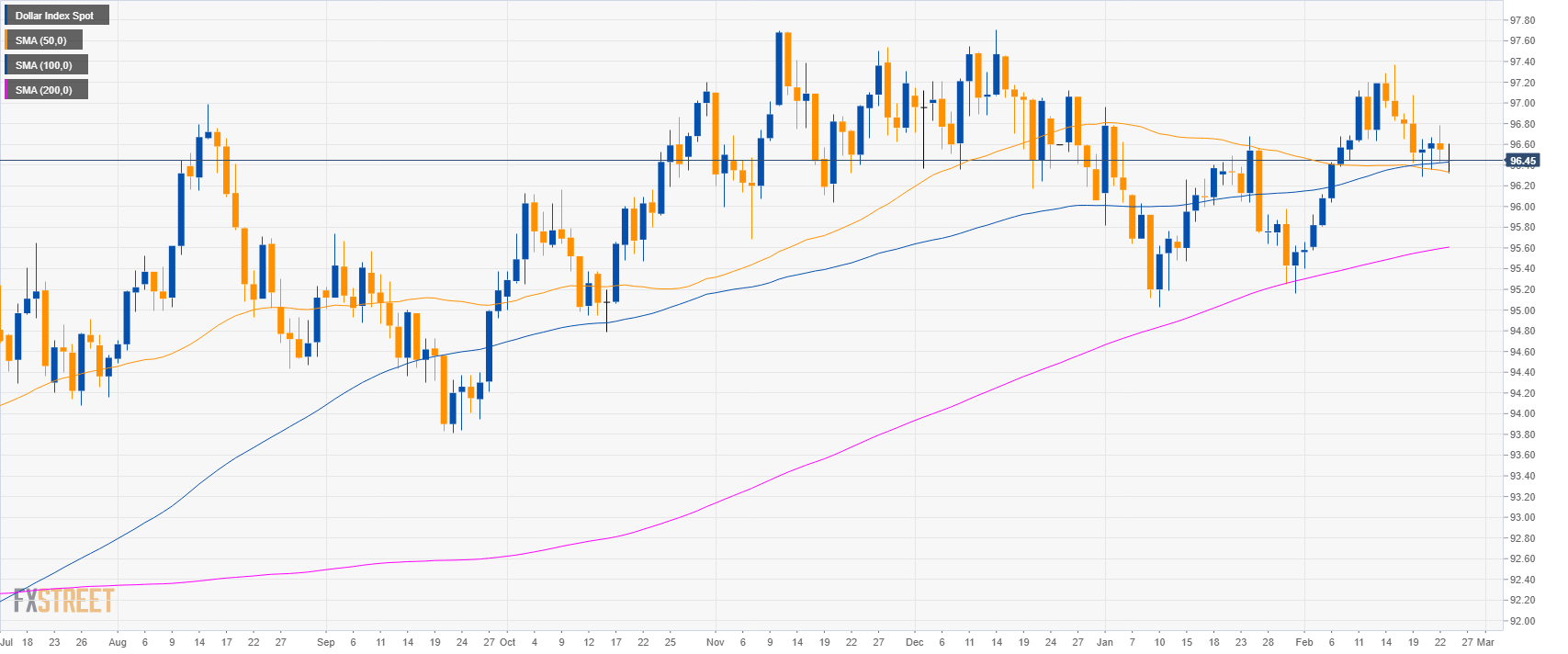

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages (SMAs).

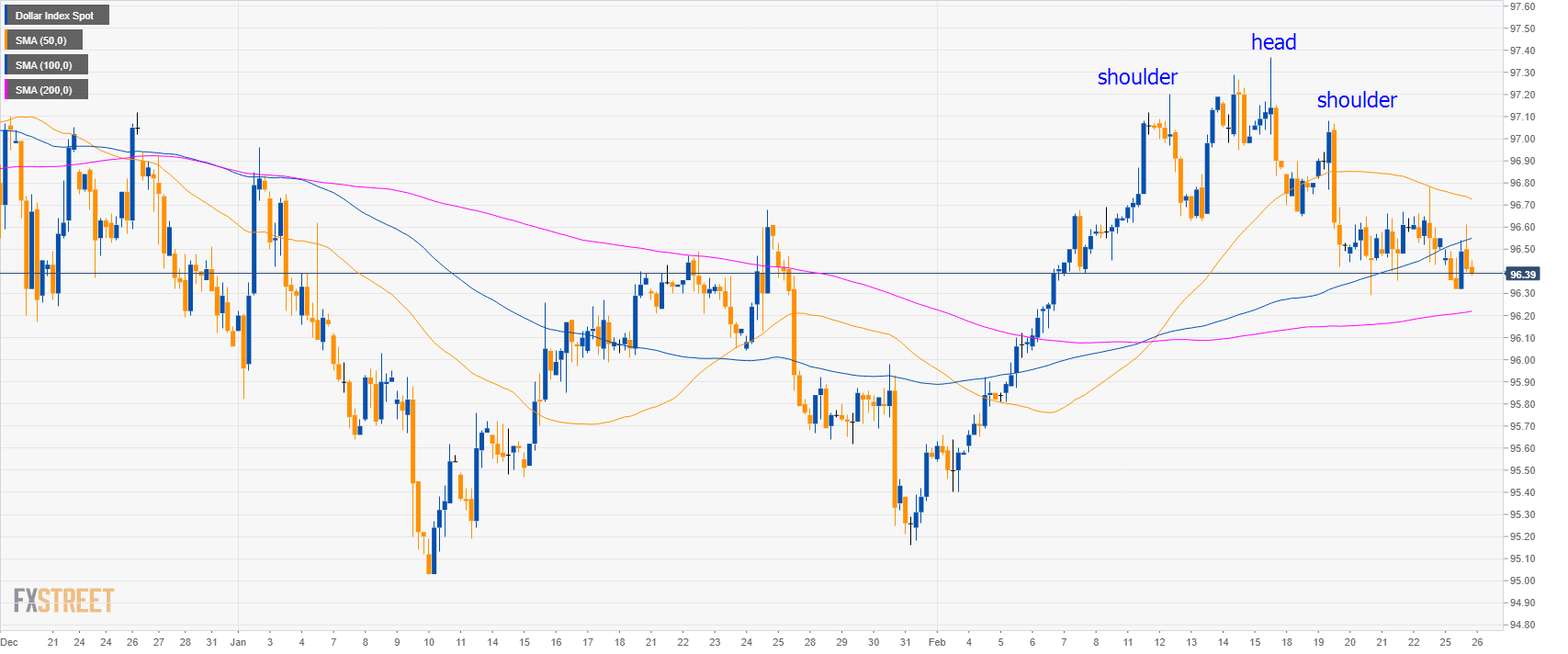

DXY 4-hour chart

- The head-and-shoulders pattern suggests further weakness ahead with 95.40 as a key bear target.

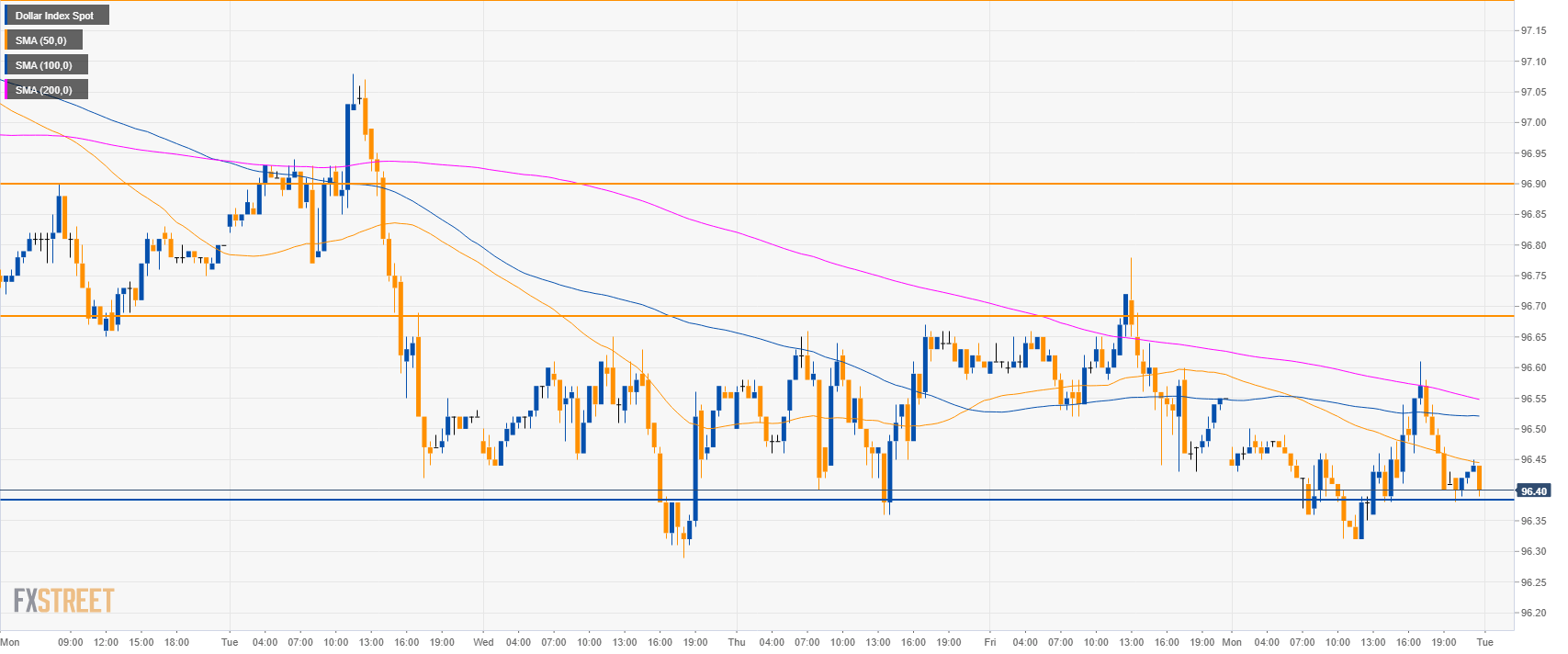

DXY 30-minute chart

- DXY is trading below the main SMAs suggesting a bearish bias in the short-term.

- Bears will likely try to break below 96.40 to get to 96.10, 95.90 and 95.40 to the downside.

- To the upside, resistances are located at 96.70 and 96.90 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.44

Today Daily change %: -0.11%

Today Daily Open: 96.55

Trends:

Daily SMA20: 96.38

Daily SMA50: 96.35

Daily SMA100: 96.42

Daily SMA200: 95.59

Levels:

Previous Daily High: 96.78

Previous Daily Low: 96.43

Previous Weekly High: 97.08

Previous Weekly Low: 96.29

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.56

Daily Fibonacci 61.8%: 96.65

Daily Pivot Point S1: 96.39

Daily Pivot Point S2: 96.24

Daily Pivot Point S3: 96.04

Daily Pivot Point R1: 96.74

Daily Pivot Point R2: 96.94

Daily Pivot Point R3: 97.09