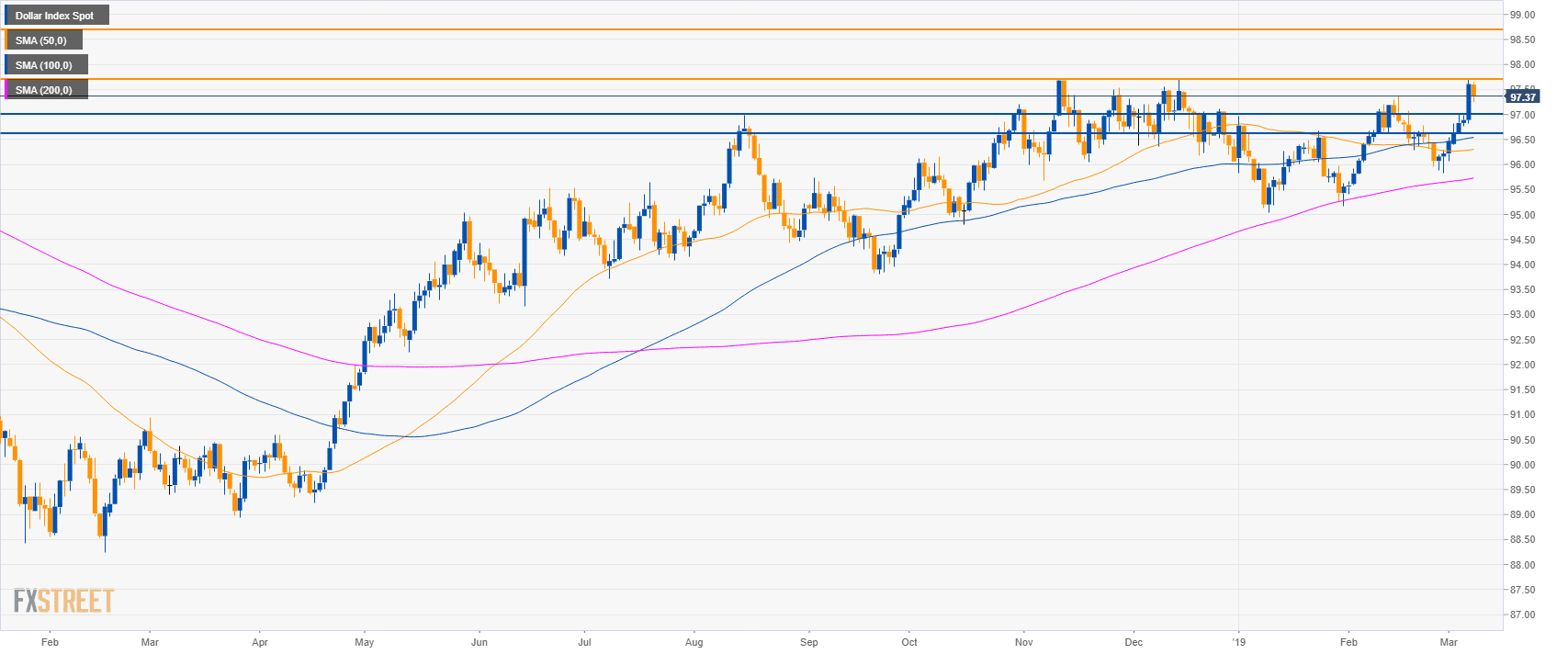

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages (SMAs).

- DXY found resistance at the 2018 high. Supports to the downside are seen at 97.00 and 96.10 level.

- On the flip side, a move beyond 97.71 resistance could lead to 98.72 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 97.37

Today Daily change: 24 ticks

Today Daily change %: -0.25%

Today Daily Open: 97.61

Trends:

Daily SMA20: 96.69

Daily SMA50: 96.29

Daily SMA100: 96.53

Daily SMA200: 95.71

Levels:

Previous Daily High: 97.71

Previous Daily Low: 96.81

Previous Weekly High: 96.61

Previous Weekly Low: 95.82

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 97.37

Daily Fibonacci 61.8%: 97.15

Daily Pivot Point S1: 97.04

Daily Pivot Point S2: 96.48

Daily Pivot Point S3: 96.14

Daily Pivot Point R1: 97.94

Daily Pivot Point R2: 98.28

Daily Pivot Point R3: 98.84