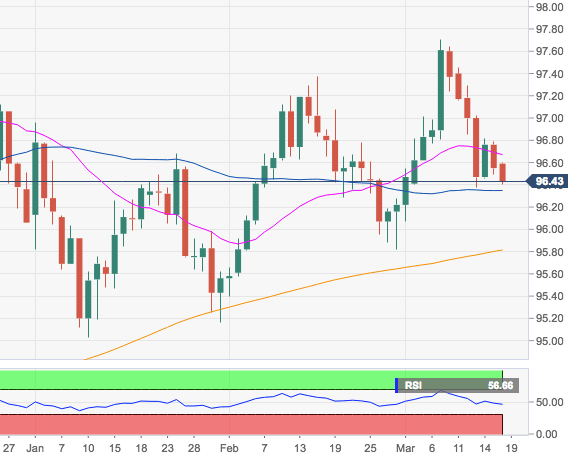

- The index is adding to Friday’s weakness and remains on the way to a potential visit of the key 55-day SMA, today at 96.33.

- Further south is expected to test the 95.80 region, where coincide late-February lows and the critical 200-day SMA.

- That said, the constructive view on DXY is expected to persist as long as the 200-day SMA underpins.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.41

Today Daily change: 20 pips

Today Daily change %: -0.15%

Today Daily Open: 96.55

Trends:

Daily SMA20: 96.68

Daily SMA50: 96.35

Daily SMA100: 96.57

Daily SMA200: 95.8

Levels:

Previous Daily High: 96.79

Previous Daily Low: 96.49

Previous Weekly High: 97.45

Previous Weekly Low: 96.38

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 96.6

Daily Fibonacci 61.8%: 96.68

Daily Pivot Point S1: 96.43

Daily Pivot Point S2: 96.31

Daily Pivot Point S3: 96.13

Daily Pivot Point R1: 96.73

Daily Pivot Point R2: 96.91

Daily Pivot Point R3: 97.03