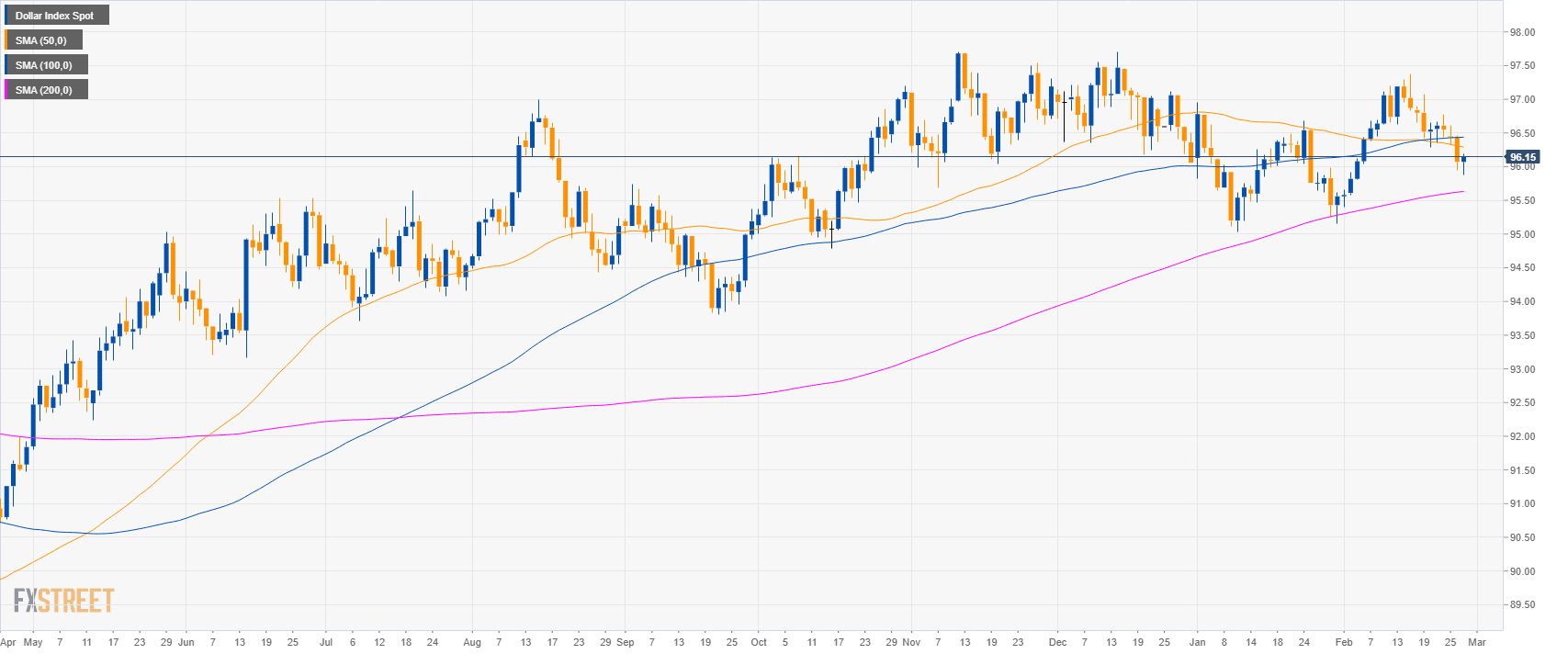

DXY daily chart

- DXY is trading in a bull trend above the 200-day simple moving average (SMA).

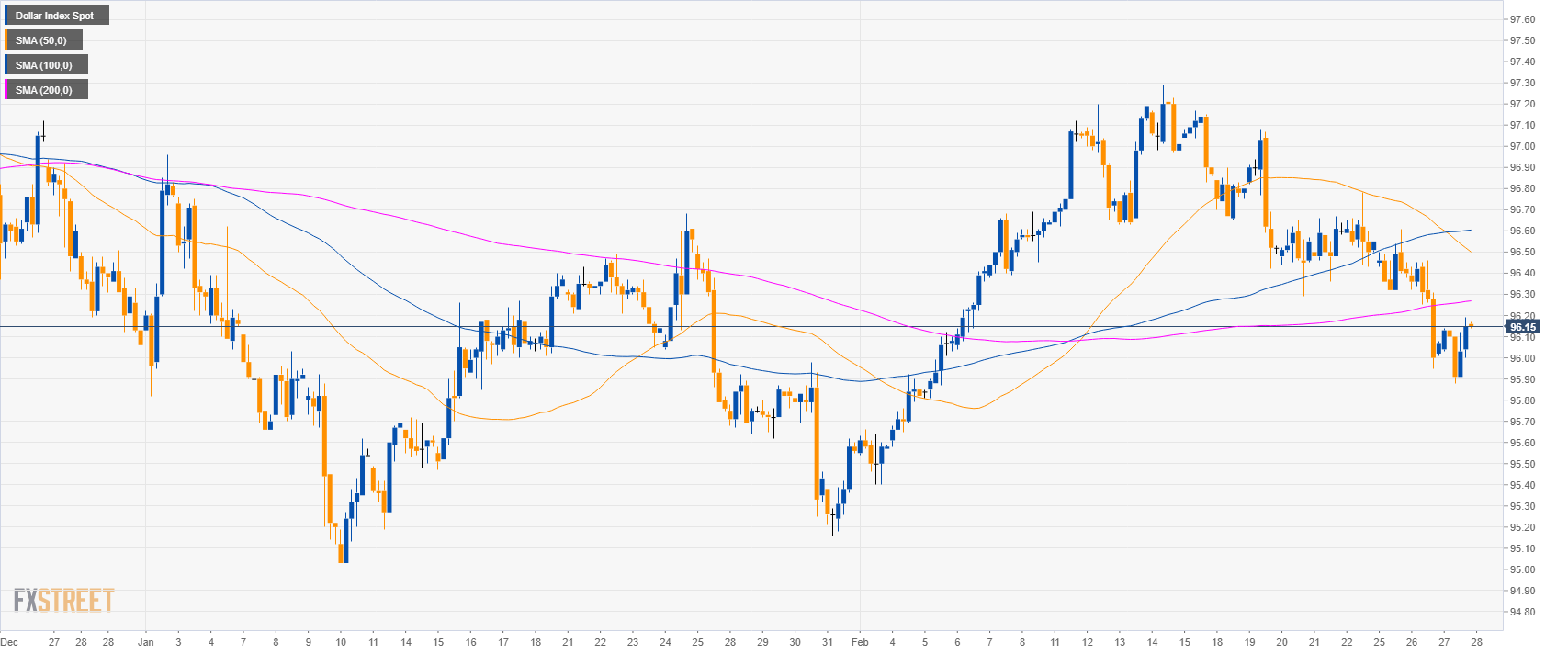

USD/JPY 4-hour chart

- DXY is trading below its main SMAs suggesting bearish momentum.

- The 95.40 bear target remains firmly in place.

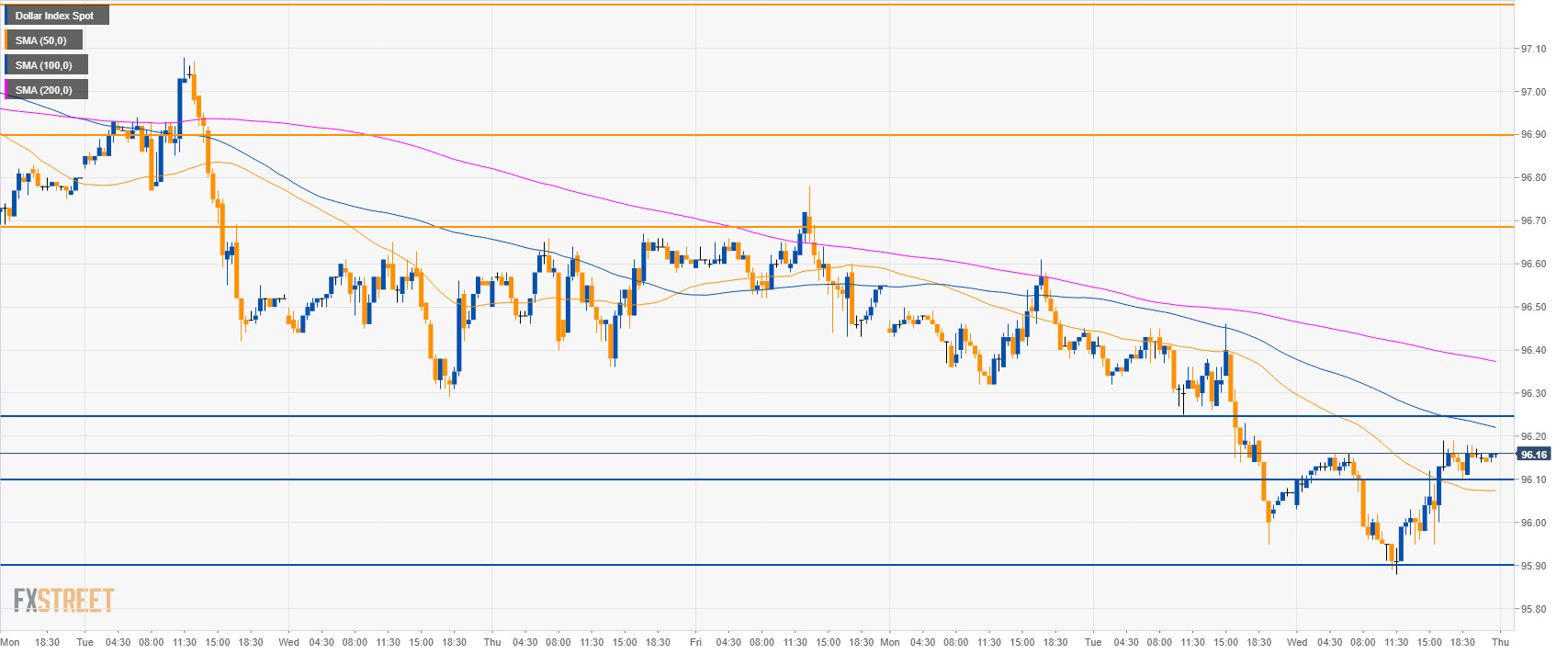

DXY 30-minute chart

- The bulls broke above 96.10 and the 50 SMA. If the market break above 96.25 it can lead to a move to 96.70 in the short-term.

- On the flip side, a break below 96.10 would see a drop to 95.90.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.16

Today Daily change %: 0.09%

Today Daily Open: 96.07

Trends:

Daily SMA20: 96.43

Daily SMA50: 96.31

Daily SMA100: 96.43

Daily SMA200: 95.62

Levels:

Previous Daily High: 96.46

Previous Daily Low: 95.95

Previous Weekly High: 97.08

Previous Weekly Low: 96.29

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.14

Daily Fibonacci 61.8%: 96.27

Daily Pivot Point S1: 95.86

Daily Pivot Point S2: 95.65

Daily Pivot Point S3: 95.35

Daily Pivot Point R1: 96.37

Daily Pivot Point R2: 96.67

Daily Pivot Point R3: 96.88