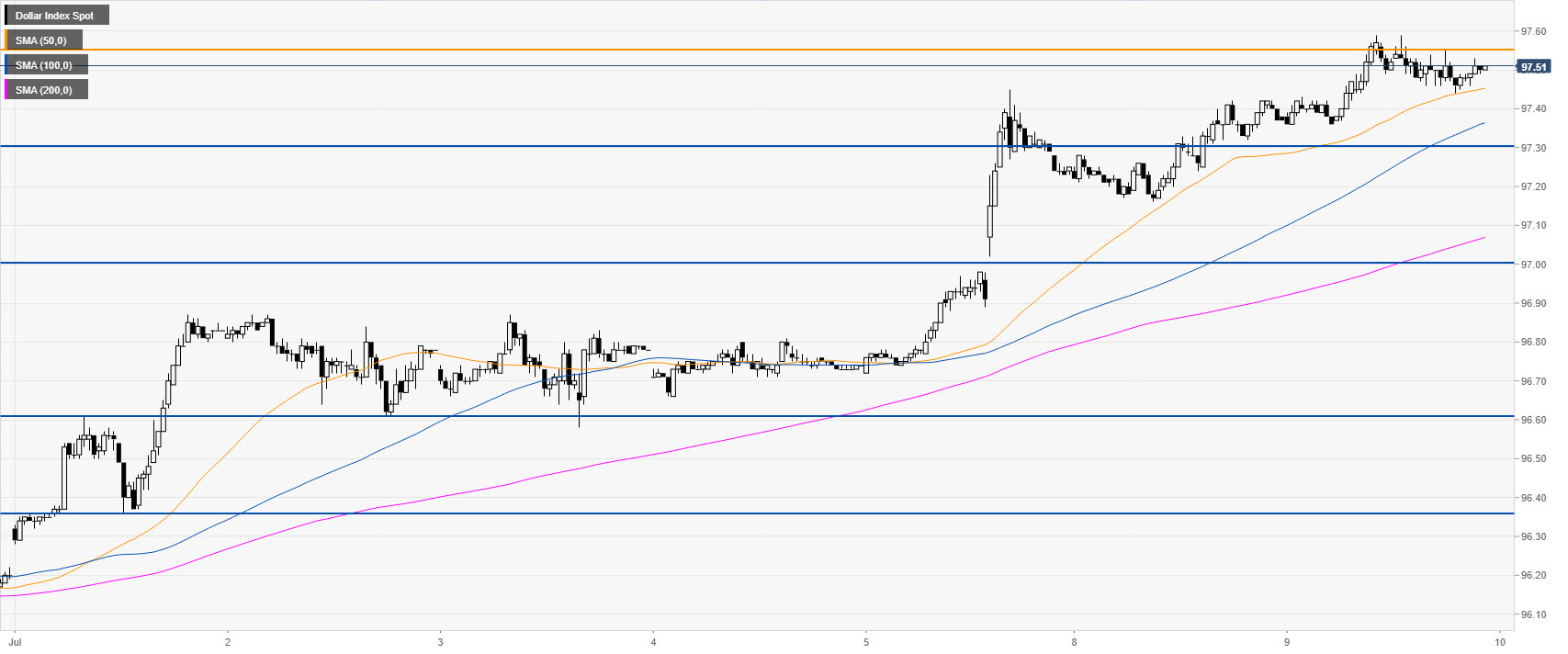

- The bulls will try to break the 97.55 and 97.80 resistances.

- Support is seen at 97.30 and the 97.00 figure.

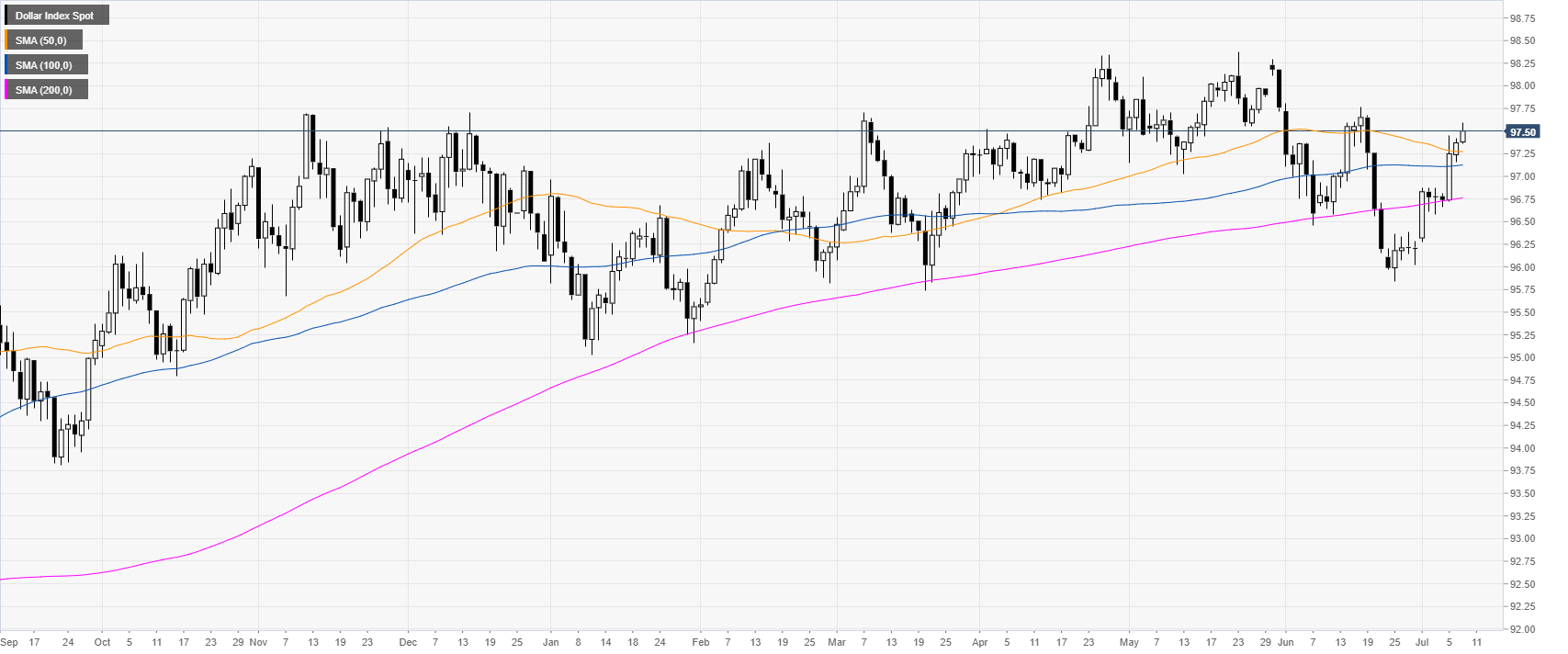

DXY daily chart

The US Dollar Index (DXY) is trading in a bull trend just above its main daily simple moving average (DSMA). The market is about to close the day just below the 97.55 resistance.

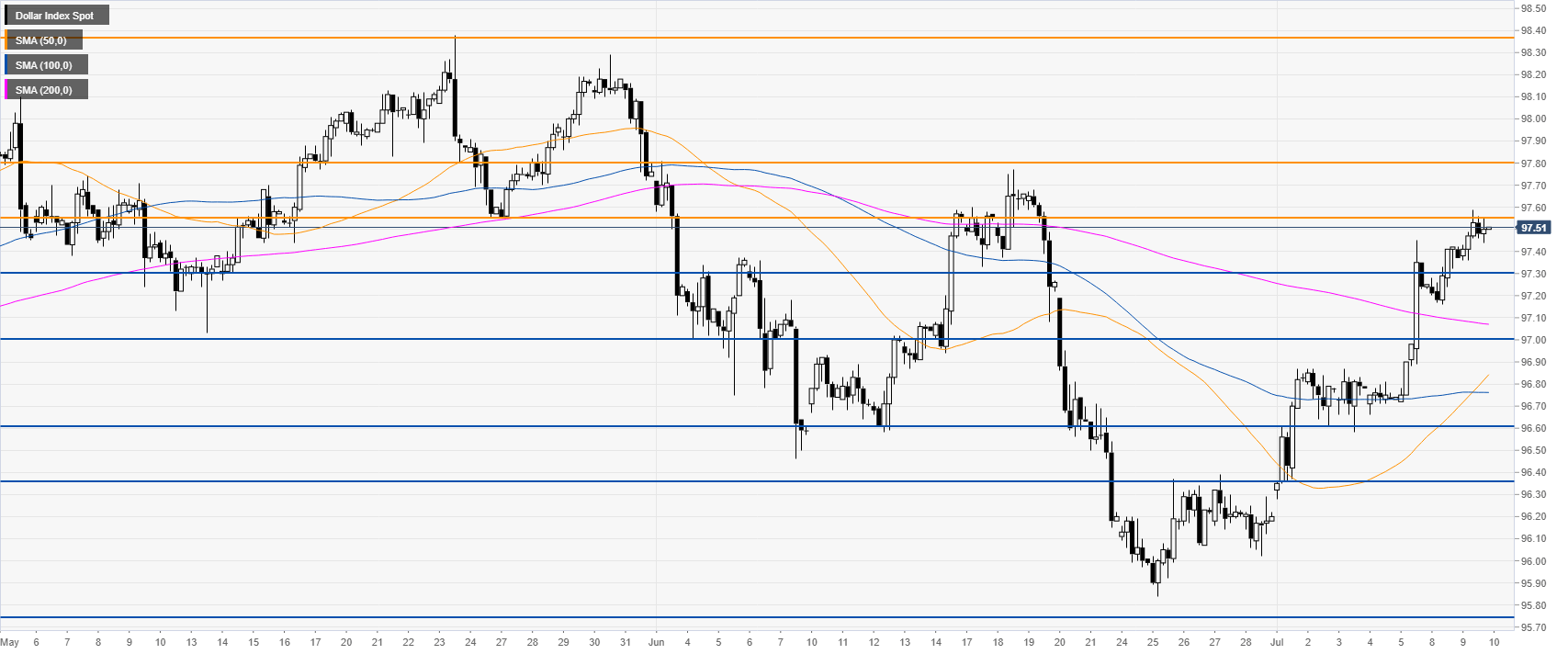

DXY 4-hour chart

The market is trading above its main SMAs suggesting bullish momentum in the medium term. Bulls will try to drive the market up to 97.80 and 98.38.

DXY 30-minute chart

The greenback is bullish in the short term above the main SMAs. The 97.30 and 97.00 levels can be seen as immediate support. A daily close below the 97.00 figure could lead to move down to 96.36.

Additional key levels