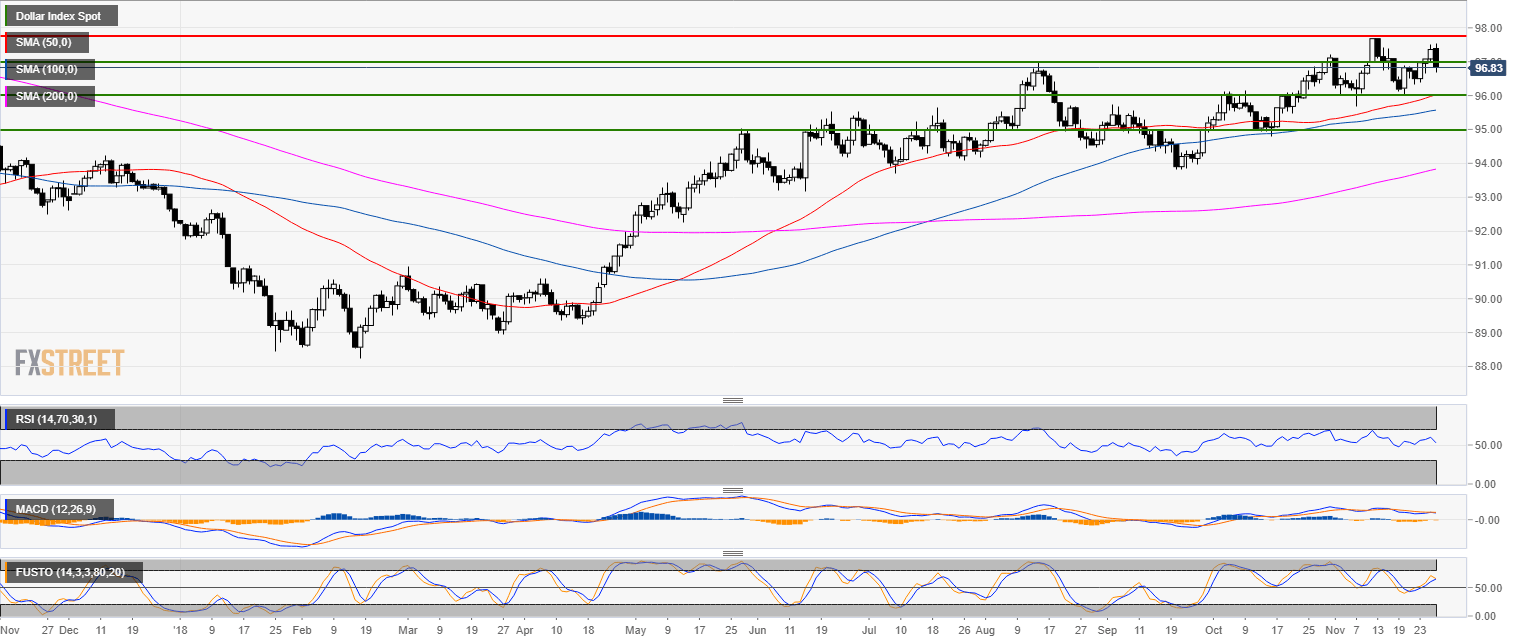

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages.

- Today’s down move was triggered by dovish comments from Fed’s Powell.

- Bears are set to close below the 97.00 psychological level as technical indicators are decelerating.

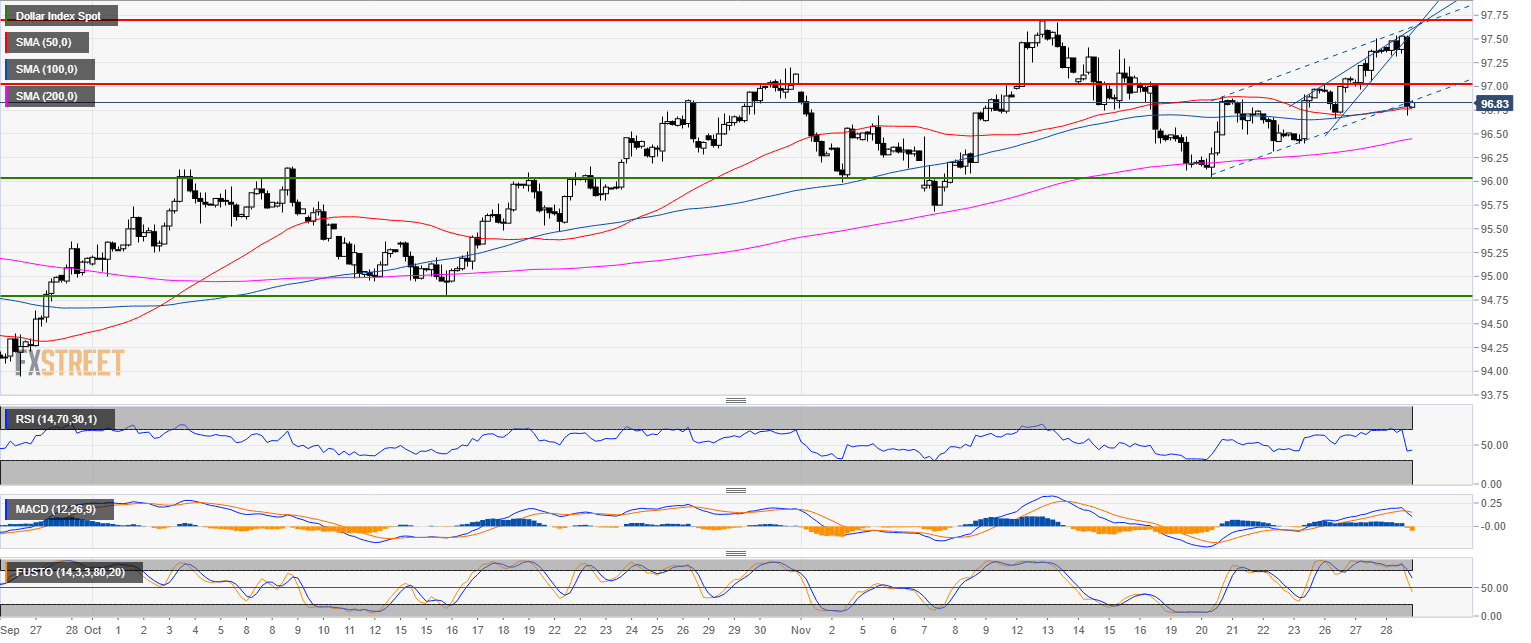

DXY 4-hour chart

- DXY plunged down to find some support at the 50 SMA.

- 97.00 and 97.25 become the new resistances.

- Technical indicators have turned bearish suggesting potential losses ahead.

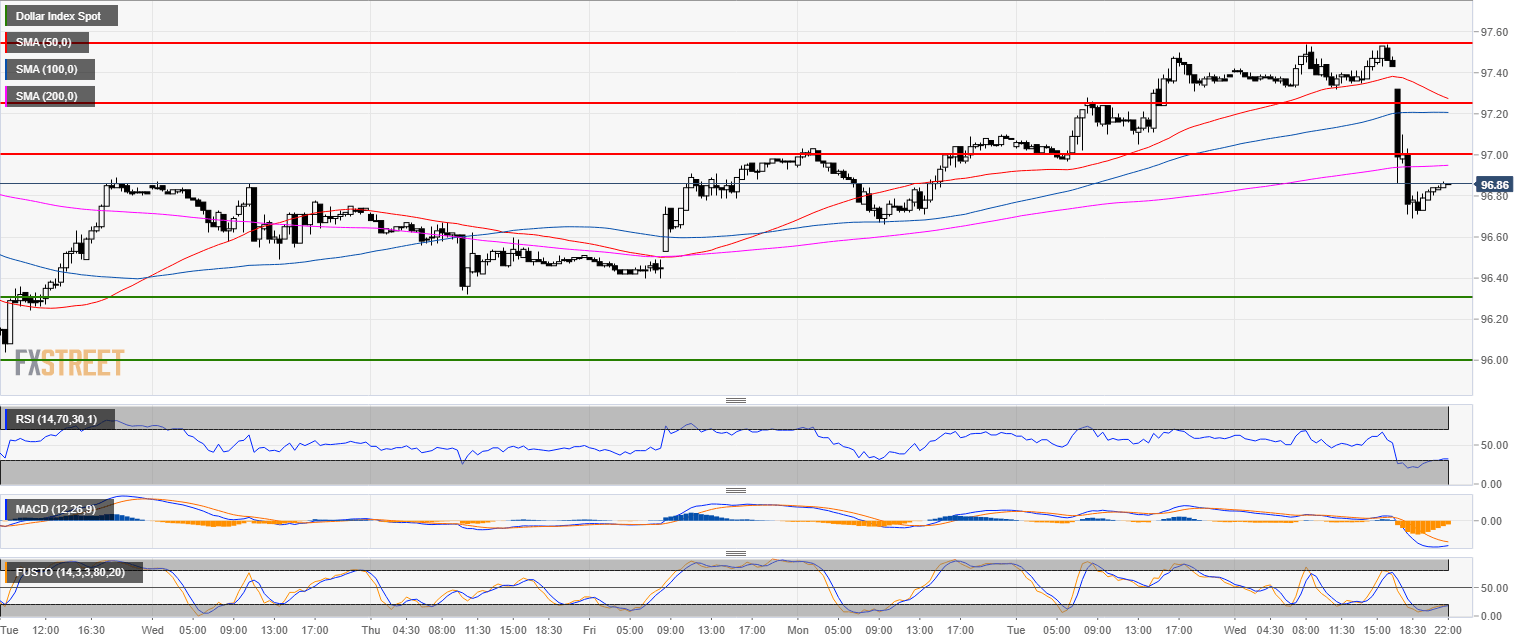

DXY 30-minute chart

- After the fresh sell-off, there can be a pullback up to 97.00 as the market might want to test the 200 SMA and the round number.

- If the bears keep the momentum going the next main target to the downside is likely located near the 96.30 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.86

Today Daily change: -50 pips

Today Daily change %: -0.514%

Today Daily Open: 97.36

Trends:

Previous Daily SMA20: 96.76

Previous Daily SMA50: 95.98

Previous Daily SMA100: 95.55

Previous Daily SMA200: 93.79

Levels:

Previous Daily High: 97.5

Previous Daily Low: 96.97

Previous Weekly High: 96.98

Previous Weekly Low: 96.04

Previous Monthly High: 97.2

Previous Monthly Low: 94.79

Previous Daily Fibonacci 38.2%: 97.3

Previous Daily Fibonacci 61.8%: 97.17

Previous Daily Pivot Point S1: 97.05

Previous Daily Pivot Point S2: 96.75

Previous Daily Pivot Point S3: 96.52

Previous Daily Pivot Point R1: 97.58

Previous Daily Pivot Point R2: 97.81

Previous Daily Pivot Point R3: 98.11