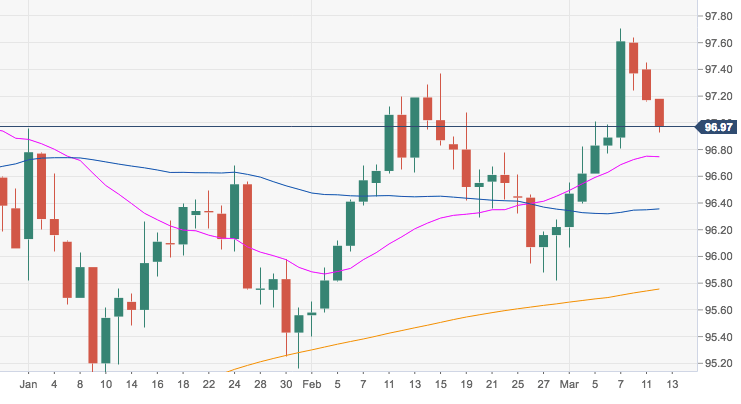

- The index keeps correcting lower following last week’s new 2019 highs in the 97.70/75 band and is currently challenging the cirtical support at 97.00 the figure.

- Extra losses are likely in the current scenario of risk-on trade and are expected to meet initial contention in the 96.80/70 band, where converge the 10-day and 21-day SMAs.

- In spite of the ongoing correction lower, the constructive outlook in DXY is seen unchanged above the critical 200-day SMA, today at 95.75.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.96

Today Daily change: 18 pips

Today Daily change %: -0.22%

Today Daily Open: 97.17

Trends:

Daily SMA20: 96.74

Daily SMA50: 96.32

Daily SMA100: 96.56

Daily SMA200: 95.74

Levels:

Previous Daily High: 97.45

Previous Daily Low: 97.16

Previous Weekly High: 97.71

Previous Weekly Low: 96.4

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 97.27

Daily Fibonacci 61.8%: 97.34

Daily Pivot Point S1: 97.07

Daily Pivot Point S2: 96.97

Daily Pivot Point S3: 96.78

Daily Pivot Point R1: 97.36

Daily Pivot Point R2: 97.55

Daily Pivot Point R3: 97.65