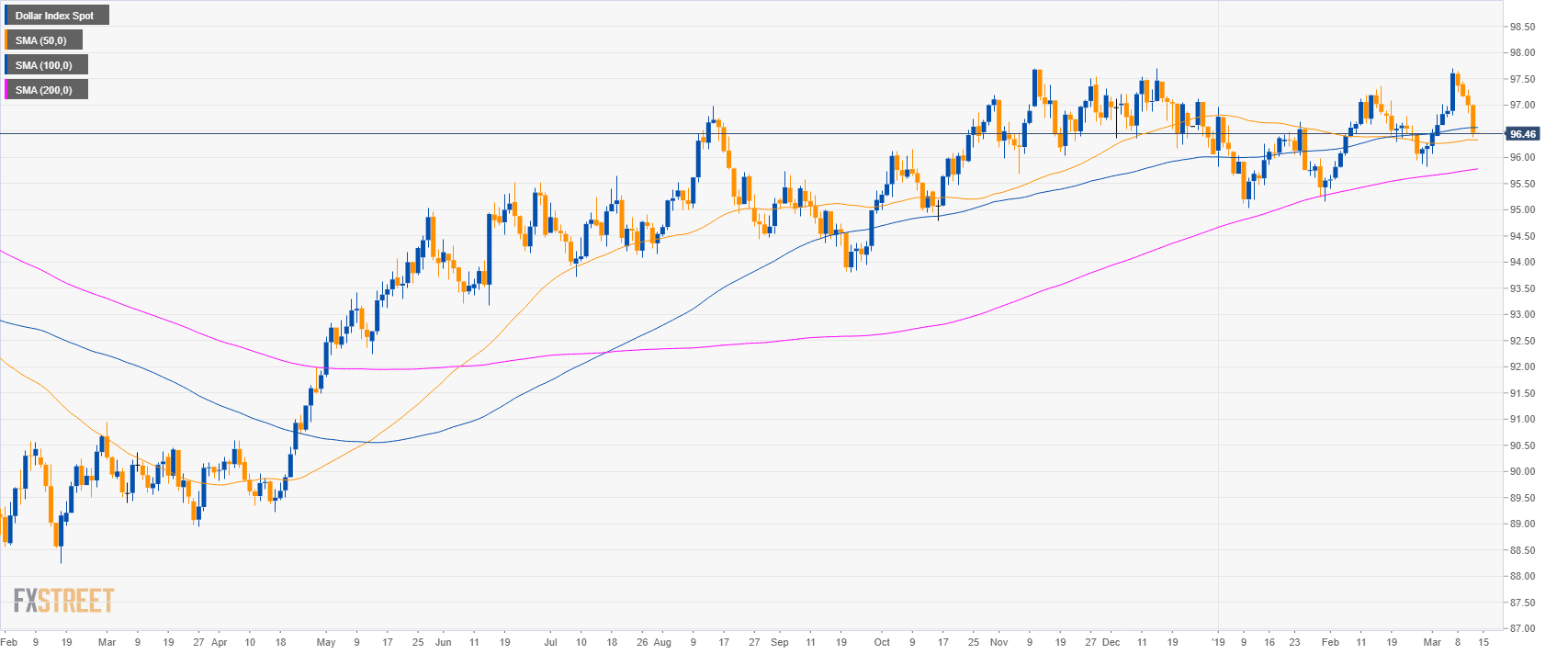

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its 200-day simple moving average.

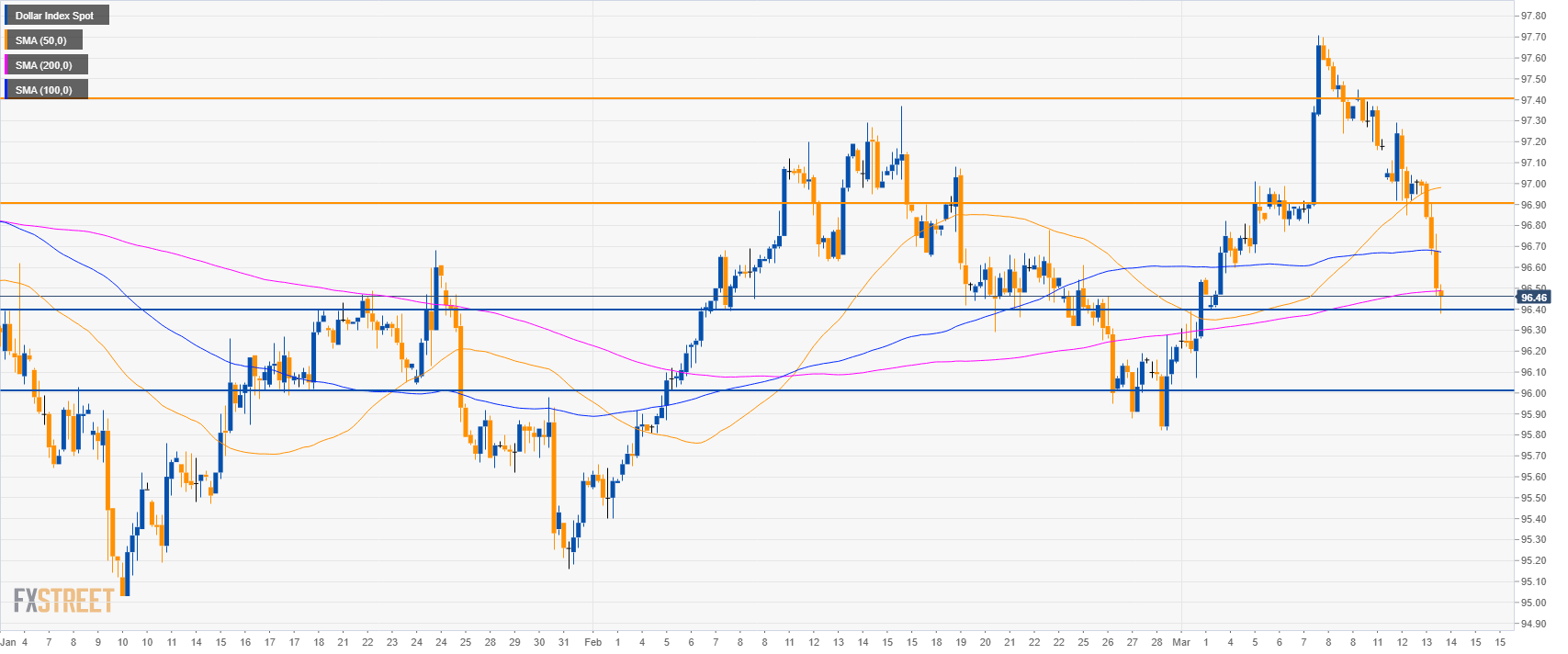

DXY 4-hour chart

- DXY is trading below its main SMAs suggesting bearish momentum in the medium-term.

- A break below 96.40 should open the doors to 96.00 the figure.

- Resistances are at 96.90 and 97.40 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.46

Today Daily change: -54 ticks

Today Daily change %: -0.56%

Today Daily Open: 97

Trends:

Daily SMA20: 96.75

Daily SMA50: 96.34

Daily SMA100: 96.57

Daily SMA200: 95.76

Levels:

Previous Daily High: 97.29

Previous Daily Low: 96.85

Previous Weekly High: 97.71

Previous Weekly Low: 96.4

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 97.02

Daily Fibonacci 61.8%: 97.12

Daily Pivot Point S1: 96.8

Daily Pivot Point S2: 96.61

Daily Pivot Point S3: 96.36

Daily Pivot Point R1: 97.24

Daily Pivot Point R2: 97.49

Daily Pivot Point R3: 97.68