- DXY (US Dollar Index) is about to end the day marginally higher this Tuesday.

- The level to beat for buyers is the 98.10 key resistance.

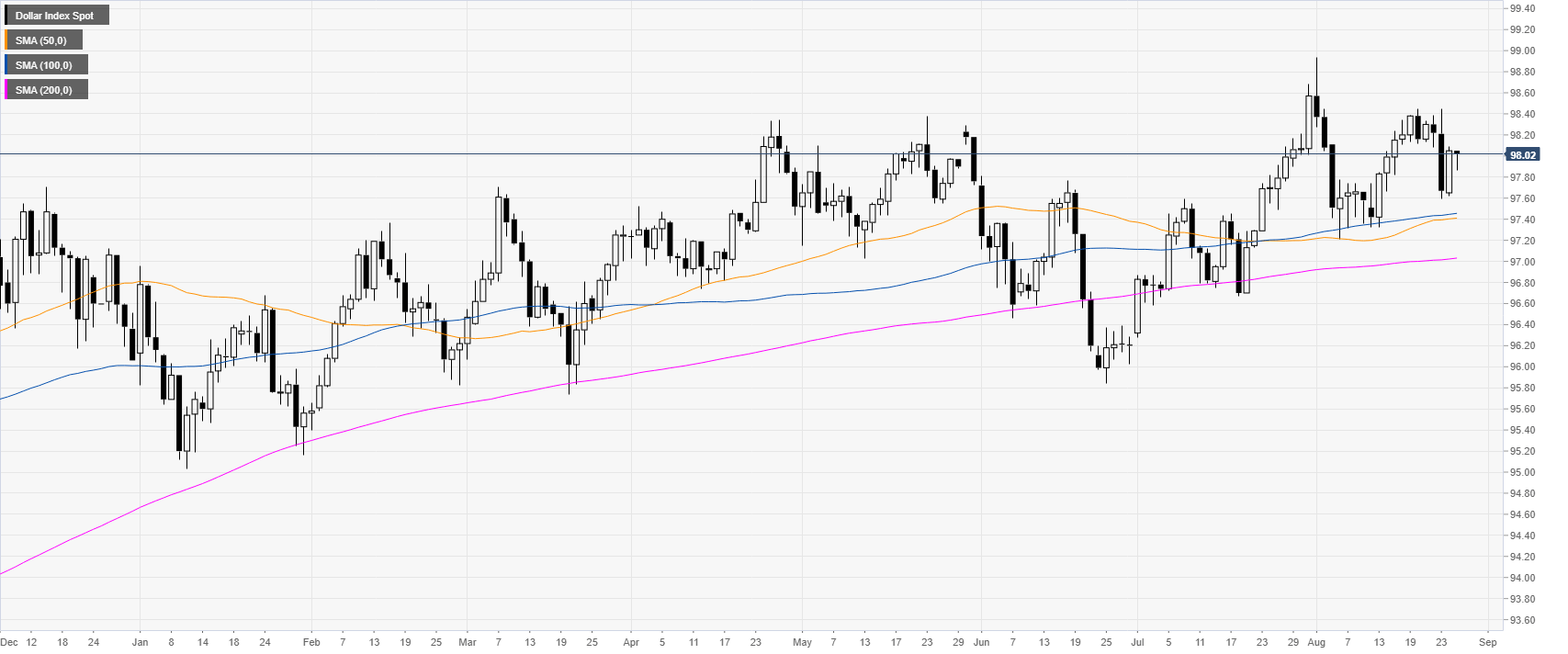

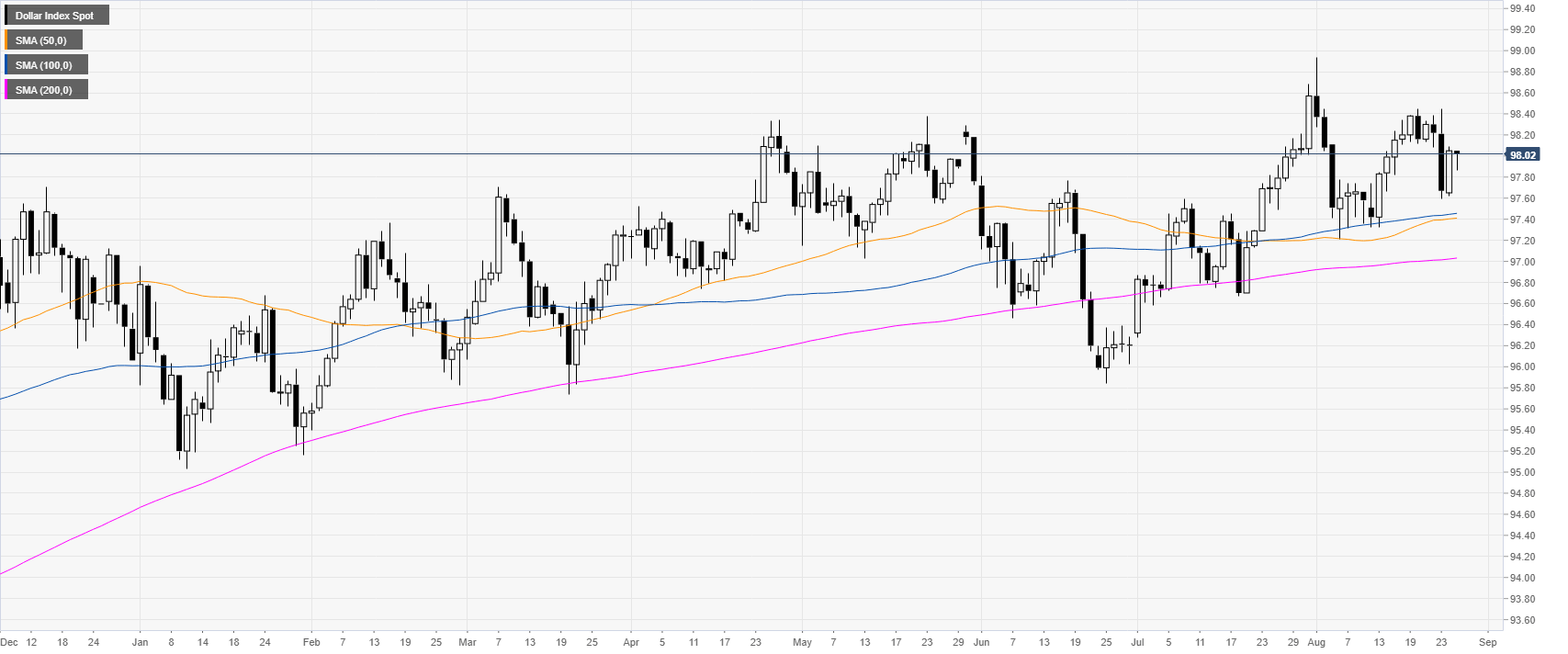

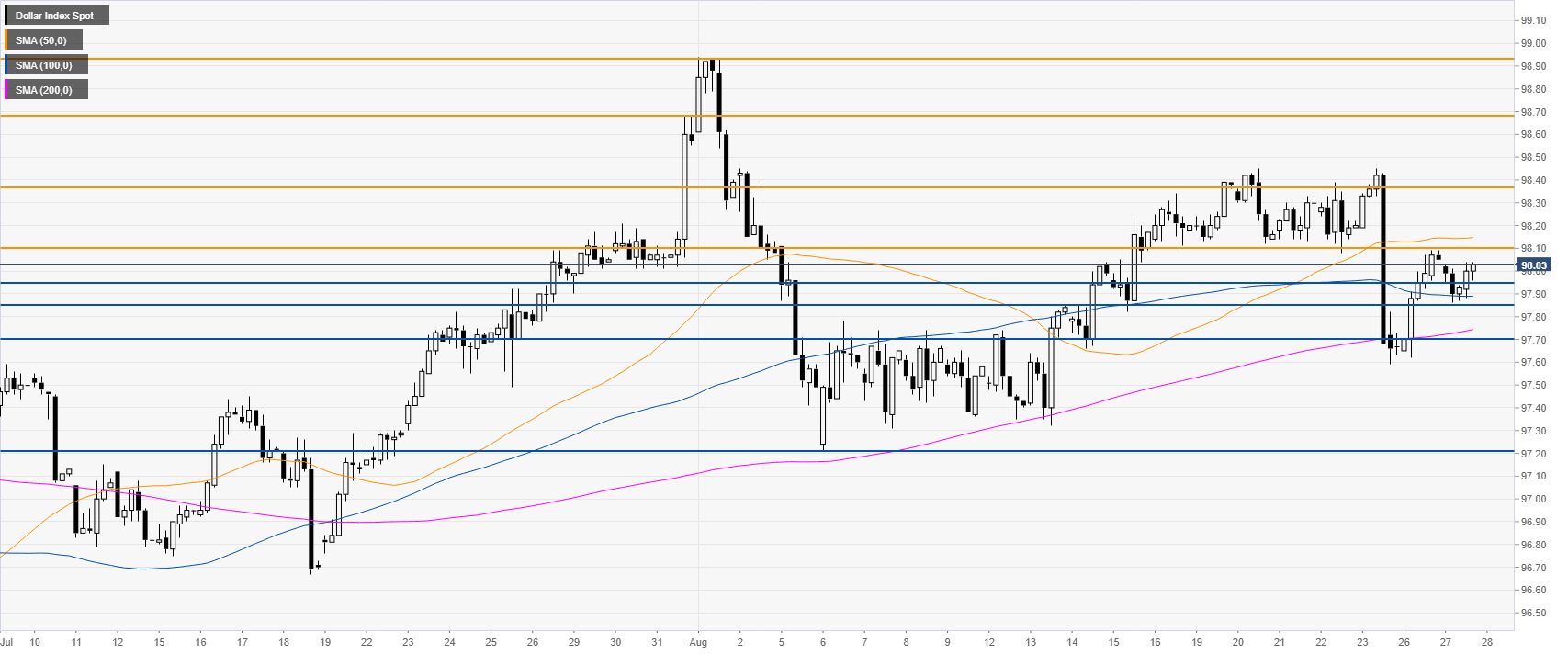

DXY daily chart

DXY (US Dollar Index) is in a bull trend above its main daily simple moving averages (DSMAs). The market is about to close near its daily high.

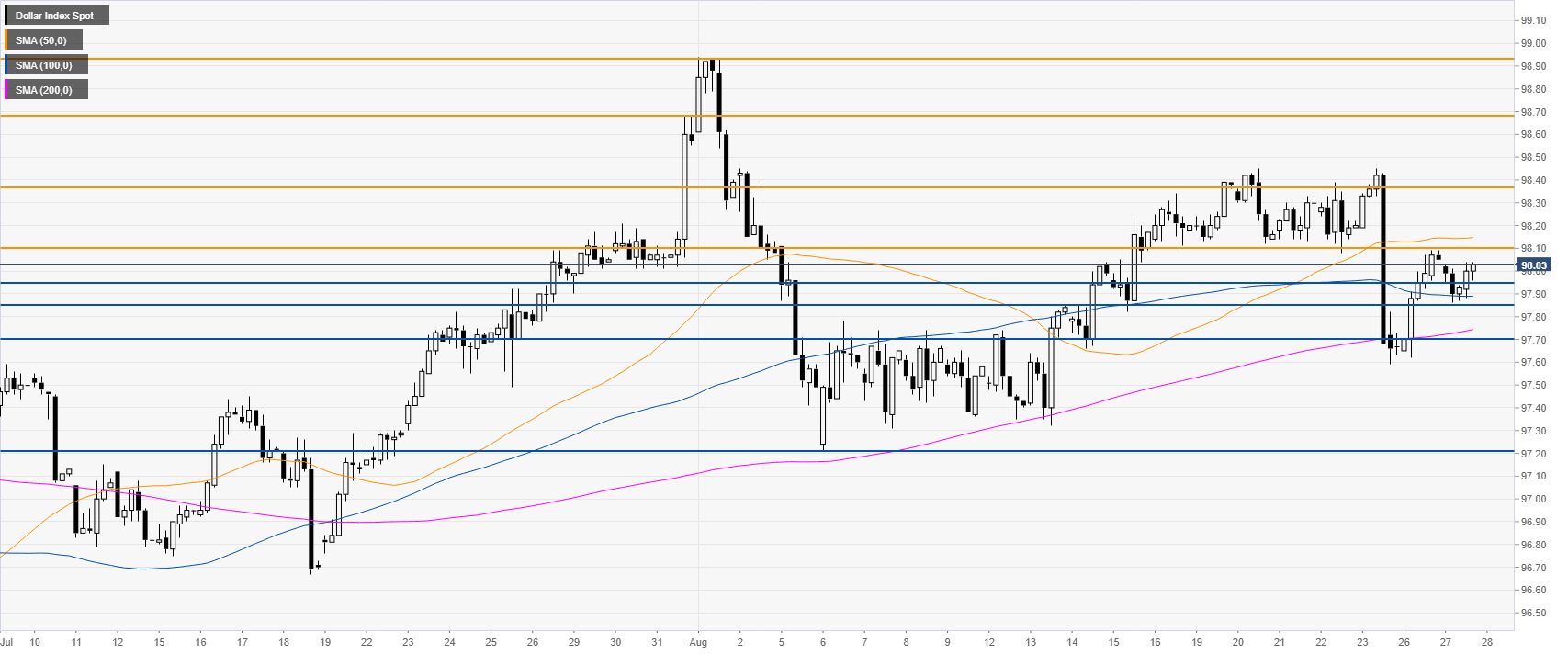

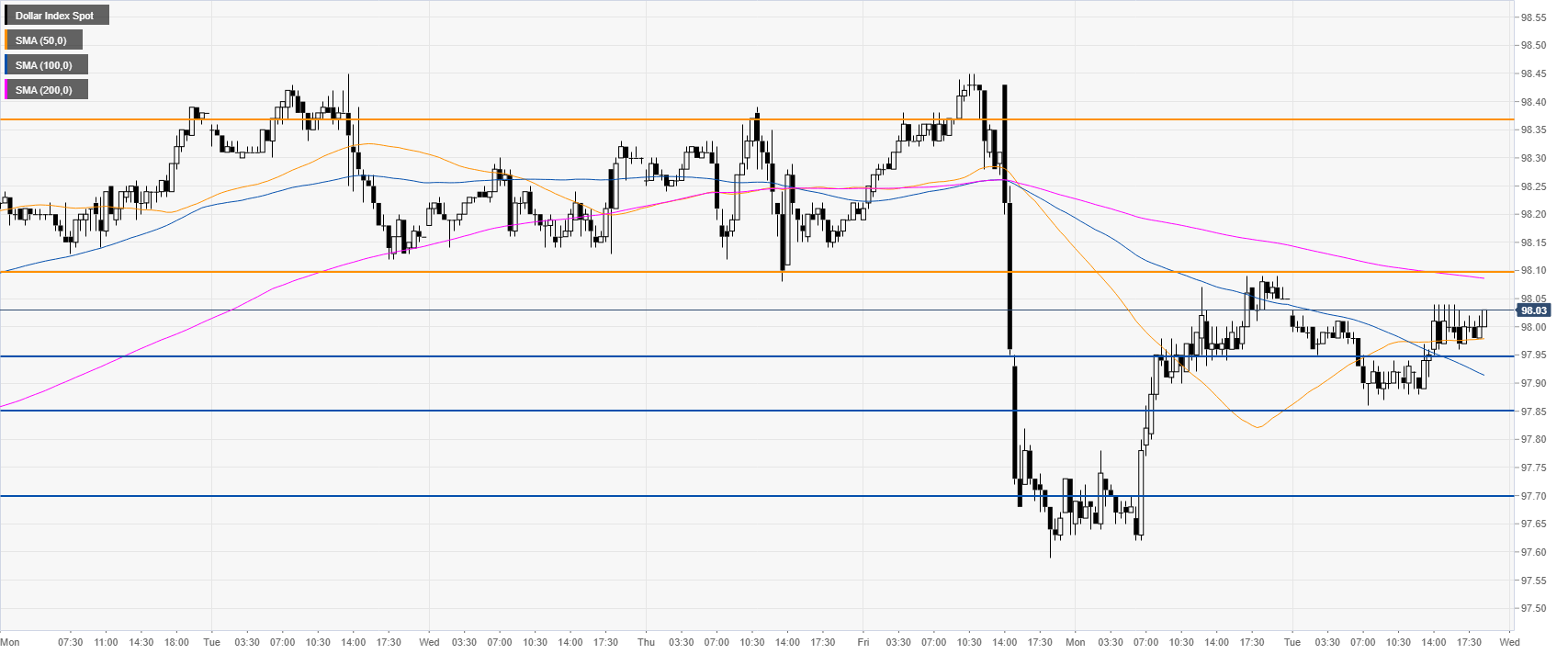

DXY 4-hour chart

DXY is about to end Tuesday near a critical resistance at the 98.10 level. It is unclear if the current move up is only a correction of last Friday’s drop. However, a sustained break above 98.10 could see 98.38 revisited on the way up.

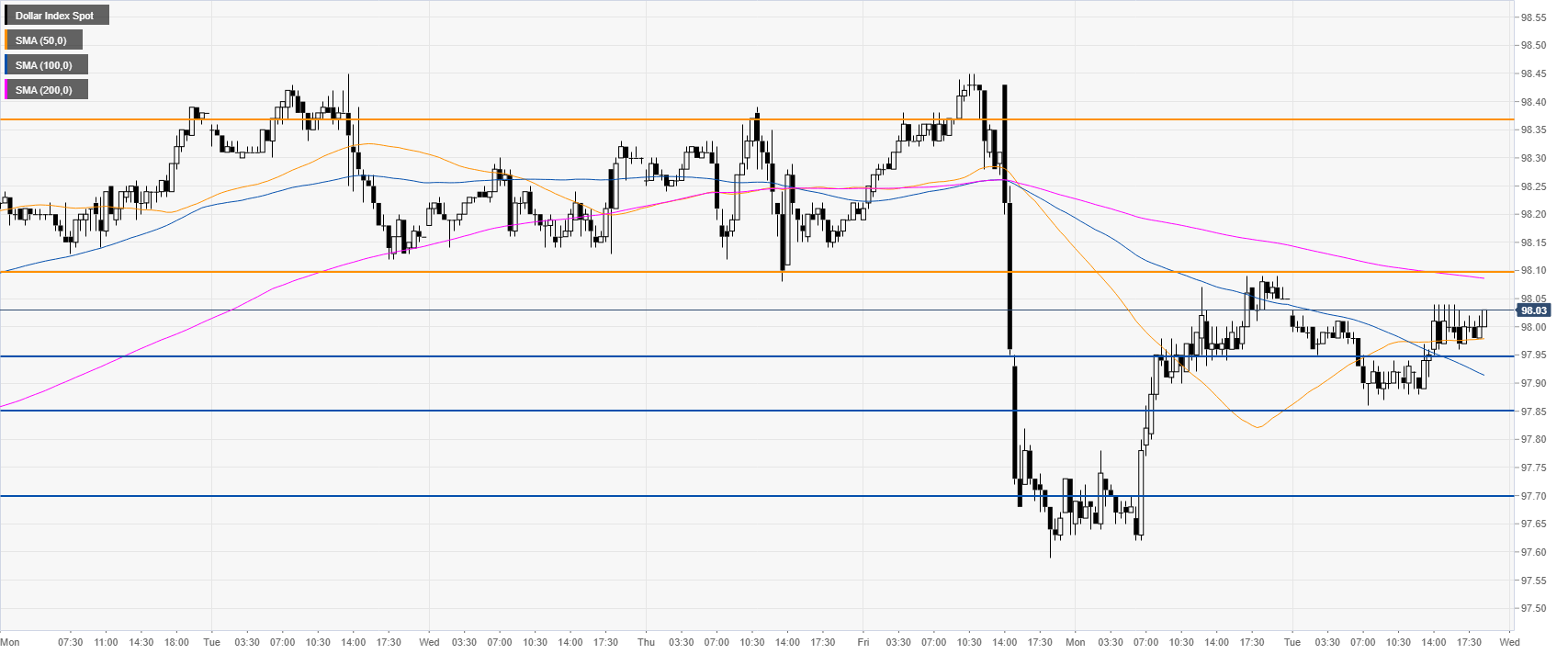

DXY 30-minute chart

The Greenback is trading below a downward sloping 200 SMAs and the key 98.10 resistance, suggesting a neutral to bearish bias in the short term. However, sellers would need to recapture 97.95/85 and 97.70 support if they want to create a meaningful move towards the 97.20 level.

Additional key levels