- 4th of July holidays in the US keep the volatility low.

- The level to beat for buyers is at the 97.00 and 97.30 levels.

- The Nonfarm Payrolls (NFP) on Friday can be the next Dollar catalyst around the corner.

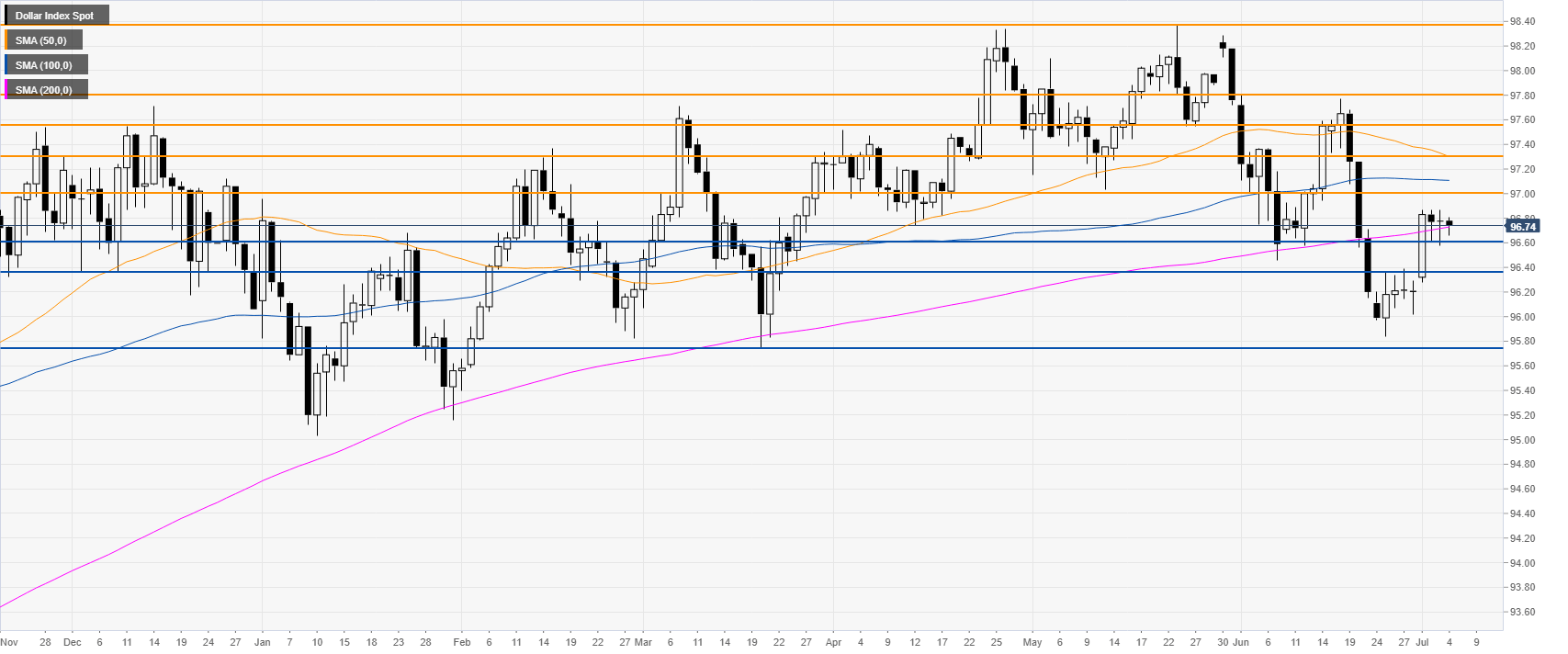

DXY daily chart

The US Dollar Index (DXY) is trading just above the 96.60 support and the 200-day simple moving average (DSMA). Bulls should break above the 97.00 figure to prevent a decline below 96.36.

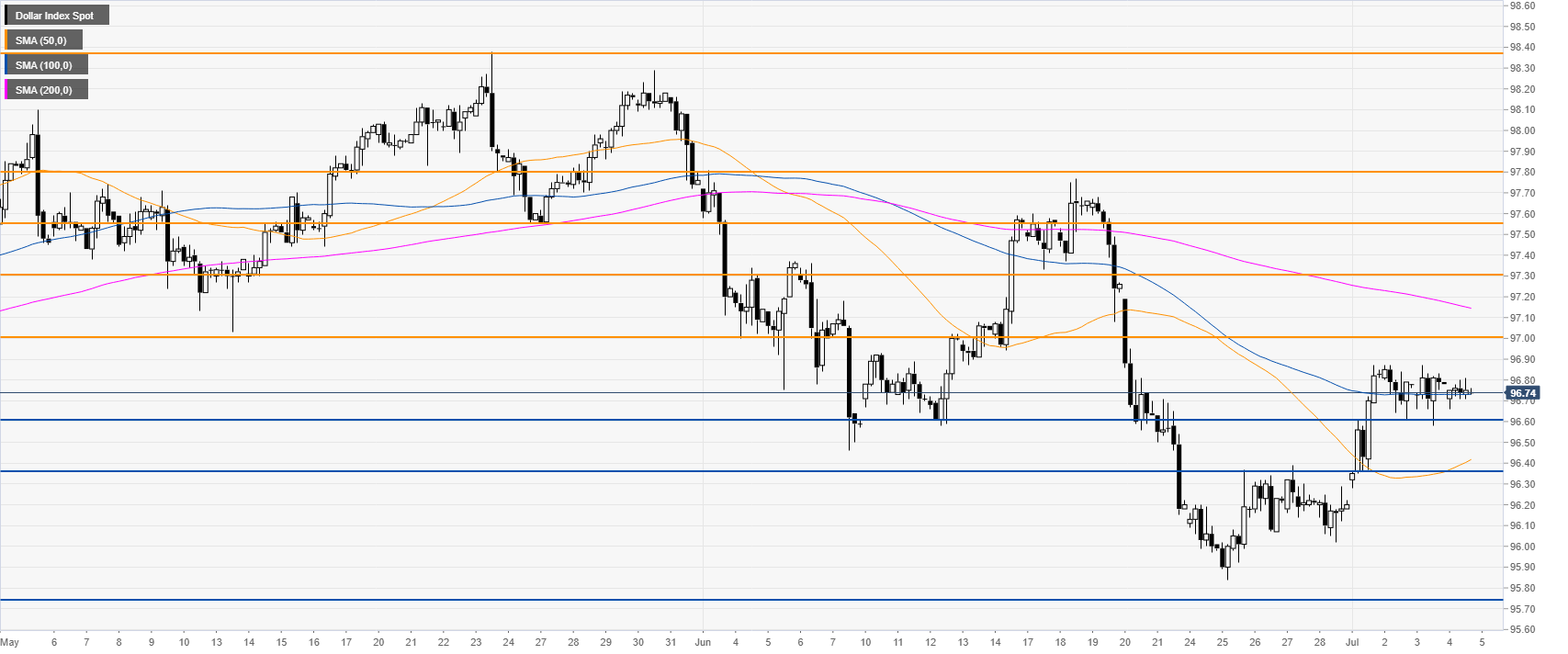

DXY 4-hour chart

DXY is coiling around the 100 SMA. If buyers can overcome the 97.00 figure the market can potentially reach 97.30 and 97.55 to the upside.

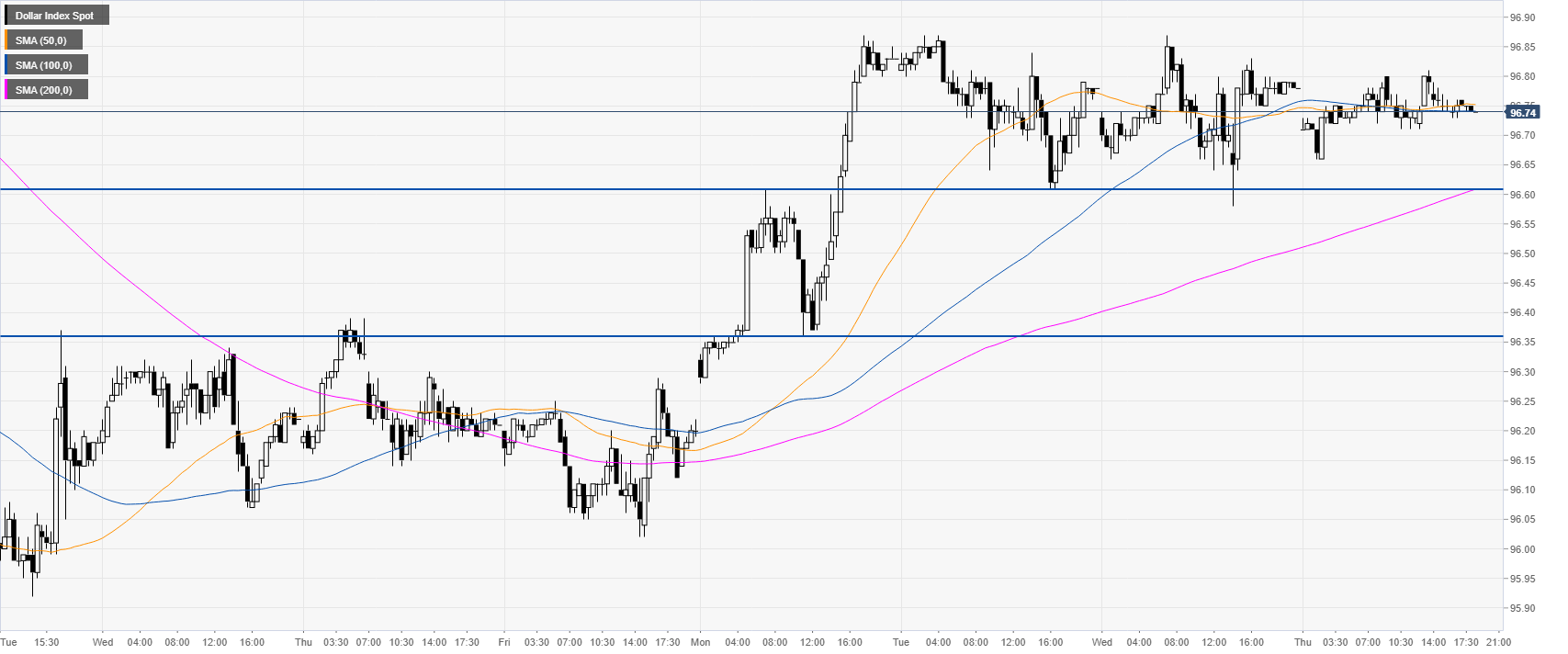

DXY 30-minute chart

The market has been trading flat for the last 3 days. Support is seen at 96.60 and 96.36. A breakdown below 96.36 on a daily closing basis could embolden the bear case.

Additional key levels