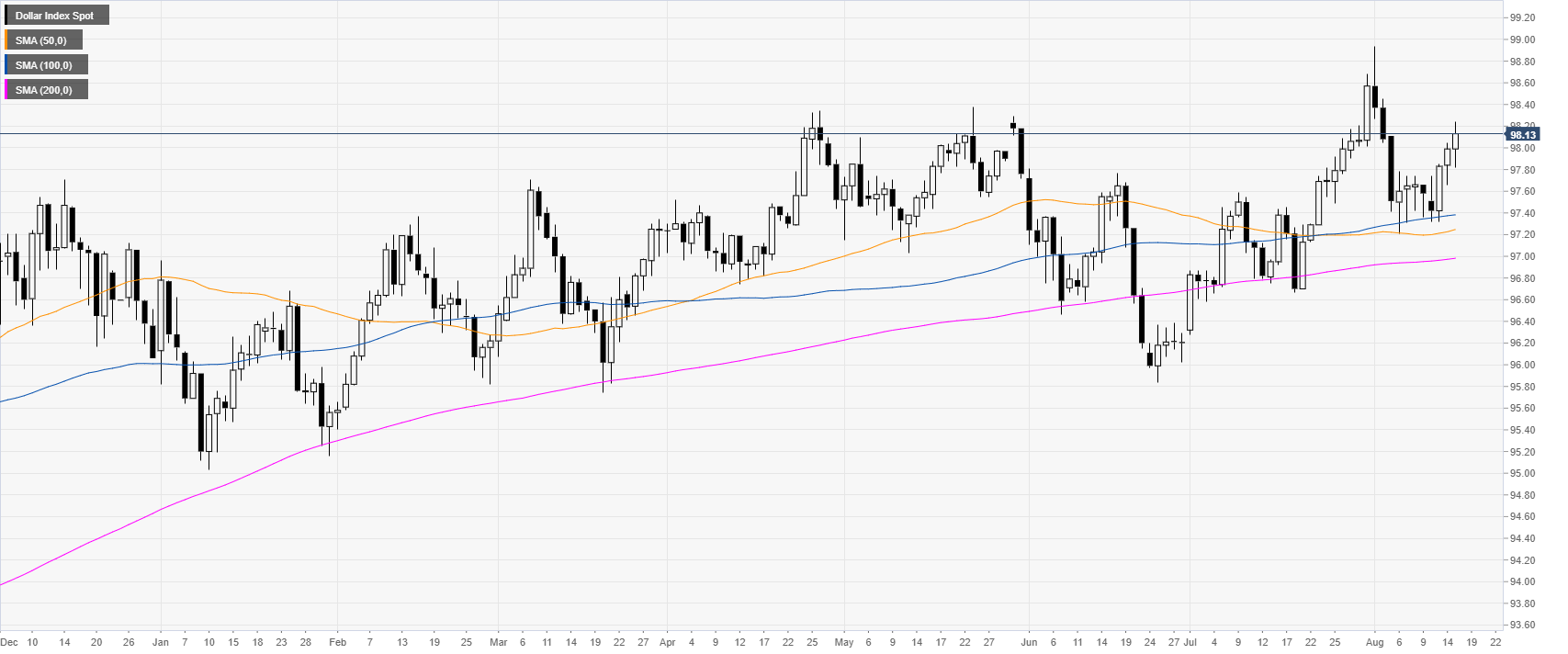

- DXY (US Dollar Index) broke above the 98.00 handle as the Euro gets slammed by ECB’s Olli Rehn.

- The next targets on the way can be located at 98.10 and the 98.38 levels.

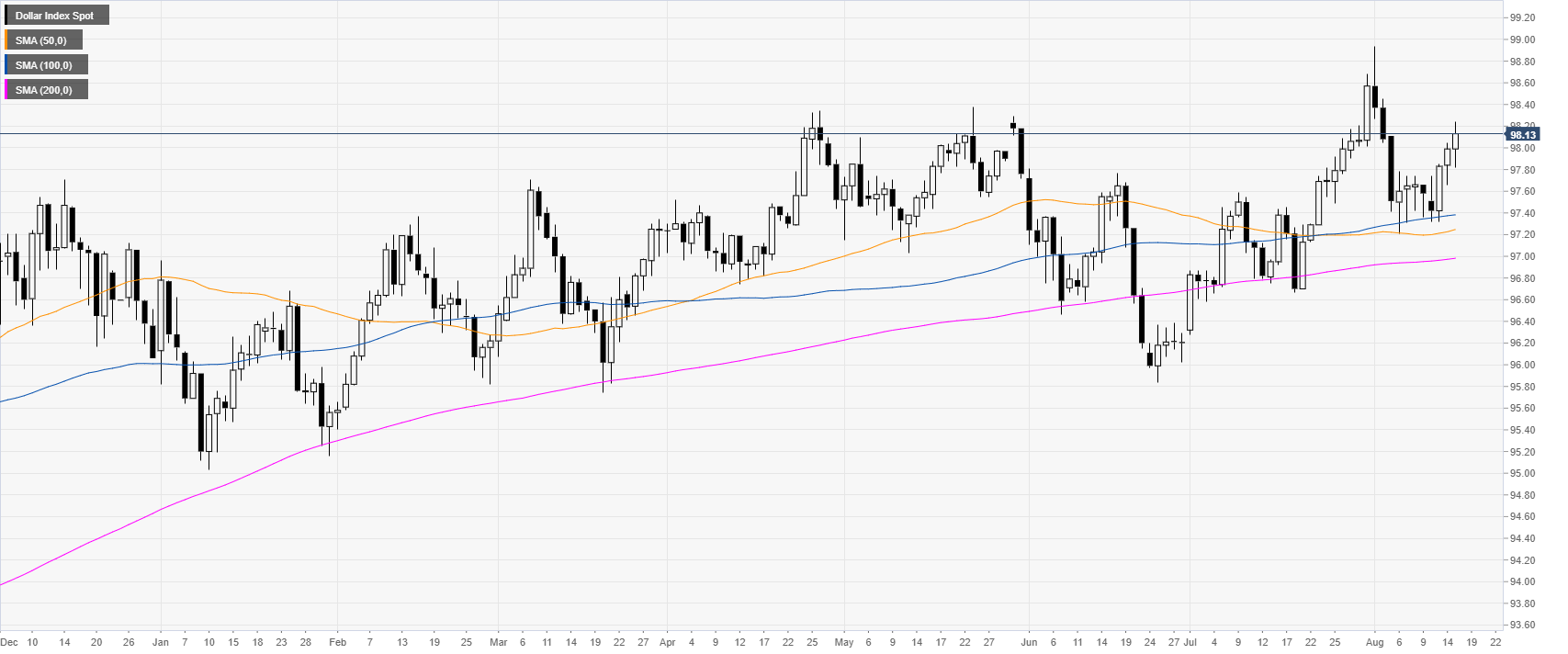

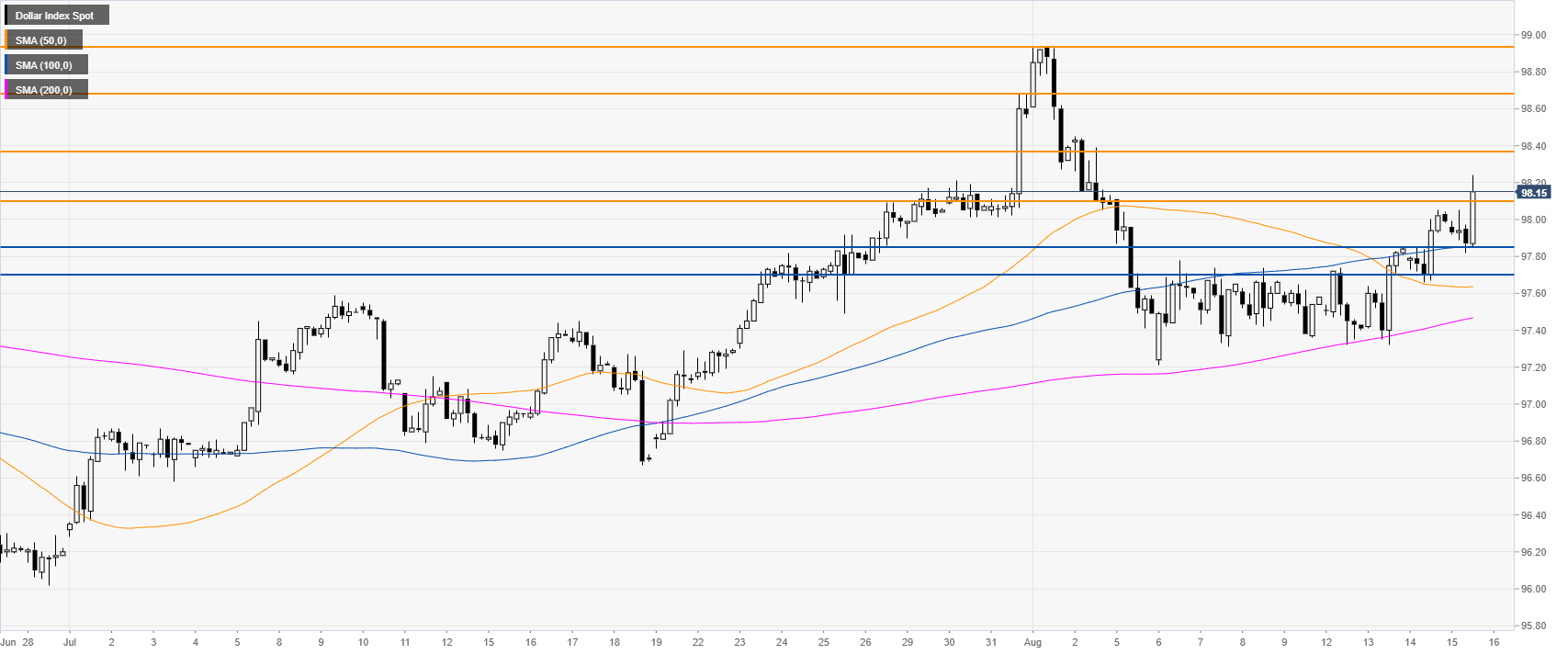

DXY daily chart

DXY (US Dollar Index) is trading in a bull trend above its main daily simple moving averages (DSMAs). DXY got an indirect boost as the European Central Bank’s (ECB) member Olli Rehn said that ECB stimulus package in September might beat expectations. Earlier, the Retail Sales Control Group in July beat expectations adding to the positive tone on the Greenback.

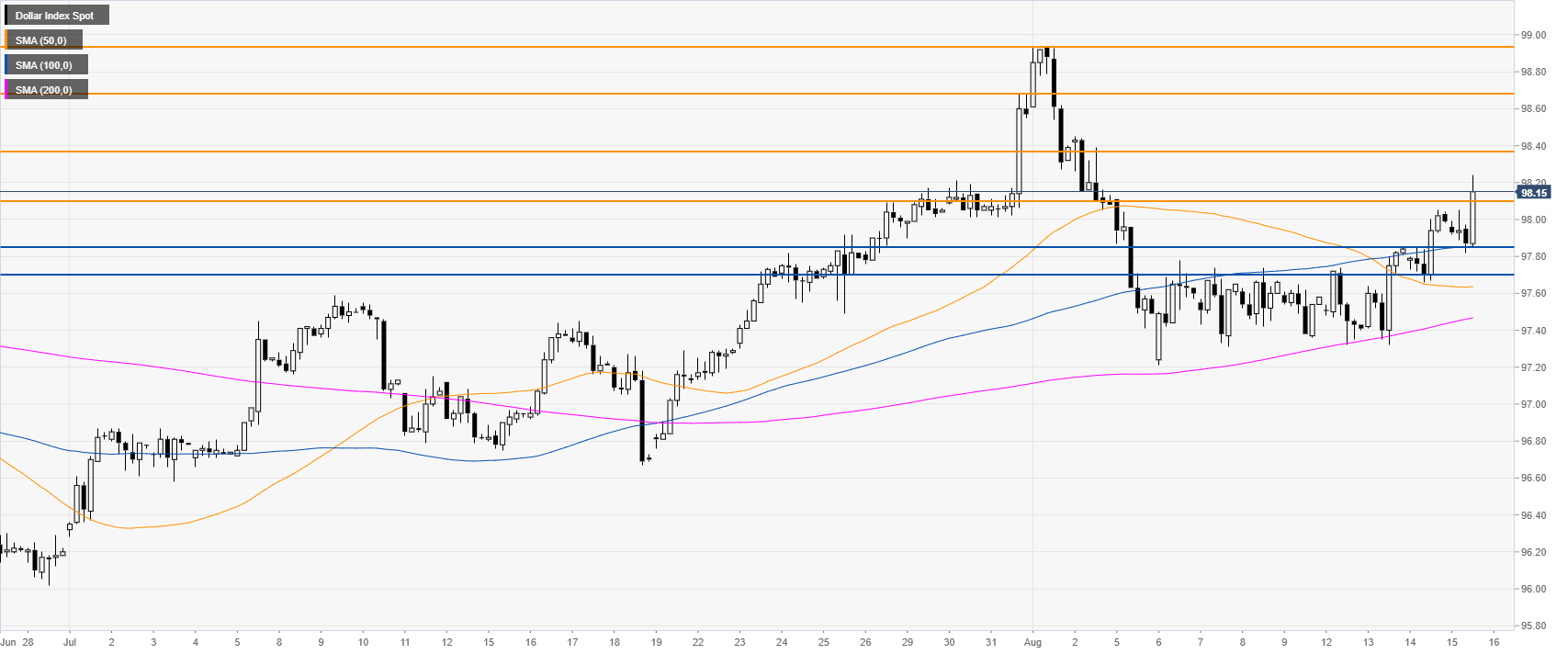

DXY 4-hour chart

The market is trading above the 98.10 level and its main SMAs. DXY bulls could drive the market towards the 98.38 resistance, which could be the last line of defense before the 98.68 and the 98.93 levels.

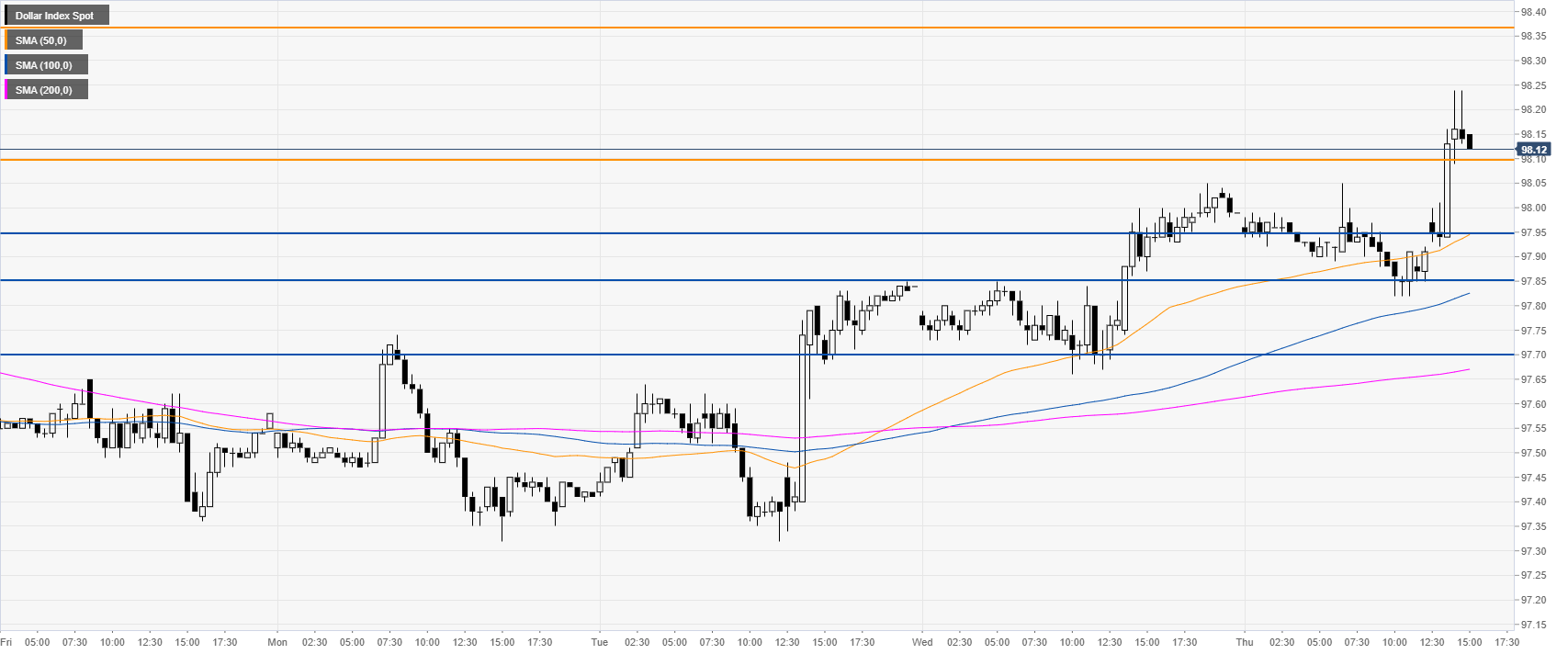

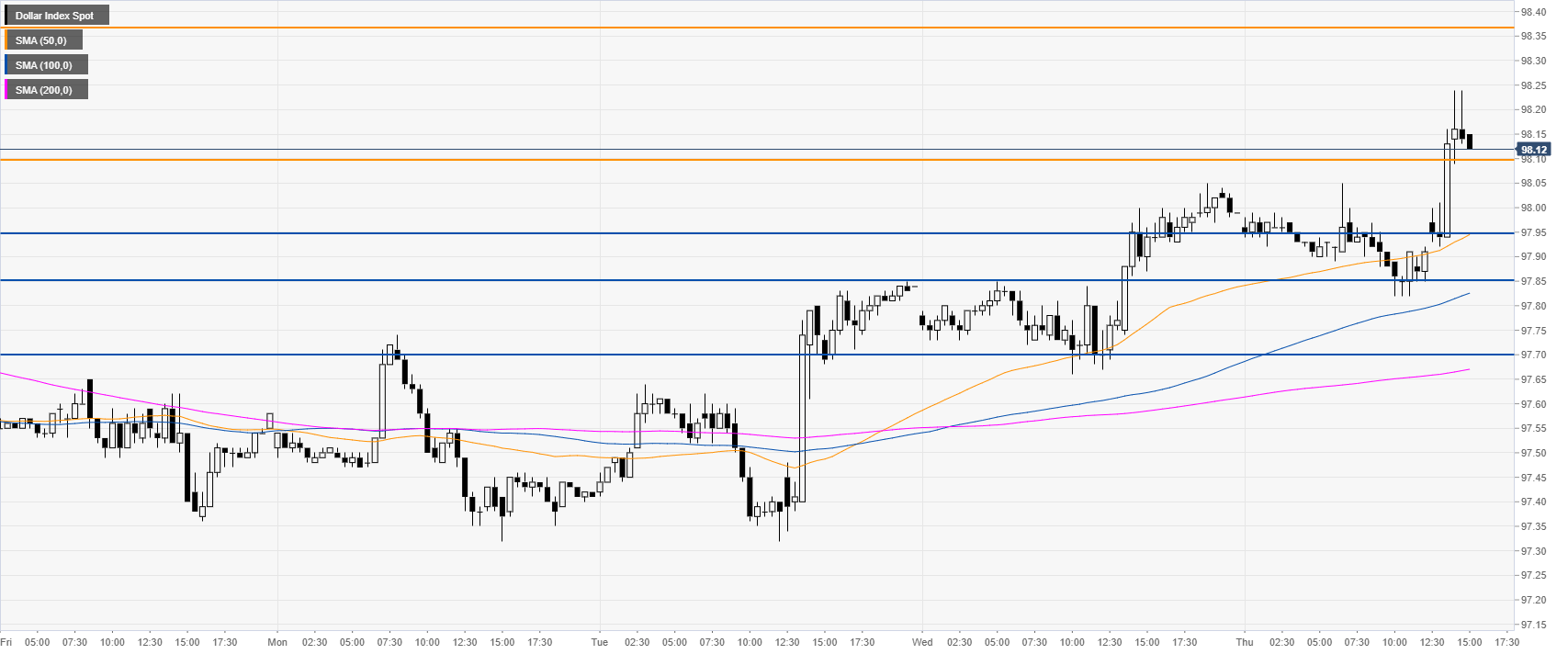

DXY 30-minute chart

The buying pressure keeps the Greenback near daily highs. Immediate support could be found near the 98.10 and 97.95 levels.

Additional key levels