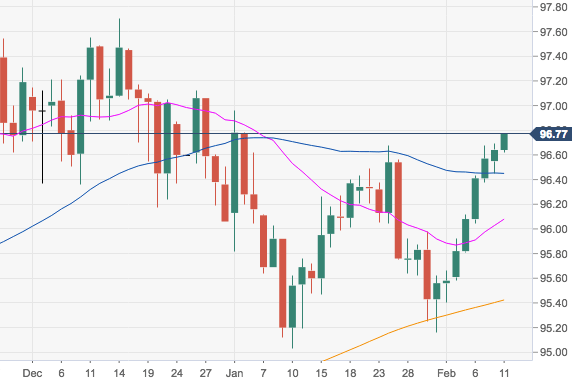

- The index is navigating fresh 6-week tops around the Fibo retracement near 96.80 so far today, paving the way for a potential visit to yearly tops in the 97.00 neighbourhood.

- Extra upside on a clear of this area are expected to meet 2018 highs around 97.70 recorded in mid-December.

- The positive view on the buck remains unchanged while above the 200-day SMA at 95.41. This relevant area of support is also reinforced by a Fibo retracement of the September-December rally at 95.30 and recent lows at 95.16.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.75

Today Daily change: 16 pips

Today Daily change %: 0.11%

Today Daily Open: 96.64

Trends:

Daily SMA20: 96.04

Daily SMA50: 96.4

Daily SMA100: 96.24

Daily SMA200: 95.4

Levels:

Previous Daily High: 96.69

Previous Daily Low: 96.45

Previous Weekly High: 96.69

Previous Weekly Low: 95.58

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.6

Daily Fibonacci 61.8%: 96.54

Daily Pivot Point S1: 96.5

Daily Pivot Point S2: 96.35

Daily Pivot Point S3: 96.26

Daily Pivot Point R1: 96.74

Daily Pivot Point R2: 96.83

Daily Pivot Point R3: 96.98