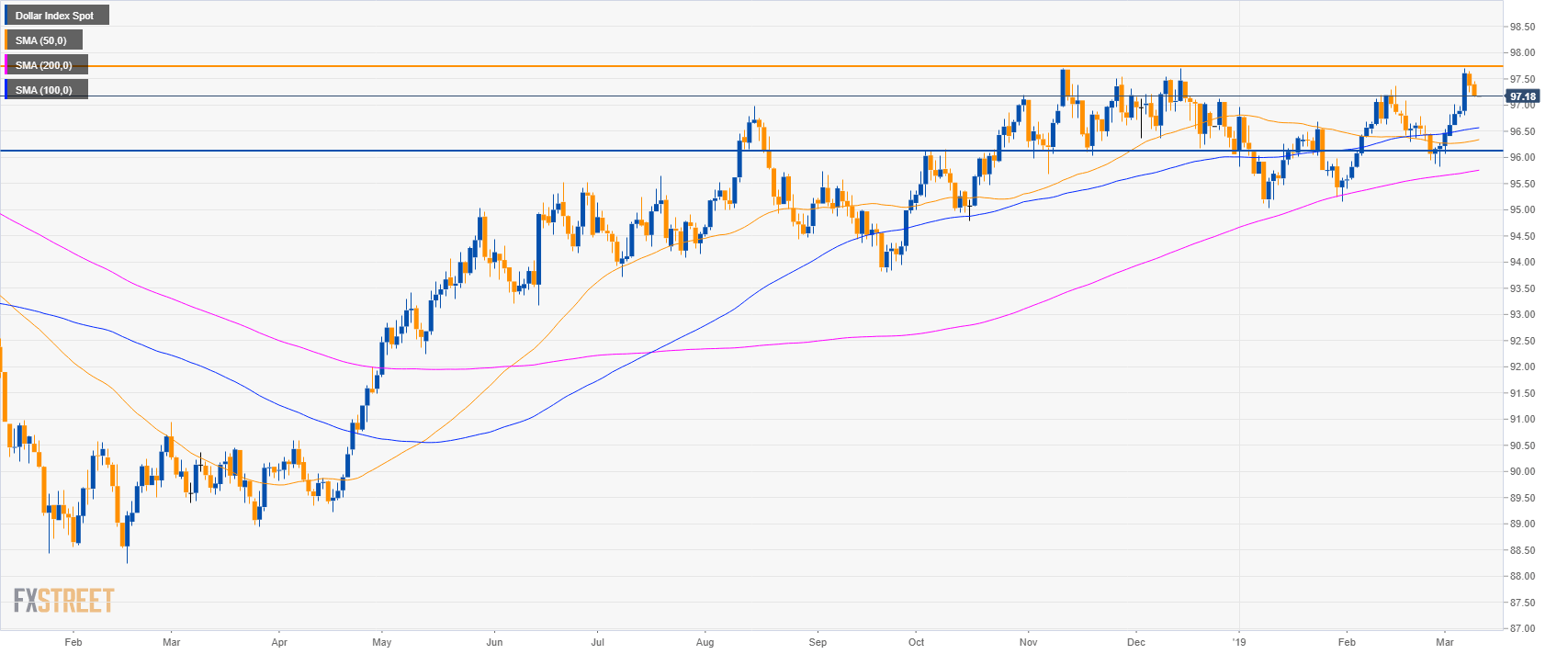

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages.

- Bulls have not been able to sustain prices above the 2018 and 2019 highs.

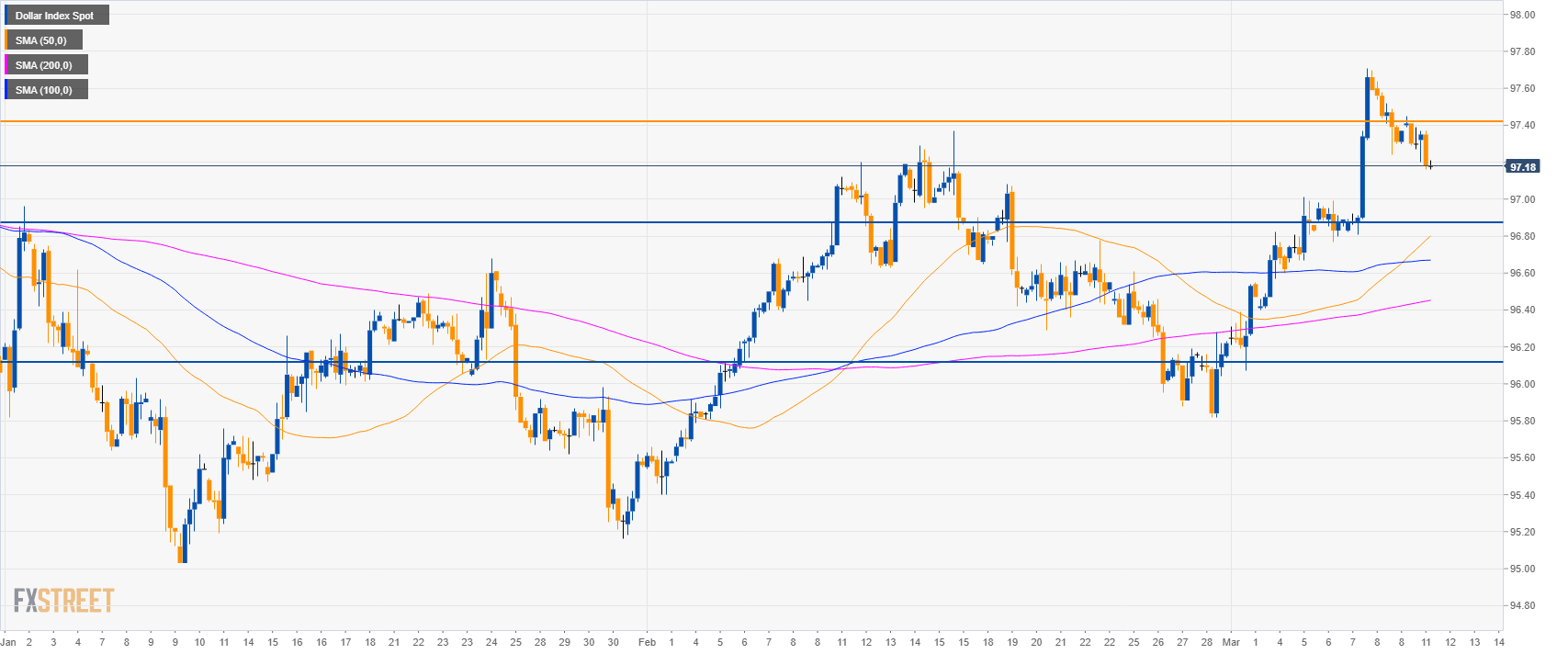

DXY 4-hour chart

- DXY is trading above its main SMAs suggesting bullish momentum in the medium-term.

- However, the break below 97.40 resistance can lead to a bearish move down to 96.87 support.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 97.18

Today Daily change: -0.19 points

Today Daily change %: -0.20%

Today Daily Open: 97.37

Trends:

Daily SMA20: 96.73

Daily SMA50: 96.3

Daily SMA100: 96.54

Daily SMA200: 95.73

Levels:

Previous Daily High: 97.64

Previous Daily Low: 97.24

Previous Weekly High: 97.71

Previous Weekly Low: 96.4

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 97.39

Daily Fibonacci 61.8%: 97.49

Daily Pivot Point S1: 97.19

Daily Pivot Point S2: 97.02

Daily Pivot Point S3: 96.79

Daily Pivot Point R1: 97.59

Daily Pivot Point R2: 97.82

Daily Pivot Point R3: 97.99