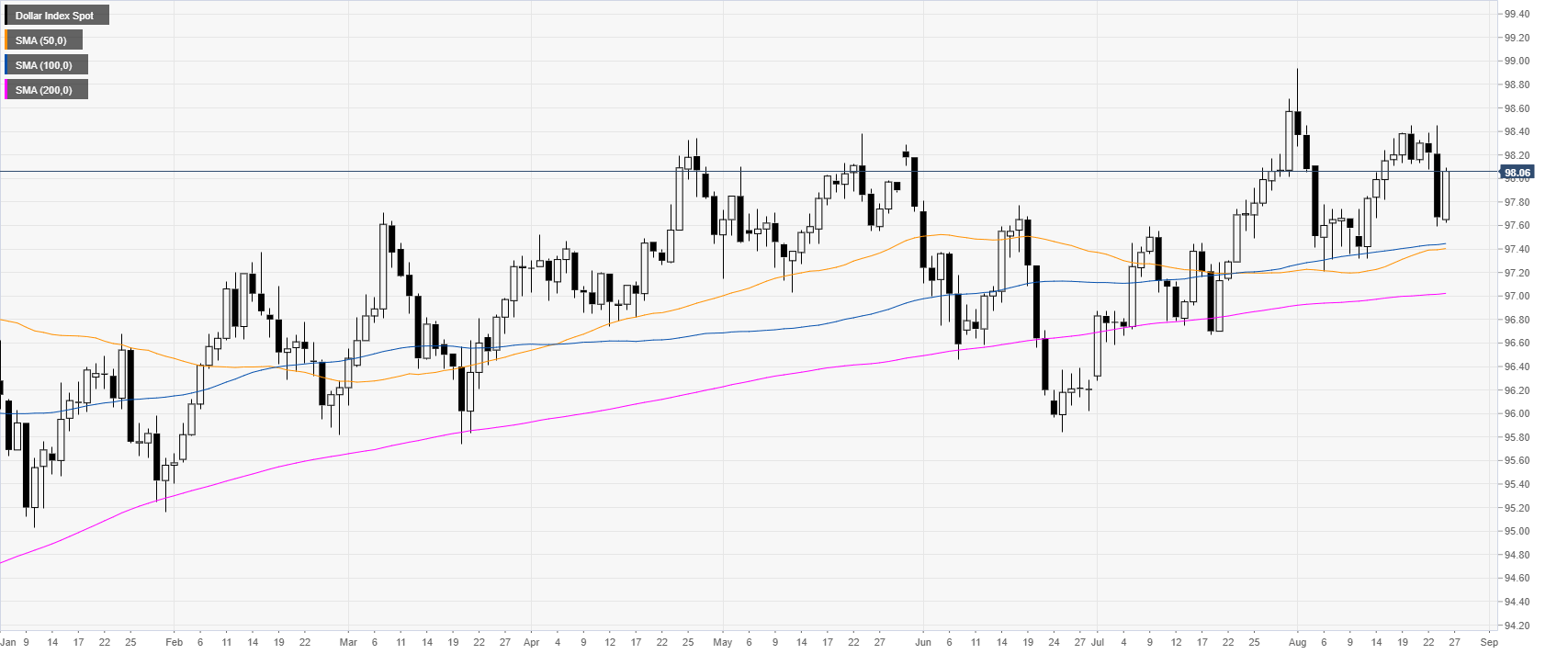

- DXY (US Dollar Index) is erasing parts of Friday’s drop.

- The market is testing an important resistance level at the 98.10 level.

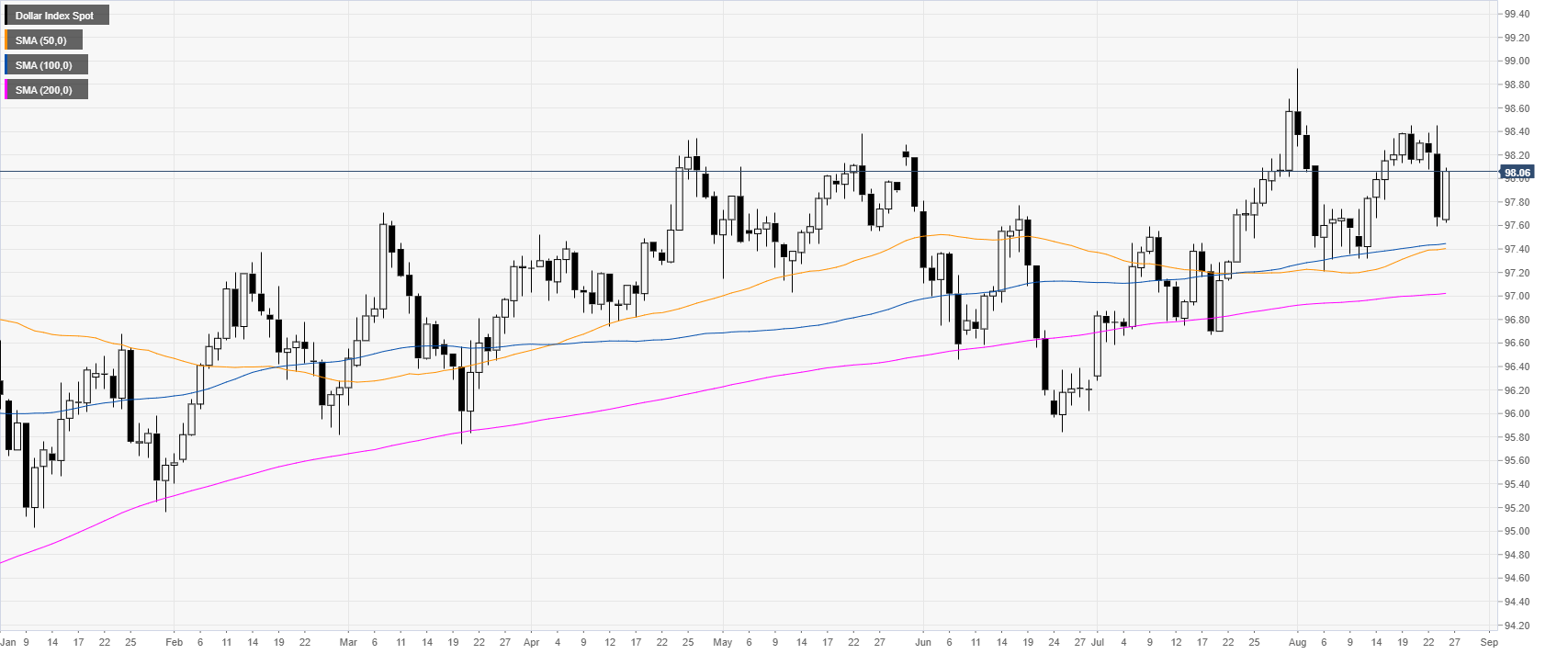

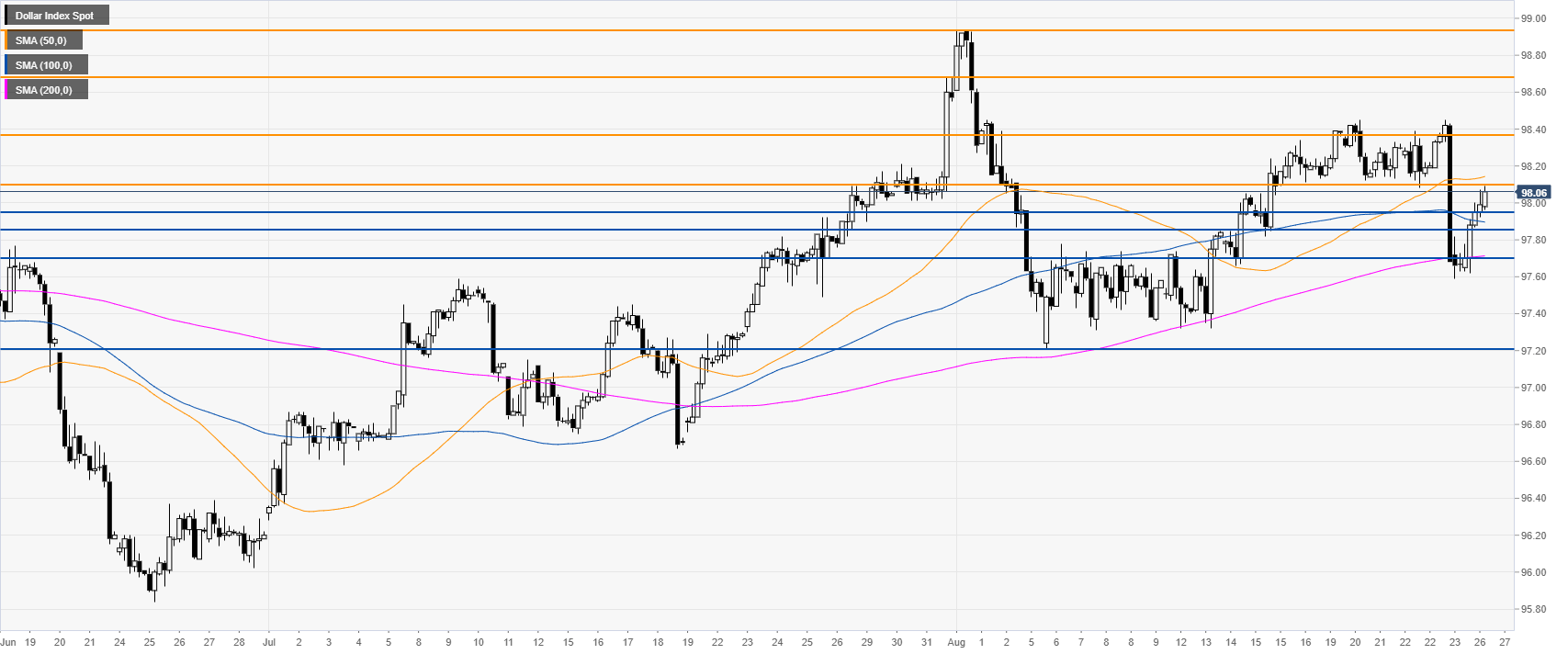

DXY daily chart

DXY (US Dollar Index) trading in a bull trend above the main daily simple moving averages (DSMAs). The market is erasing the sharp decline seen last Friday.

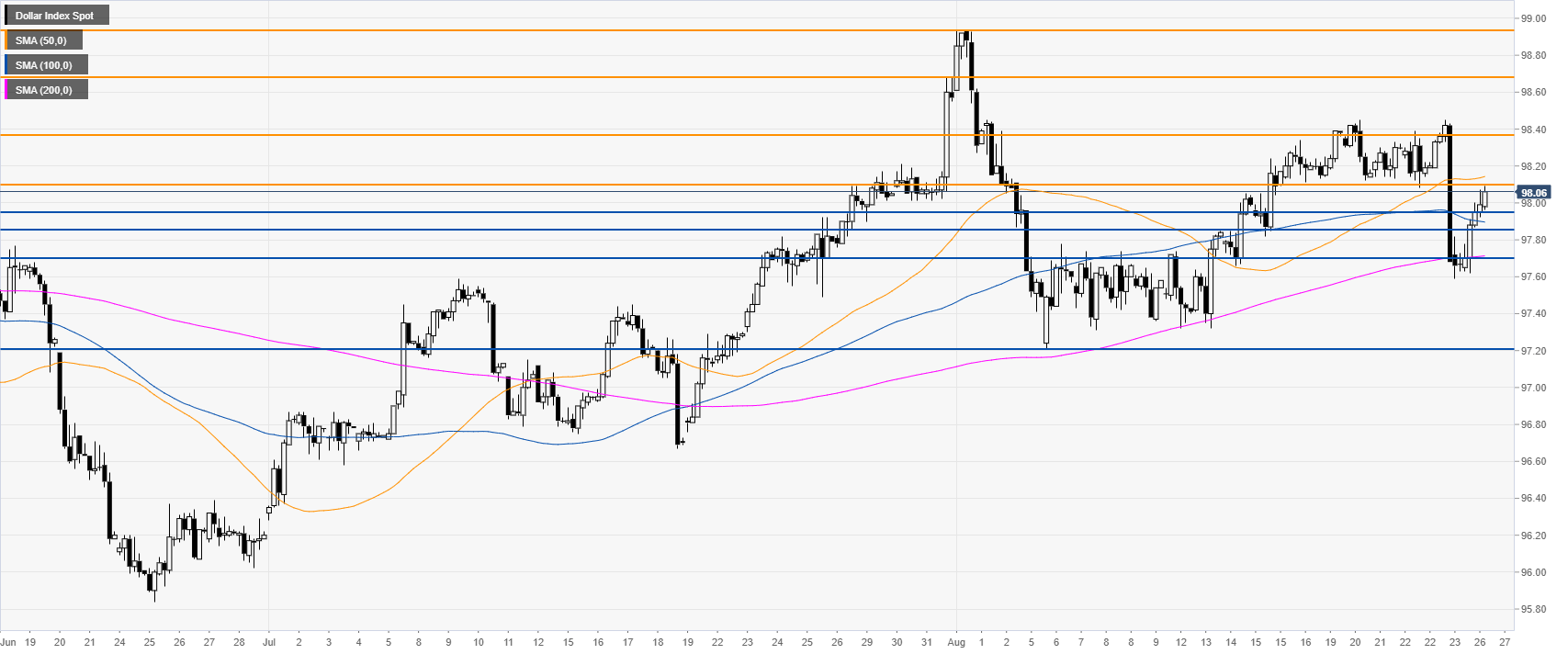

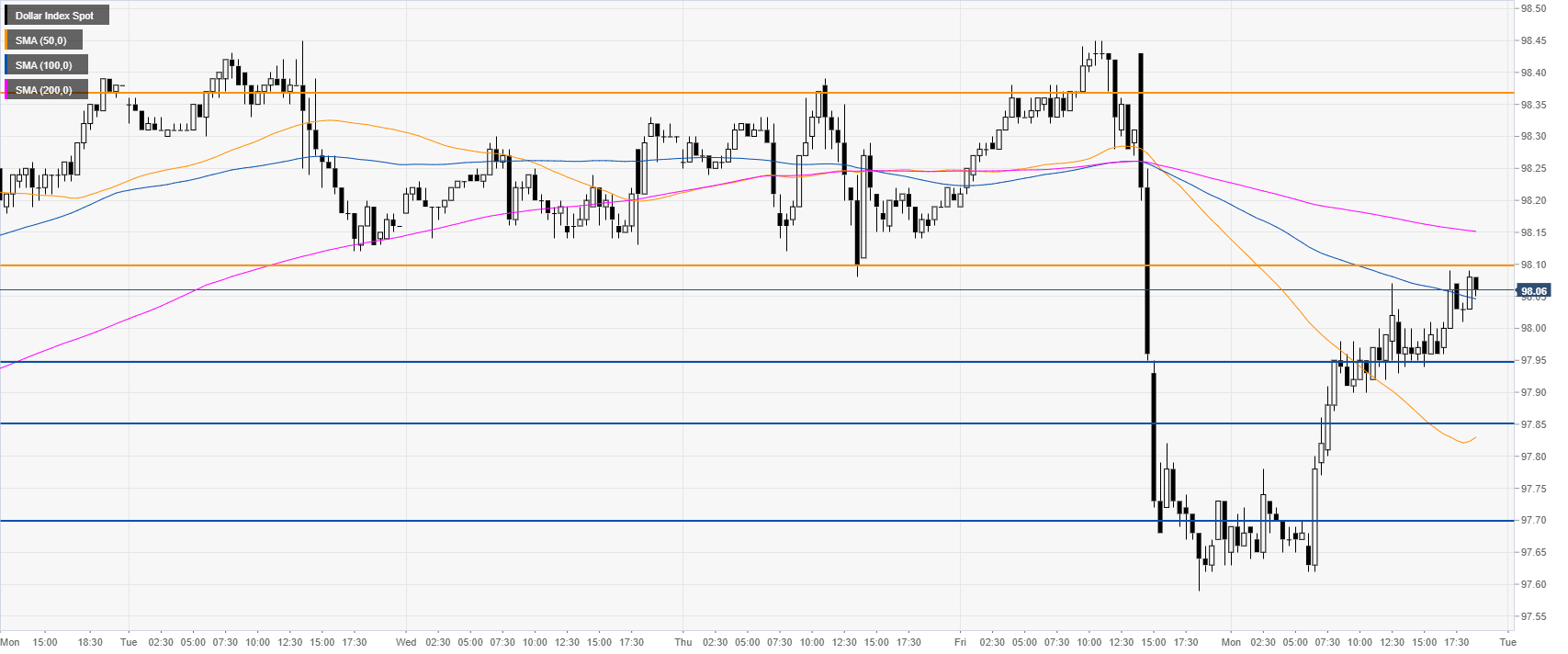

DXY 4-hour chart

DXY is testing a critical key resistance at 98.10 near the 50 SMA. If bulls manage to have a sustained breakout above this level, the market is most likely going to test 98.38 on the way up.

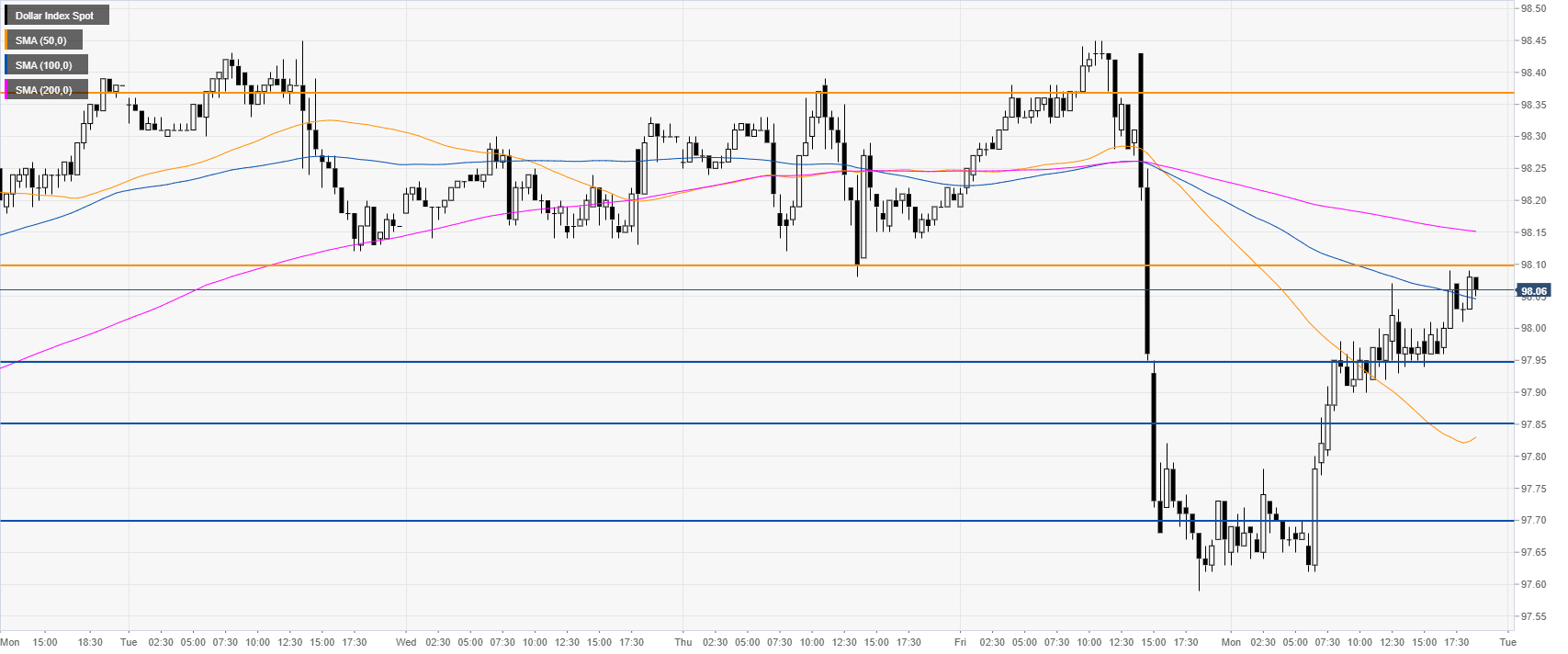

DXY 30-minute chart

The Greenback is trading below a downward sloping 200 SMAs, suggesting bearish momentum in the short term. Bears will need to defend the 98.10 resistance and clear 97.95/85 and 97.70 support if they want to create a meaningful breakdown towards the 97.20 level.

Additional key levels