- DXY (US Dollar Index) is gaining steam as the market broke above the 98.38 resistance.

- The next key resistance can be located near the 98.68 level.

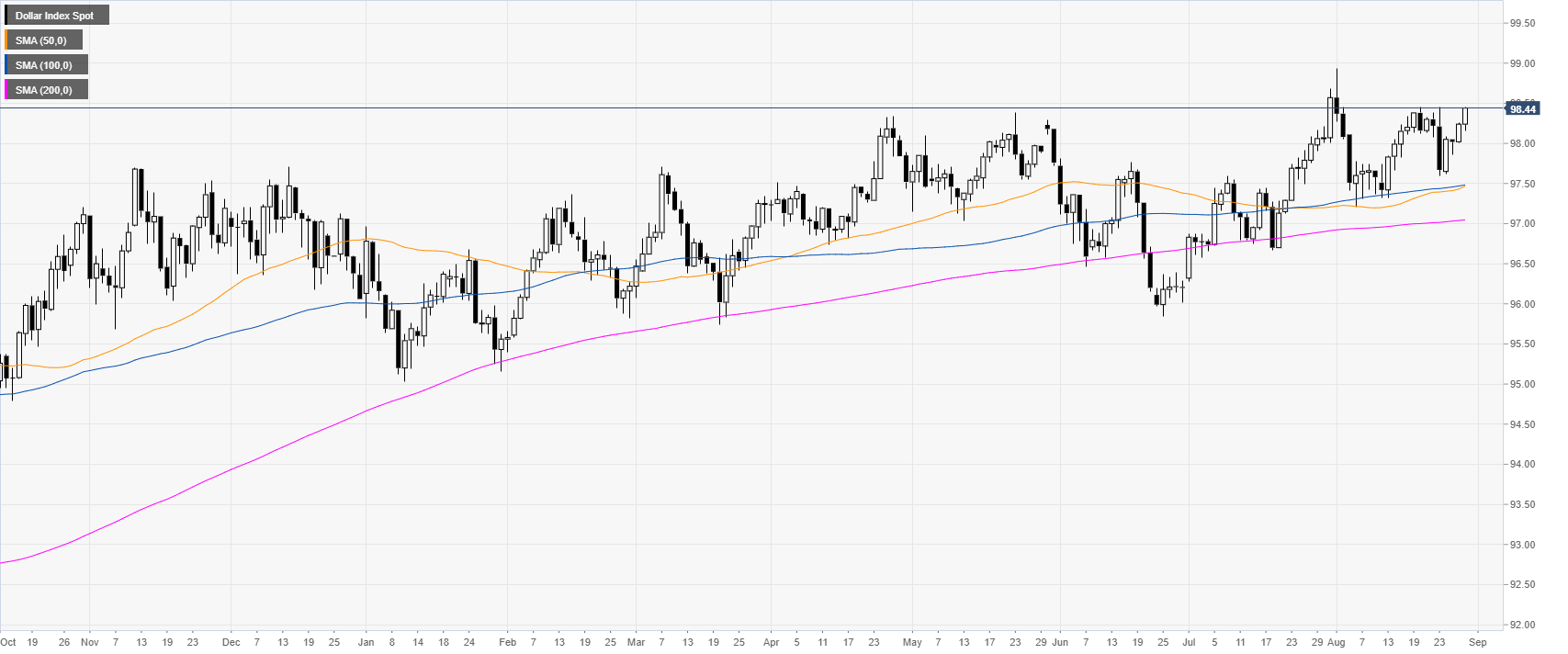

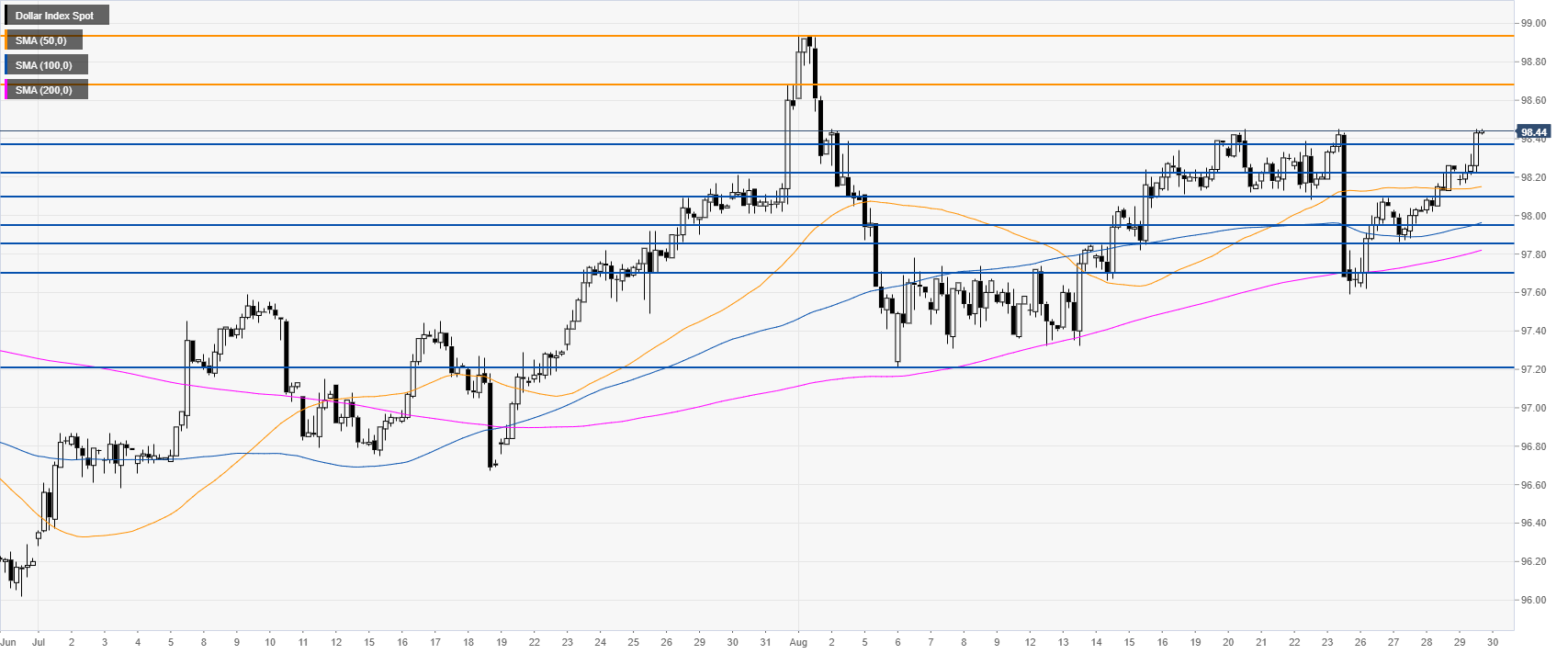

DXY daily chart

DXY (US Dollar Index) is in a bull trend above the main daily simple moving averages (DSMAs). The market is trading at 4-day highs with a current intraday high at 98.45.

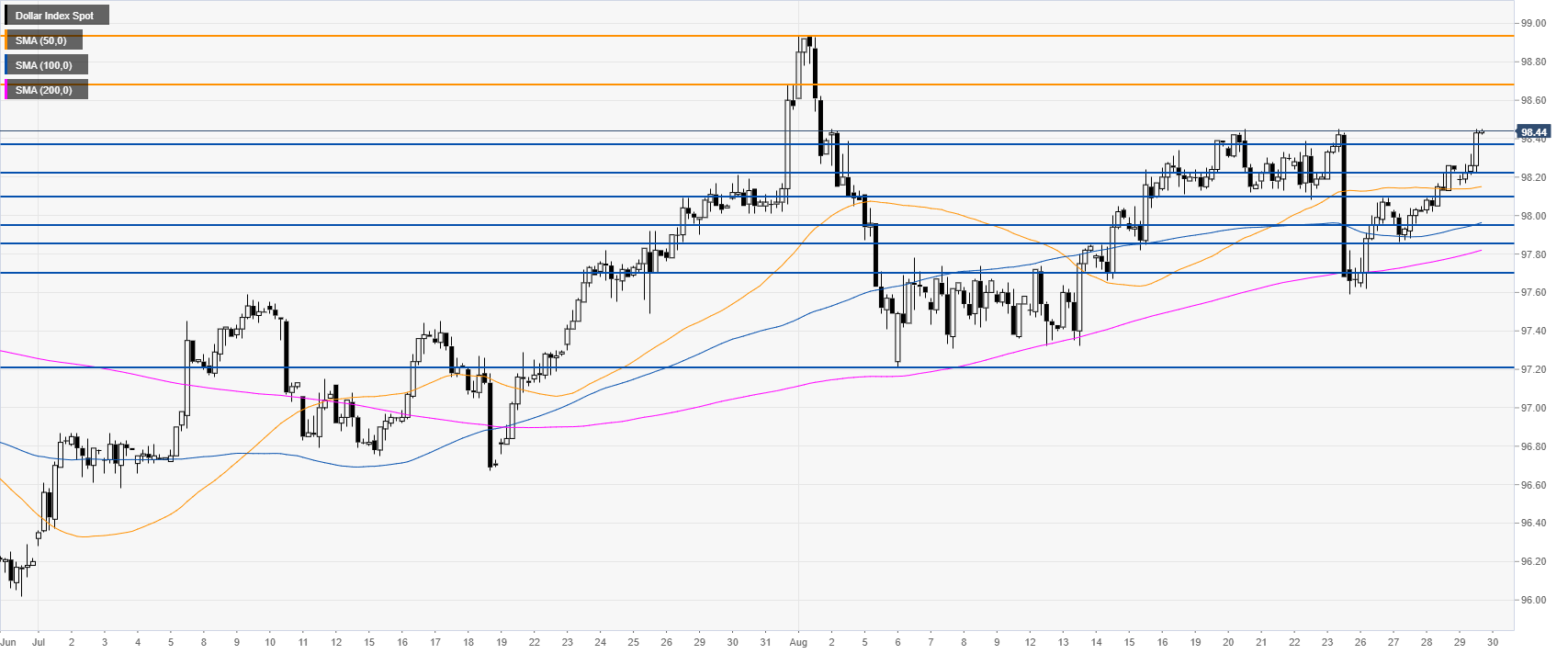

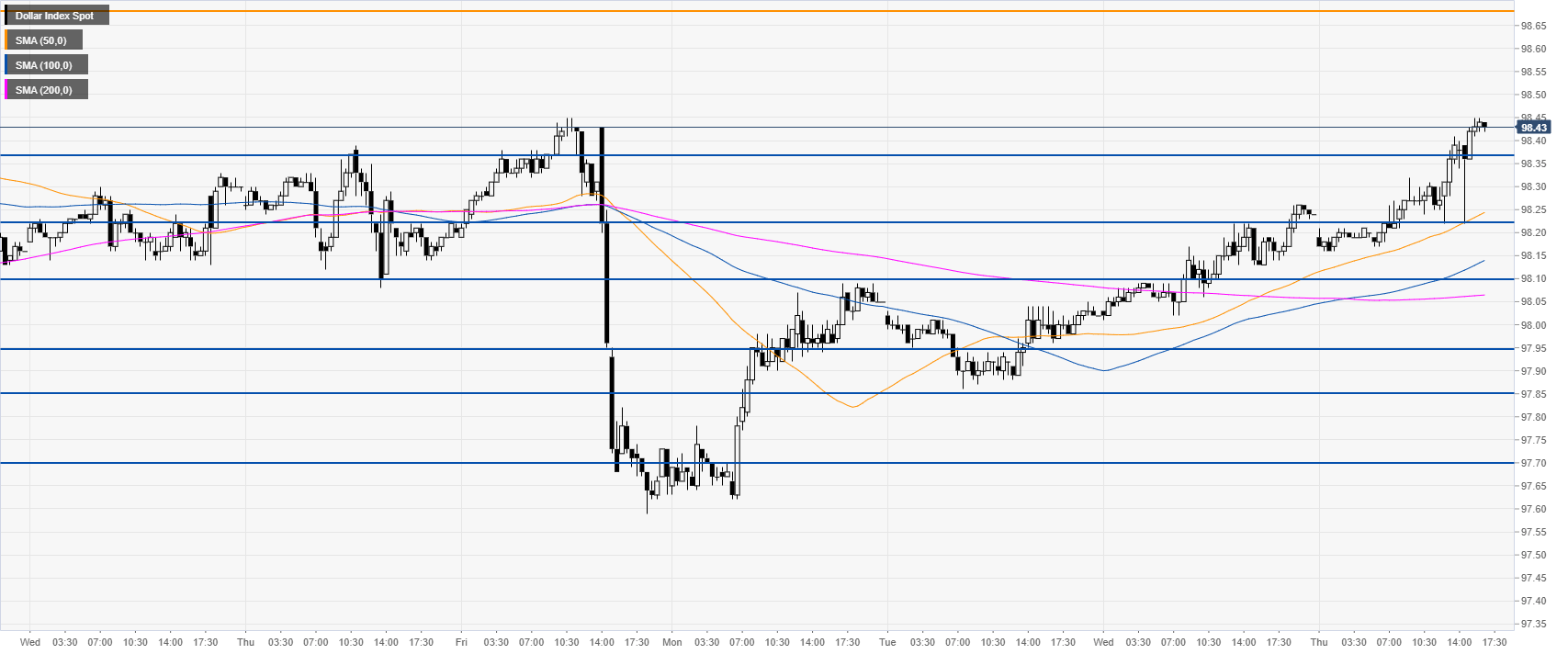

DXY 4-hour chart

This Thursday DXY is breaking above the 98.38 resistance opening the doors for a potential continuation up towards 98.68 resistance and 98.94 (the 2019 high) on the way up. If the market holds above the 98.38 level, it would be seen as a bullish sign.

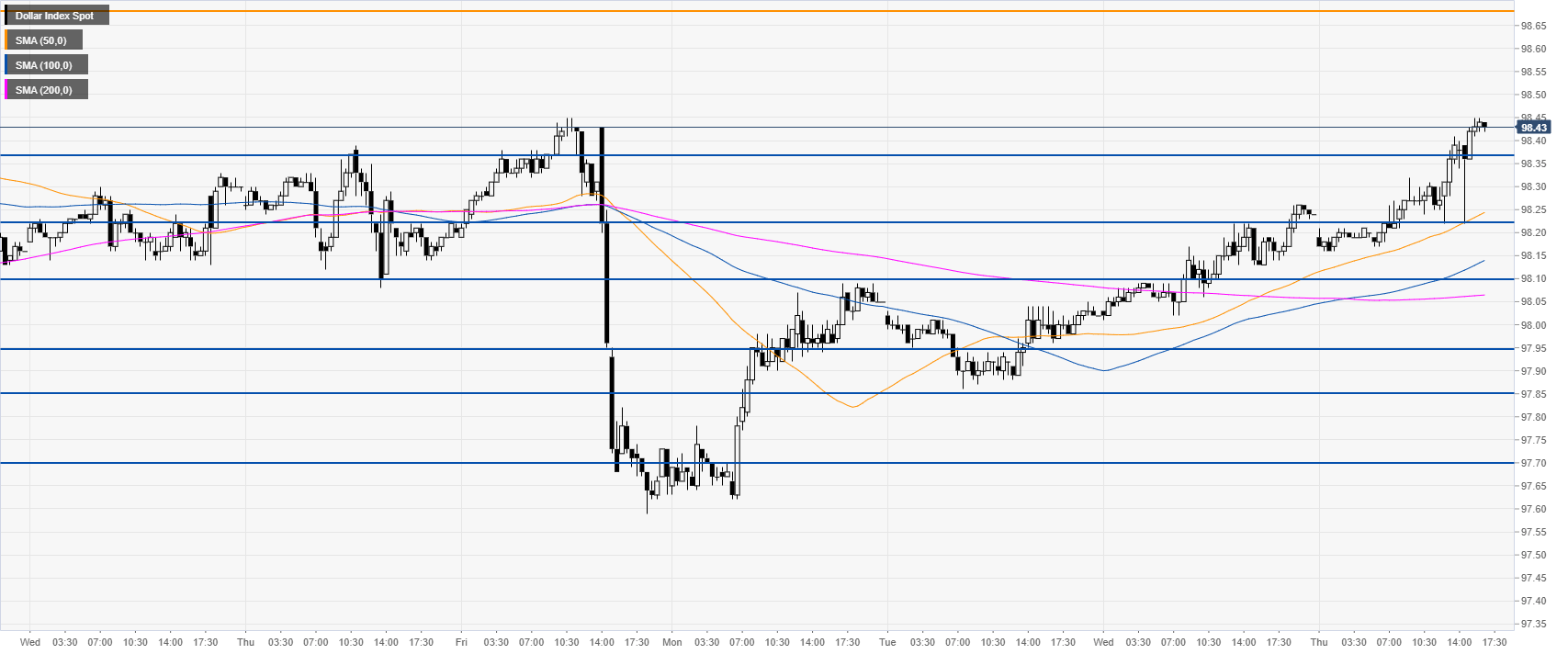

DXY 30-minute chart

The Greenback is trading above the main SMAs, suggesting bullish momentum in the short term. Immediate support is seen at the 98.38 and the 98.22 levels.

Additional key levels