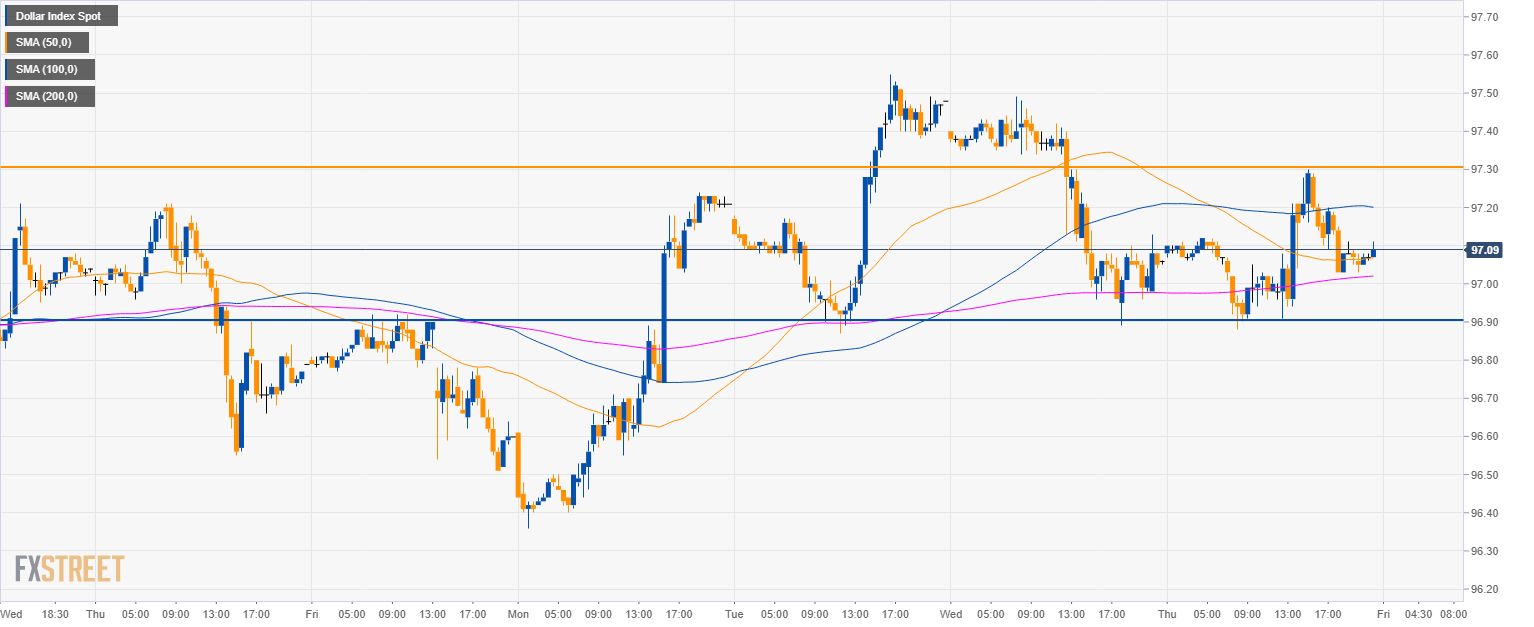

DXY 30-minute chart

- DXY is trapped in a range between the 96.90 and 97.30 levels.

- Bears have a slight advantage as 96.90 can be the next target.

Additional key resistance

Dollar Index Spot

Overview:

Today Last Price: 97.09

Today Daily change: 4.0 pips

Today Daily change %: 0.0412%

Today Daily Open: 97.05

Trends:

Previous Daily SMA20: 96.9

Previous Daily SMA50: 96.47

Previous Daily SMA100: 95.8

Previous Daily SMA200: 94.18

Levels:

Previous Daily High: 97.49

Previous Daily Low: 96.89

Previous Weekly High: 97.21

Previous Weekly Low: 96.37

Previous Monthly High: 97.7

Previous Monthly Low: 95.68

Previous Daily Fibonacci 38.2%: 97.12

Previous Daily Fibonacci 61.8%: 97.26

Previous Daily Pivot Point S1: 96.8

Previous Daily Pivot Point S2: 96.54

Previous Daily Pivot Point S3: 96.2

Previous Daily Pivot Point R1: 97.4

Previous Daily Pivot Point R2: 97.74

Previous Daily Pivot Point R3: 98