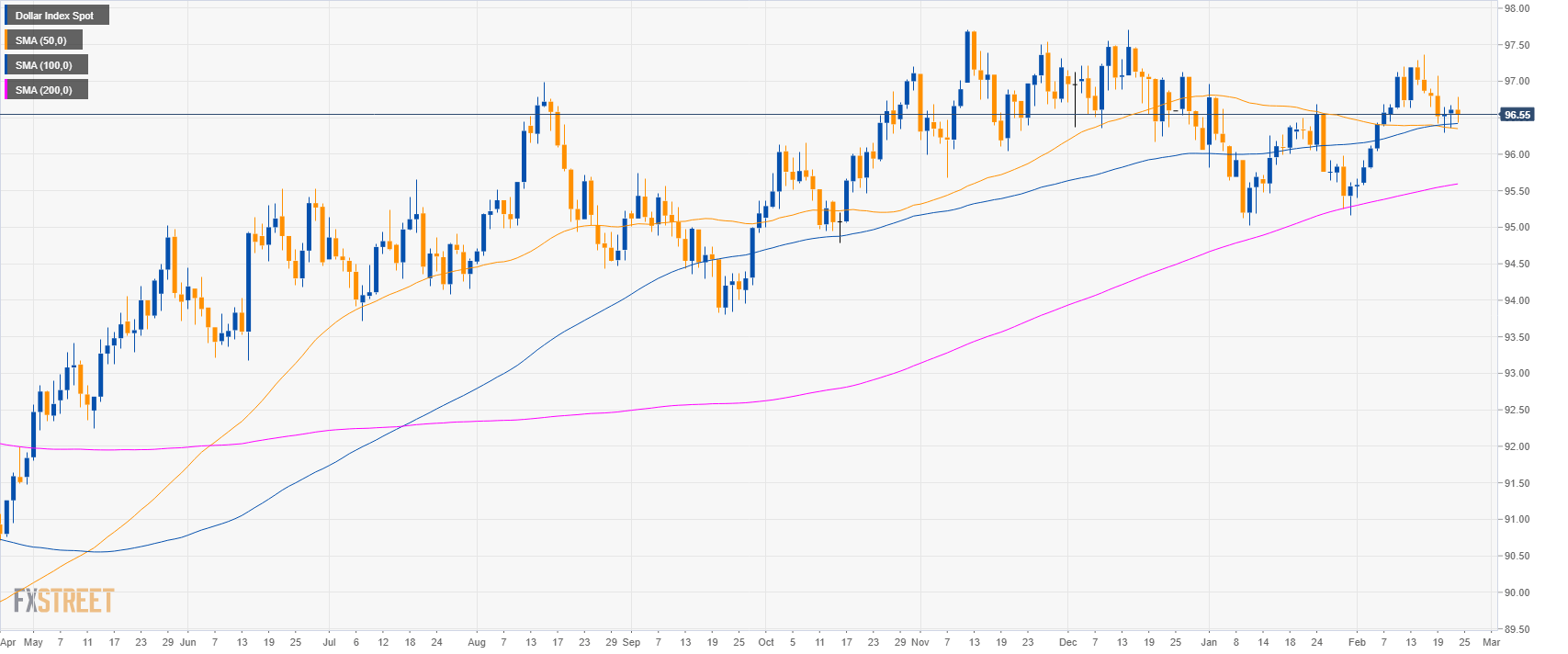

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages (SMAs).

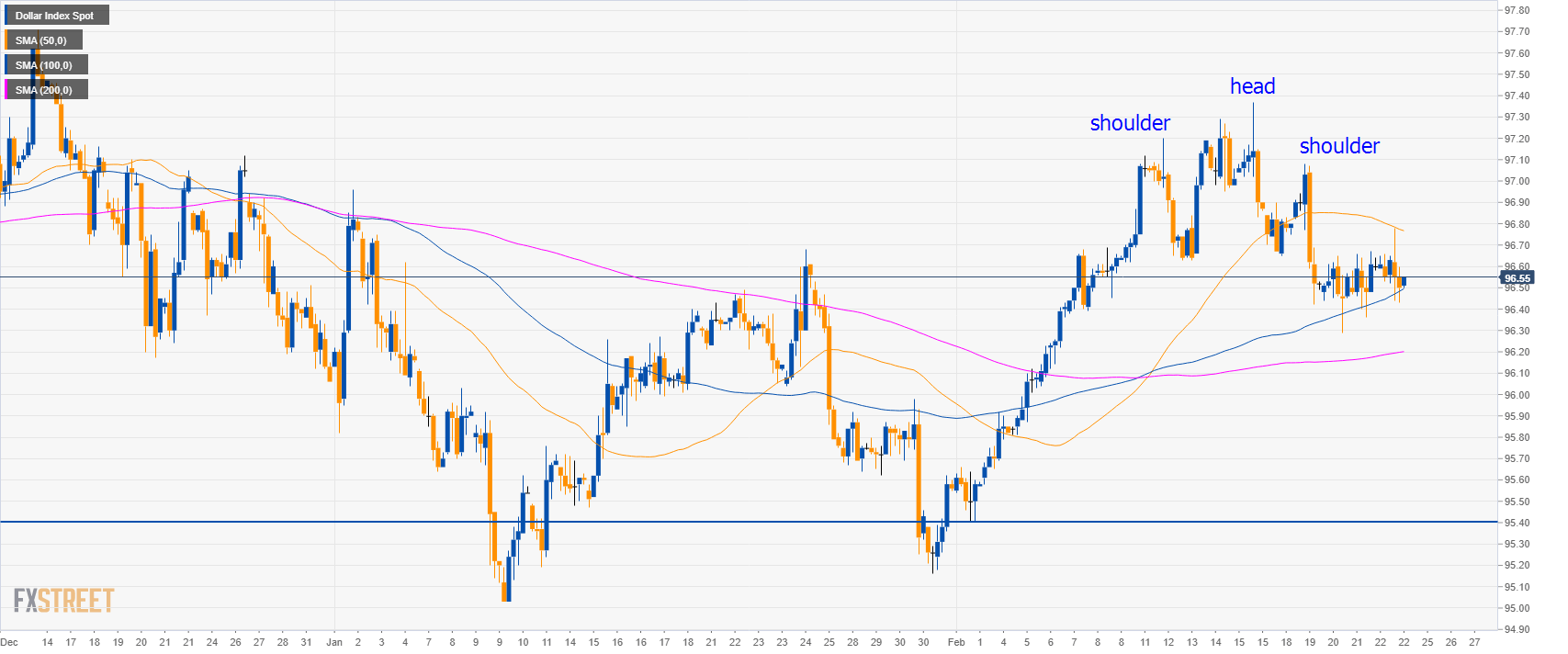

DXY 4-hour chart

- The head-and-shoulders pattern suggests continued weakness ahead with 95.40 as main support.

- Resistances are at 96.70 and 97.10 level.

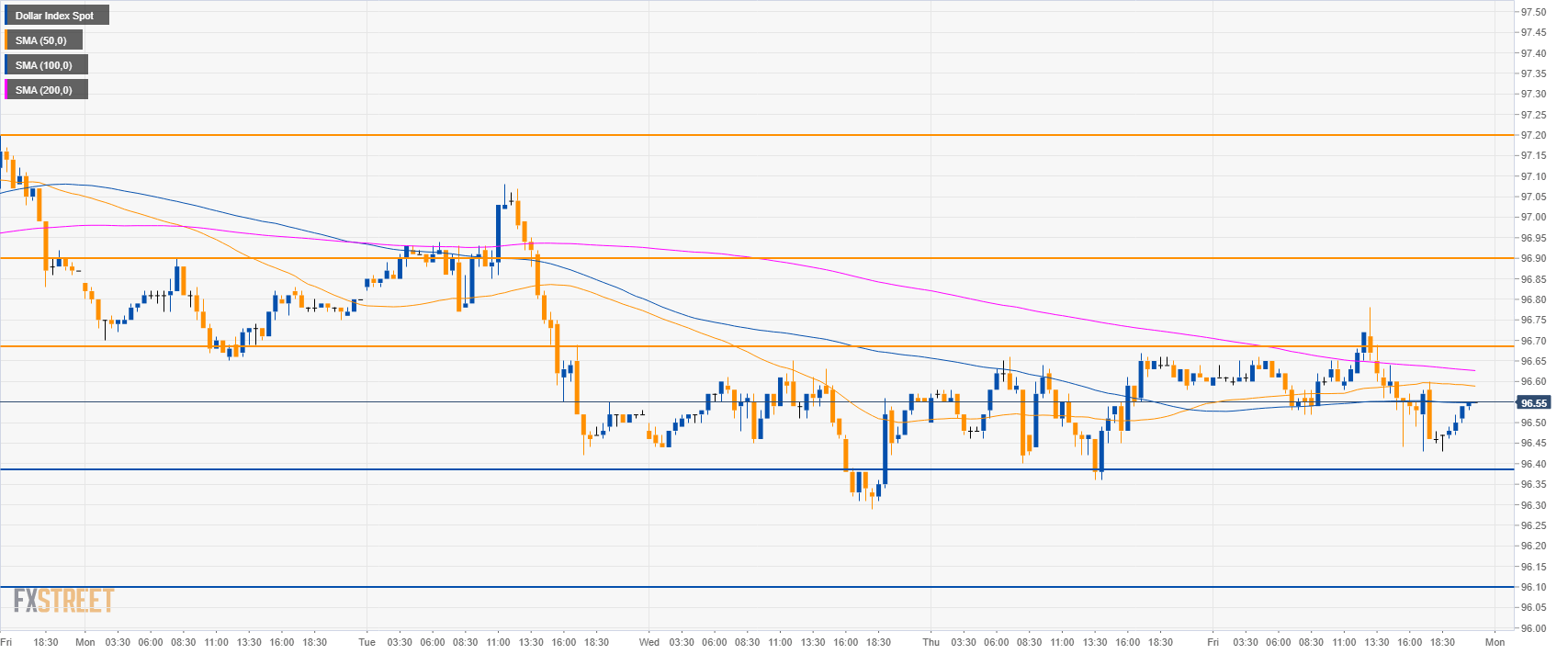

DXY 30-minute chart

- DXY is trading below the main SMAs suggesting a bearish market in the short-term.

- Bears should try to break below 96.40 to get to 96.10, 95.90 and 95.40 to the downside.

- To the upside, resistances are at 96.70 and 96.90 level.

Additional key levels:

Dollar Index Spot

Overview:

Today Last Price: 96.55

Today Daily change: -6 pips

Today Daily change %: -0.06%

Today Daily Open: 96.61

Trends:

Daily SMA20: 96.34

Daily SMA50: 96.36

Daily SMA100: 96.41

Daily SMA200: 95.58

Levels:

Previous Daily High: 96.67

Previous Daily Low: 96.36

Previous Weekly High: 97.37

Previous Weekly Low: 96.62

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.55

Daily Fibonacci 61.8%: 96.48

Daily Pivot Point S1: 96.42

Daily Pivot Point S2: 96.24

Daily Pivot Point S3: 96.11

Daily Pivot Point R1: 96.73

Daily Pivot Point R2: 96.86

Daily Pivot Point R3: 97.04