- Weaker-than-expected data in the United States is weighing on the Greenback.

- The level to beat for bears is the 99.00 figure.

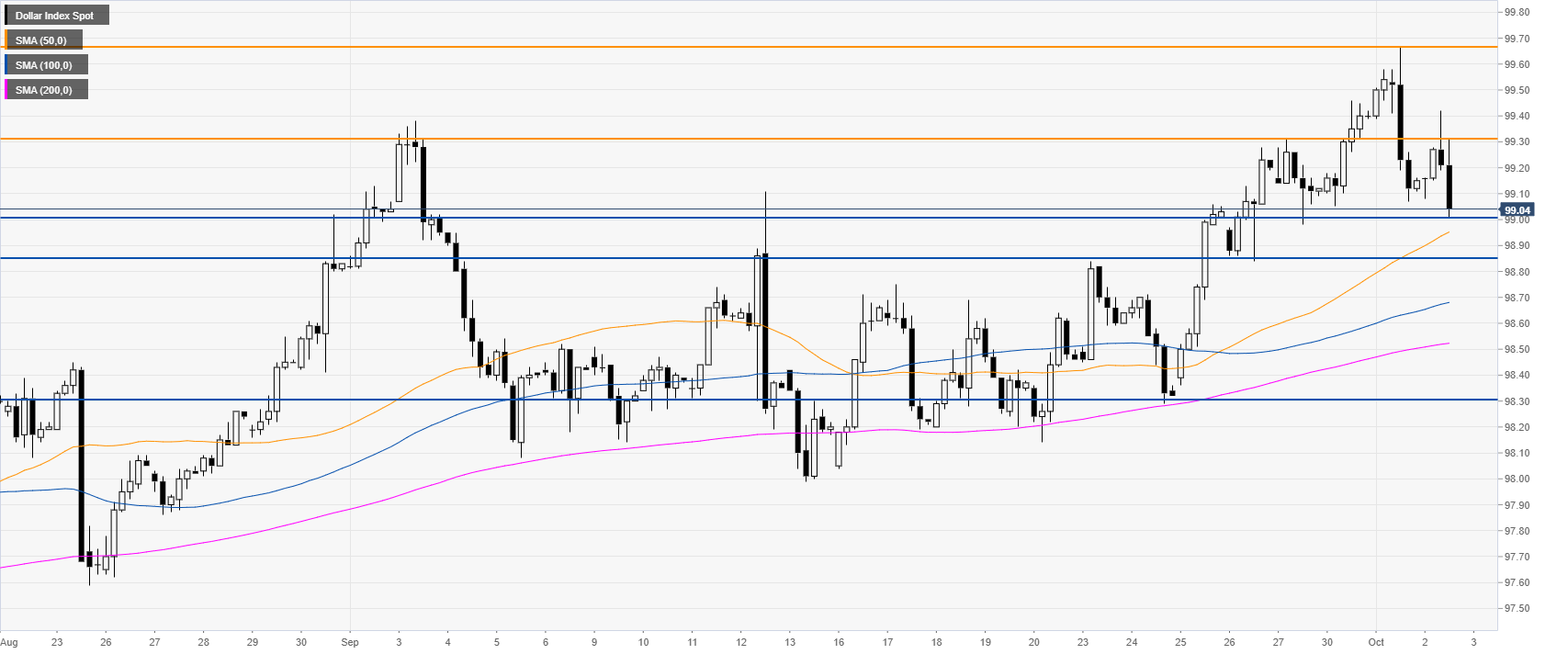

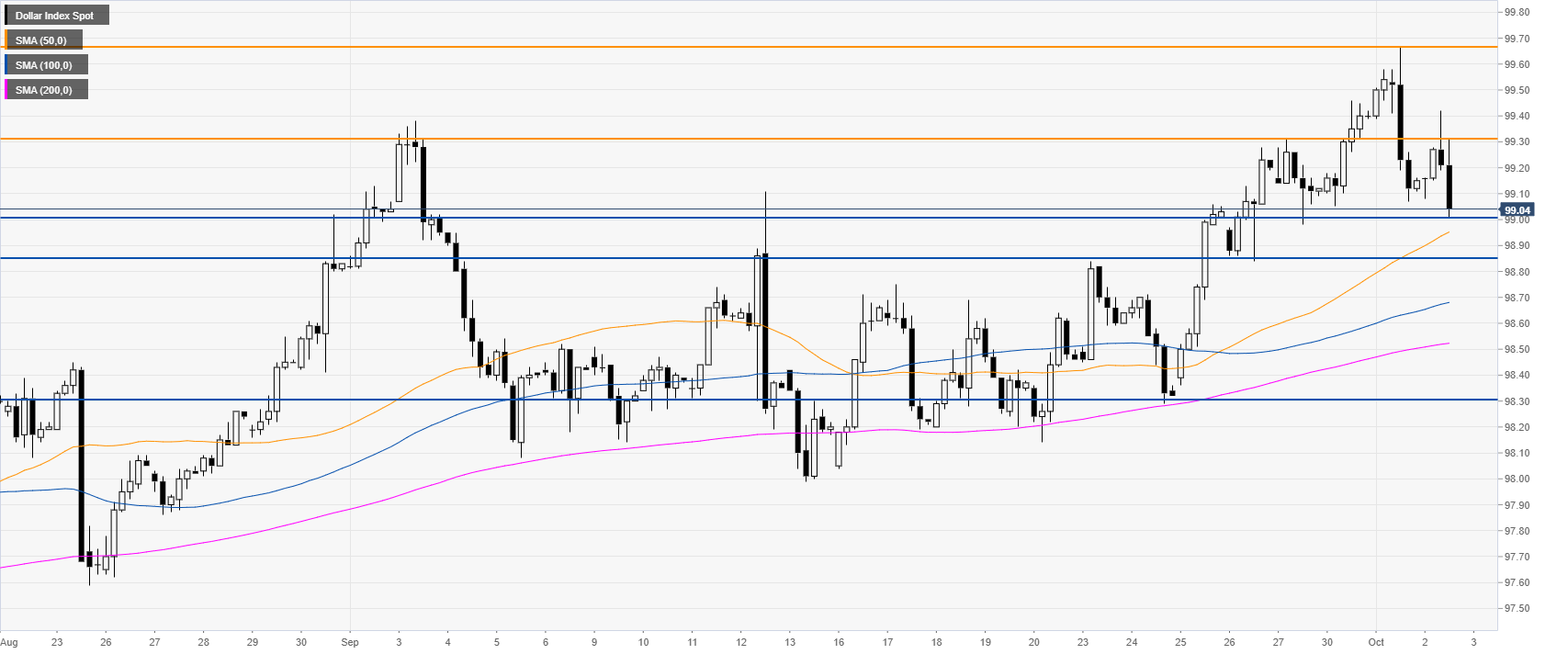

DXY daily chart

The US Dollar Index (DXY) is trading a bull trend above its main daily simple moving averages (DSMAs). In the New York session, the ADP, the forerunner of the Nonfarm Payrolls on Friday, disappointed the market with only 135k vs. 140k expected in September. This adds to the negative sentiment on the Greenback which started on Tuesday after the ISM Manufacturing PMI came in below expectations at 47.8 vs. 50.1 forecast. This was the worst reading since 2009 and sent the index lower.

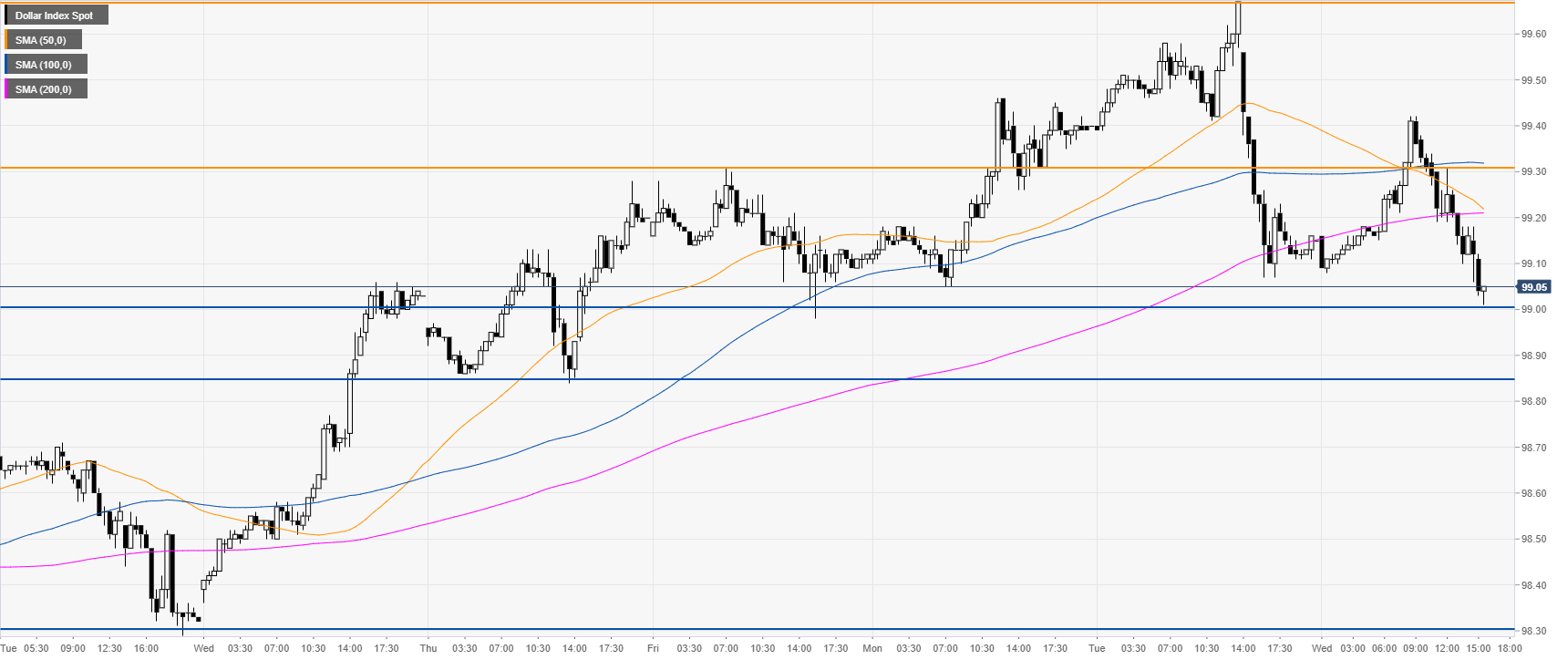

DXY four-hour chart

DXY is retracing down after hitting a new 2019 high at 99.67. The market is challenging the 99.00 figure. A break of the level can lead to 98.85 support area and potentially to 98.30 if the bears gather enough steam.

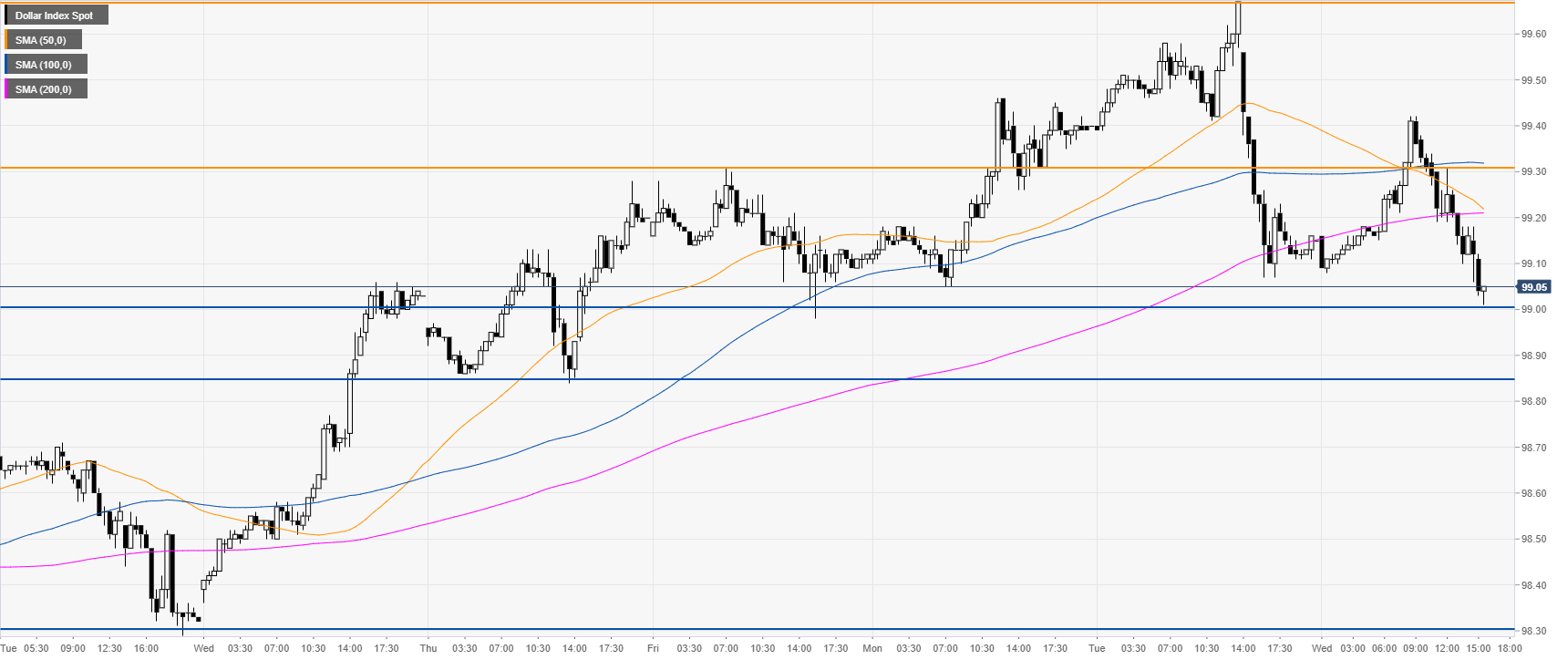

DXY 30-minute chart

DXY is trading below its main SMAs, suggesting a bearish bias in the short term. Immediate resistance is seen at the 99.30 price level and 99.67 (2019 high).

Additional key levels