- The Greenback is trapped in a triangle pattern as the market is waiting for a catalyst.

- The level to beat for bulls is the 98.55/98.66 resistance zone.

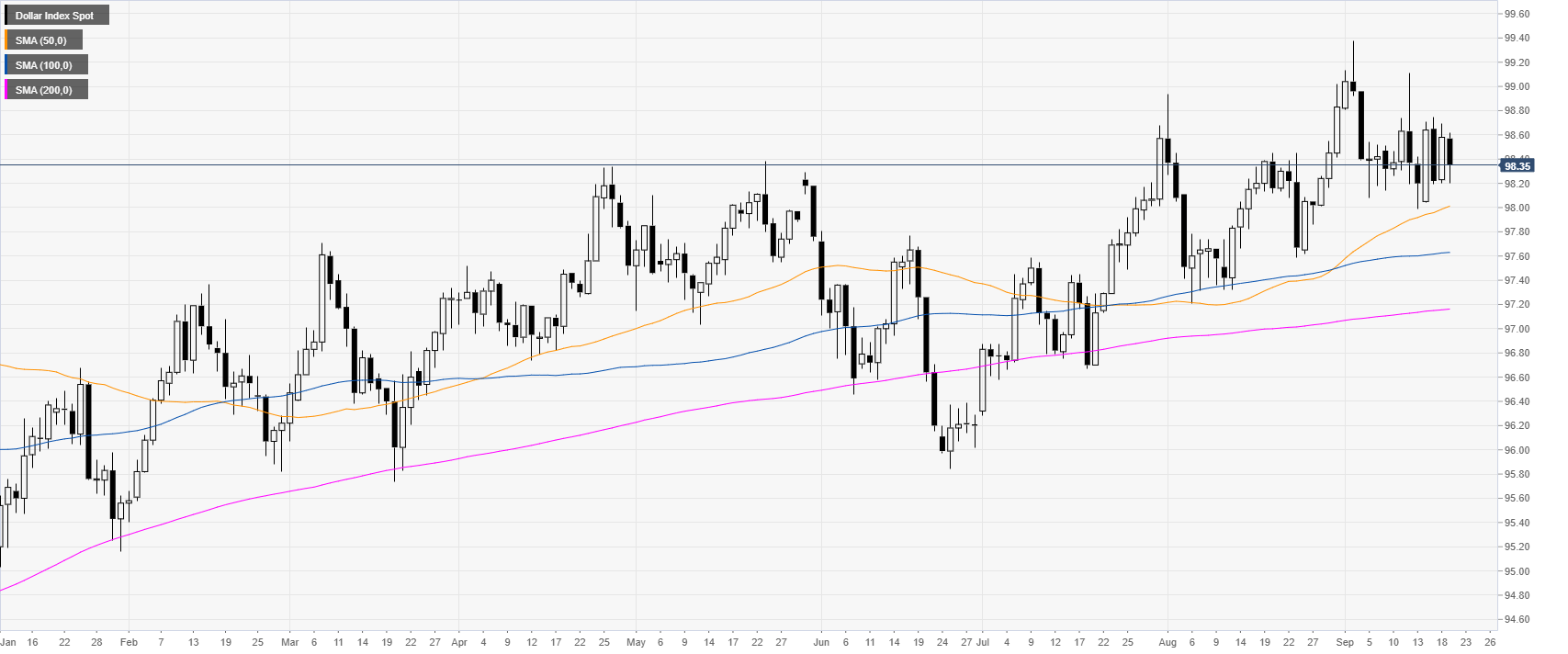

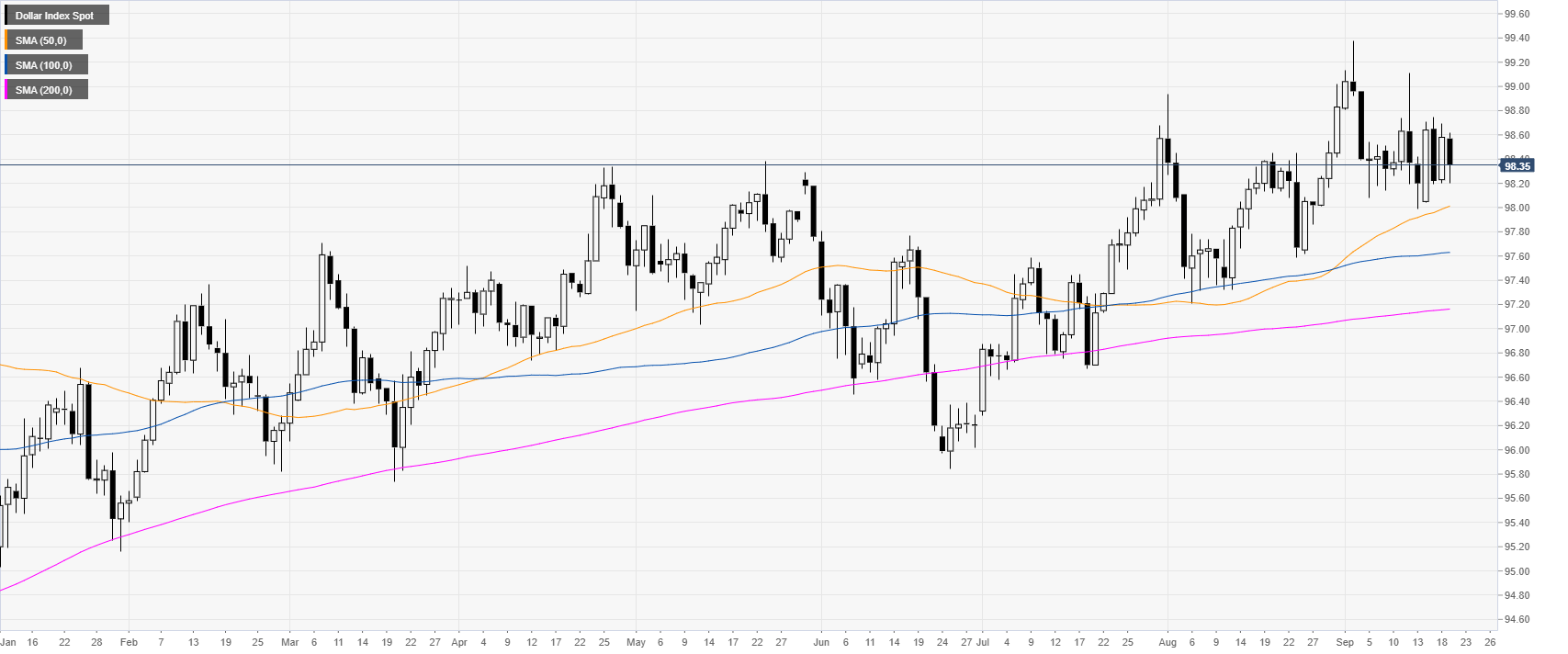

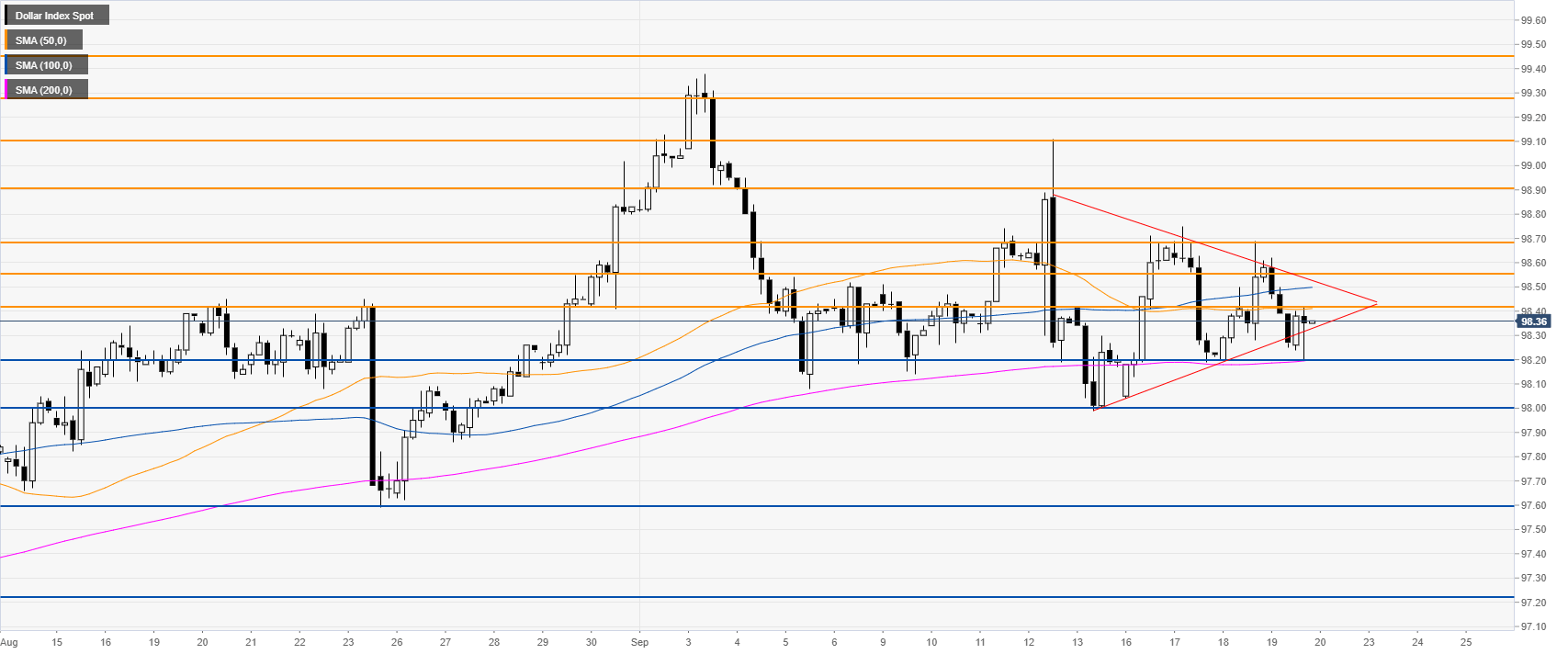

DXY daily chart

DXY (US Dollar Index) is trading in a bull trend above its main daily simple moving averages (DSMAs). In the last two weeks, the Greenback has been trading in a trading range revolving around the 98.40 level.

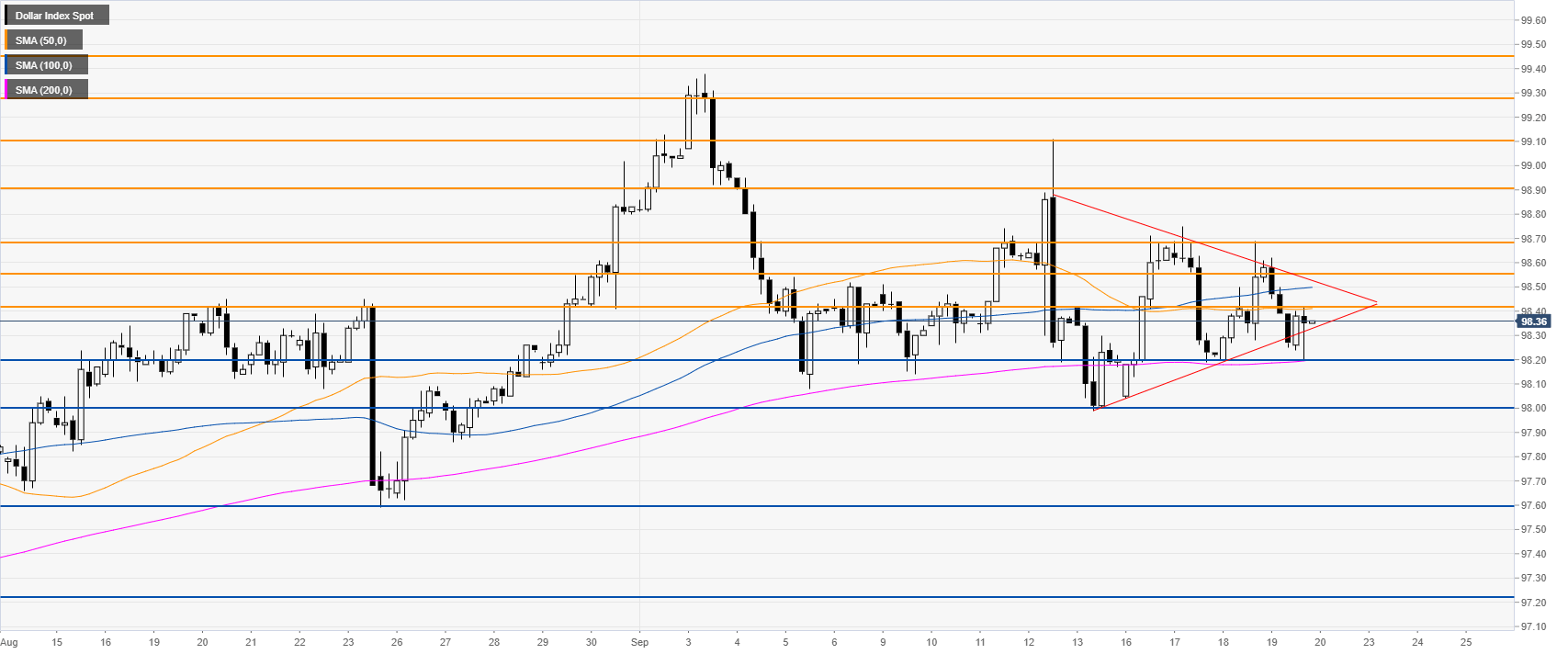

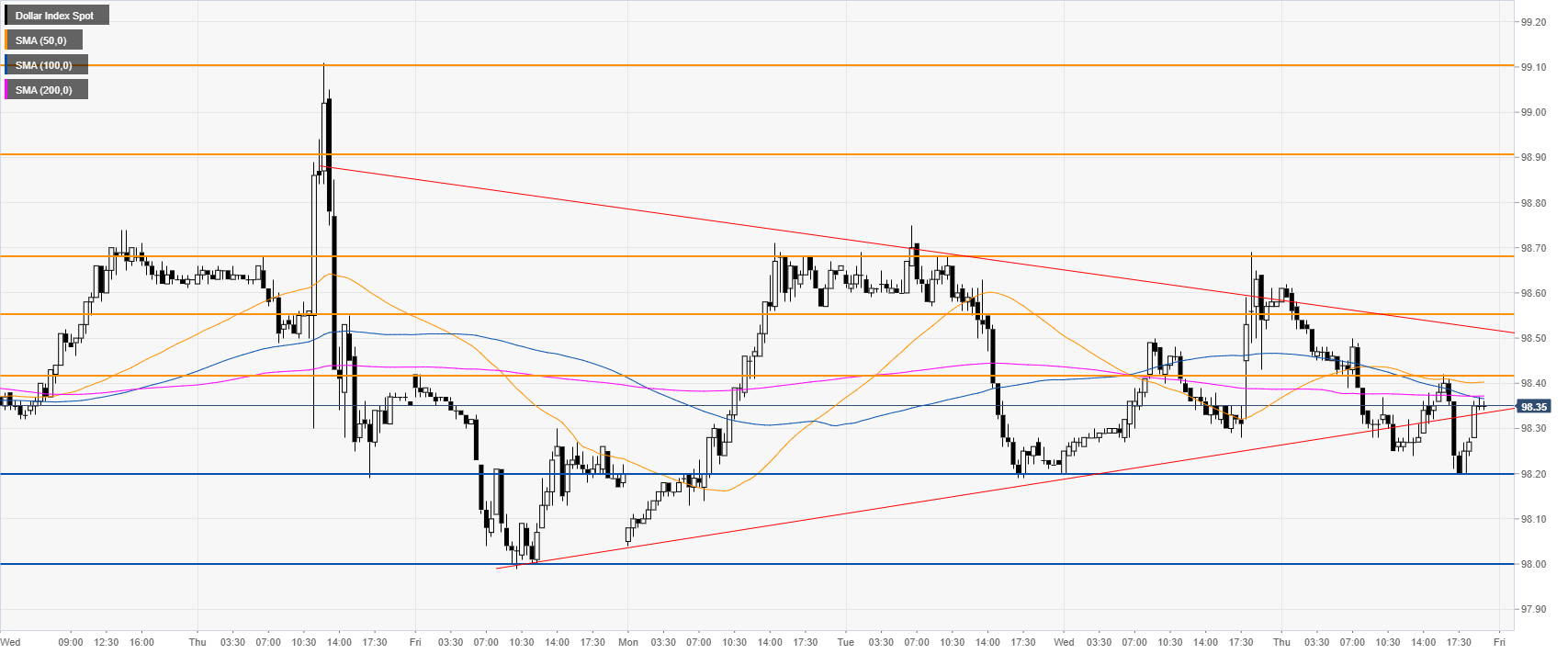

DXY four-hour chart

DXY is ranging above the 98.20 support and the 200 SMA. DXY is forming a triangle pattern with a potential breakout in either direction, although the primary bias is to the upside.

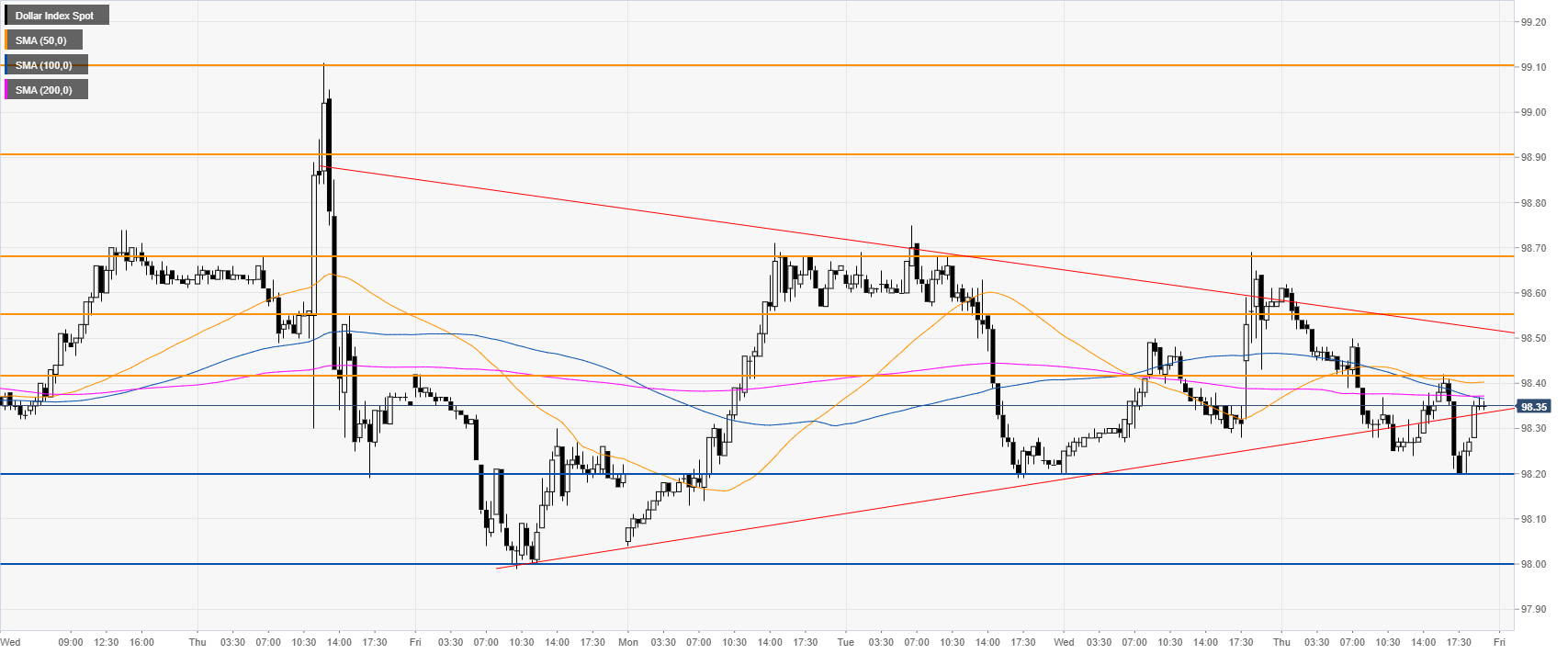

DXY 30-minute chart

DXY bulls would need a break above the 98.55/98.68 resistance zone to pull away from the triangle pattern. On the flip side, bears need to overcome the 98.20/98.00 support zone.

Additional key levels