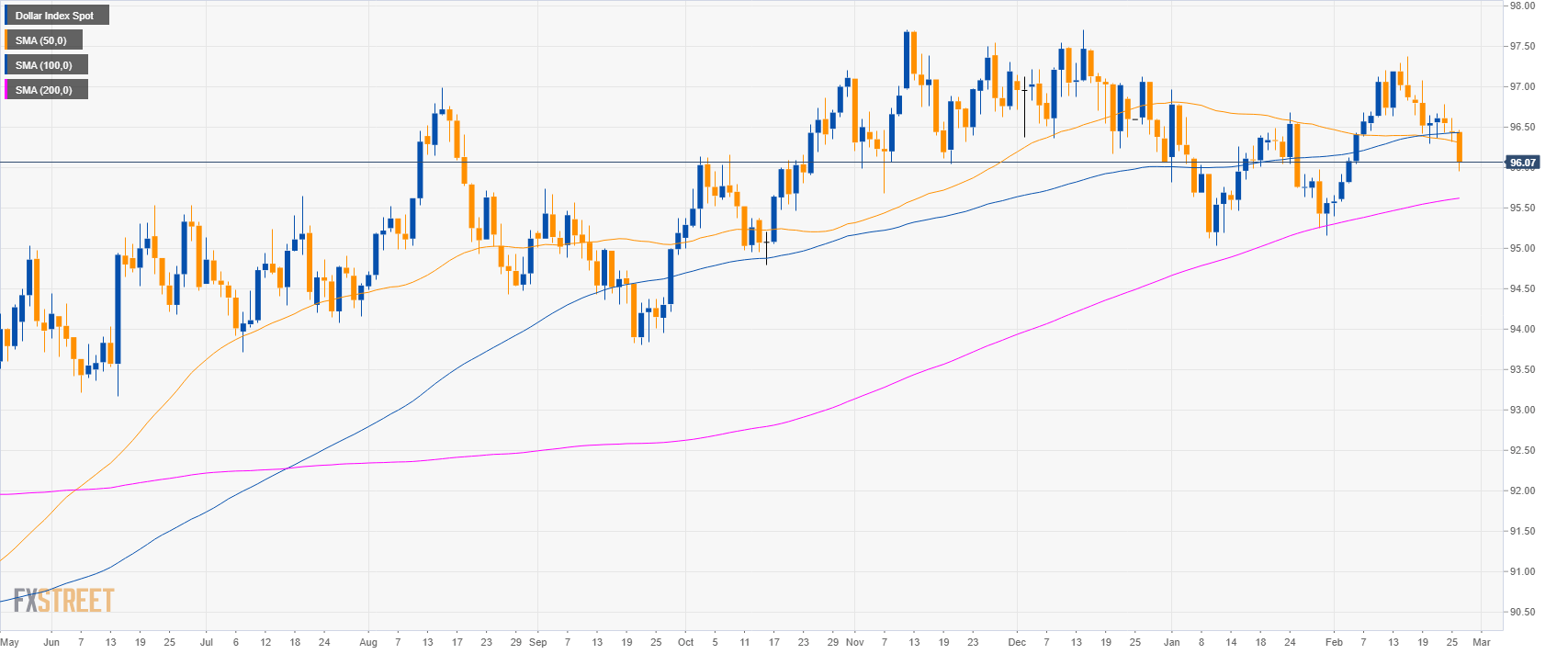

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its 200-day simple moving averages (SMA).

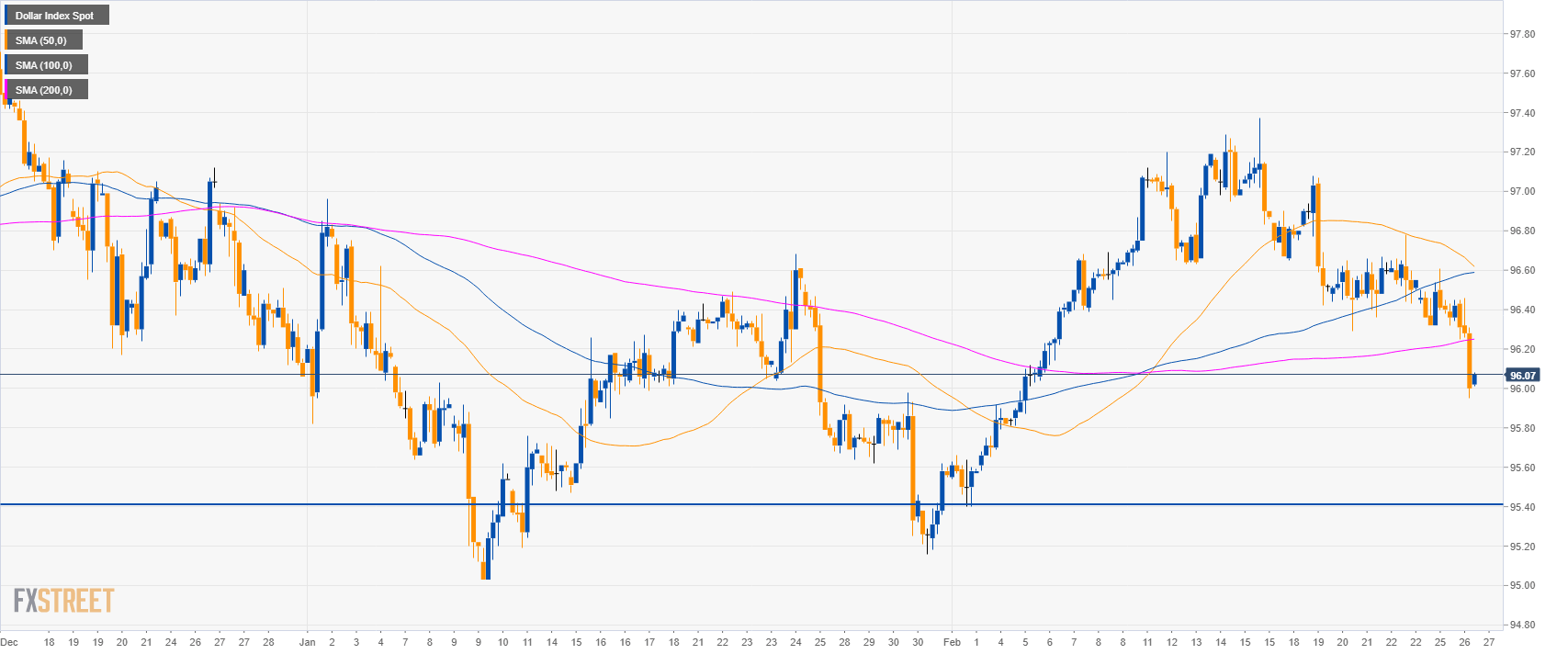

DXY 4-hour chart

- DXY is trading below its main SMAs suggesting a bearish bias.

- The 95.40 bear target remains in place.

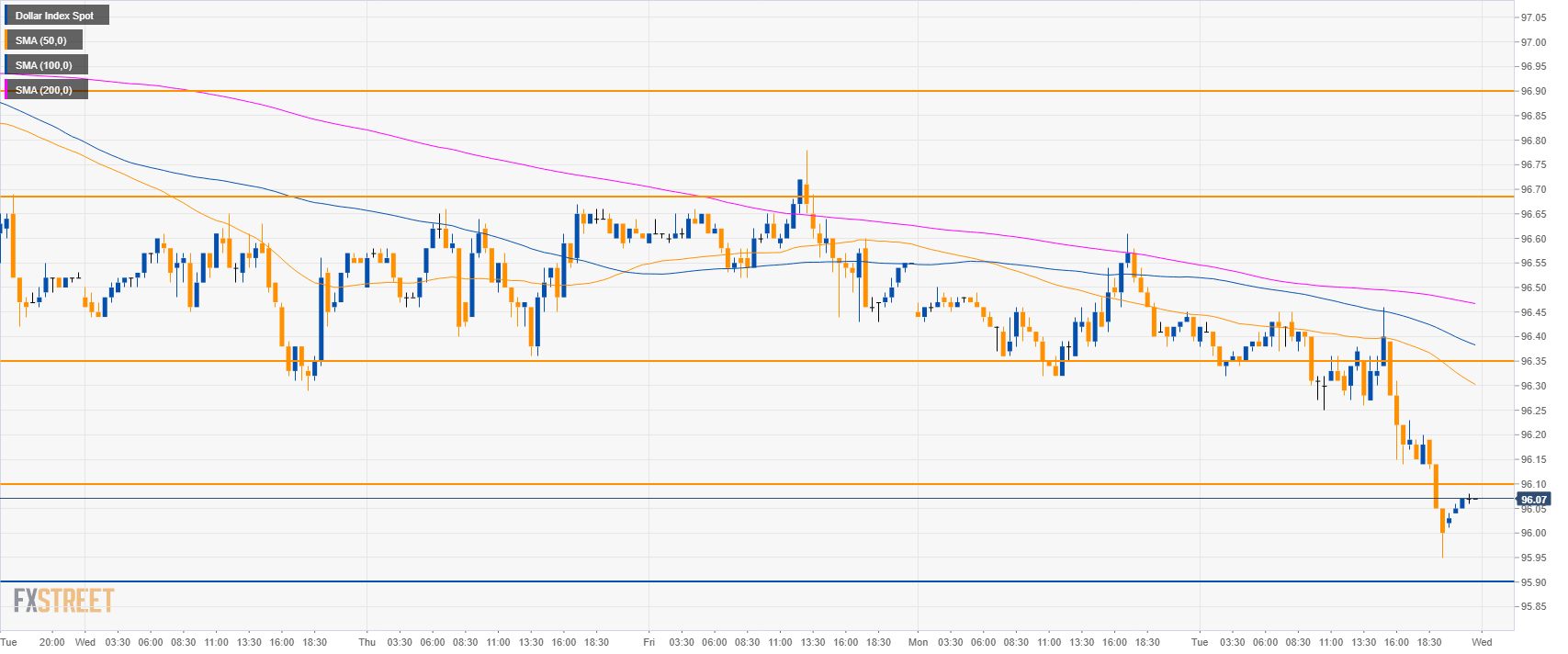

DXY 30-minute chart

- DXY is trading below the main SMAs suggesting a bearish bias in the short-term.

- The 96.10 target has been reached while 95.90 is still on the cards for bears in the short-term.

- To the upside, resistances are located at 96.10 and 96.35 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.07

Today Daily change: -37 ticks

Today Daily change %: -0.38%

Today Daily Open: 96.44

Trends:

Daily SMA20: 96.41

Daily SMA50: 96.33

Daily SMA100: 96.43

Daily SMA200: 95.61

Levels:

Previous Daily High: 96.61

Previous Daily Low: 96.32

Previous Weekly High: 97.08

Previous Weekly Low: 96.29

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.43

Daily Fibonacci 61.8%: 96.5

Daily Pivot Point S1: 96.3

Daily Pivot Point S2: 96.17

Daily Pivot Point S3: 96.01

Daily Pivot Point R1: 96.59

Daily Pivot Point R2: 96.75

Daily Pivot Point R3: 96.88