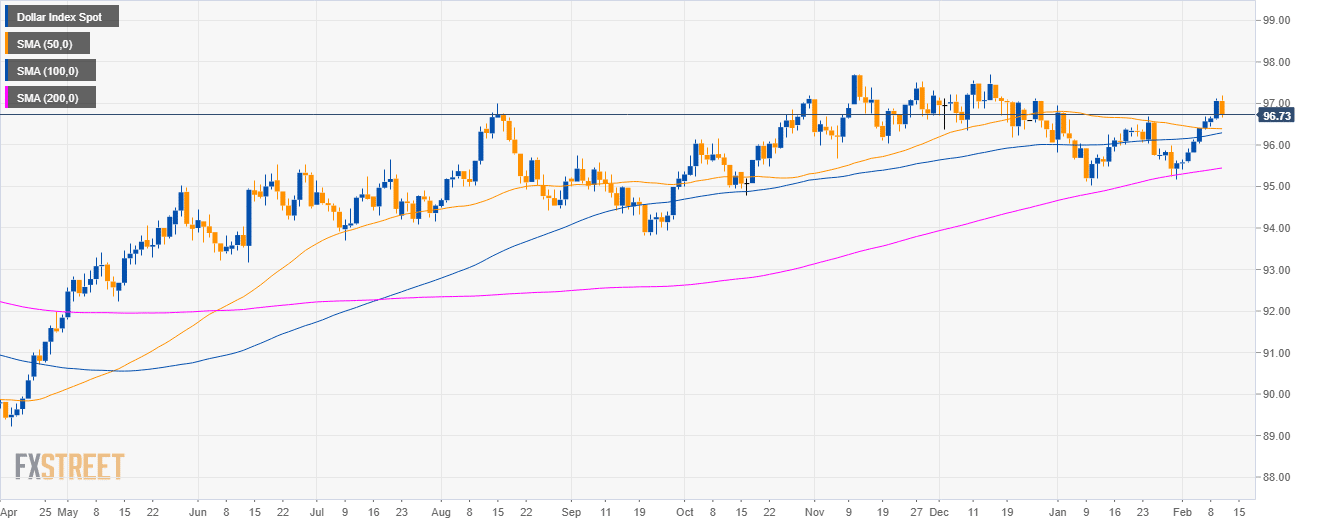

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages (SMAs).

- This Tuesday marks the largest daily decline in two weeks for the Greenback.

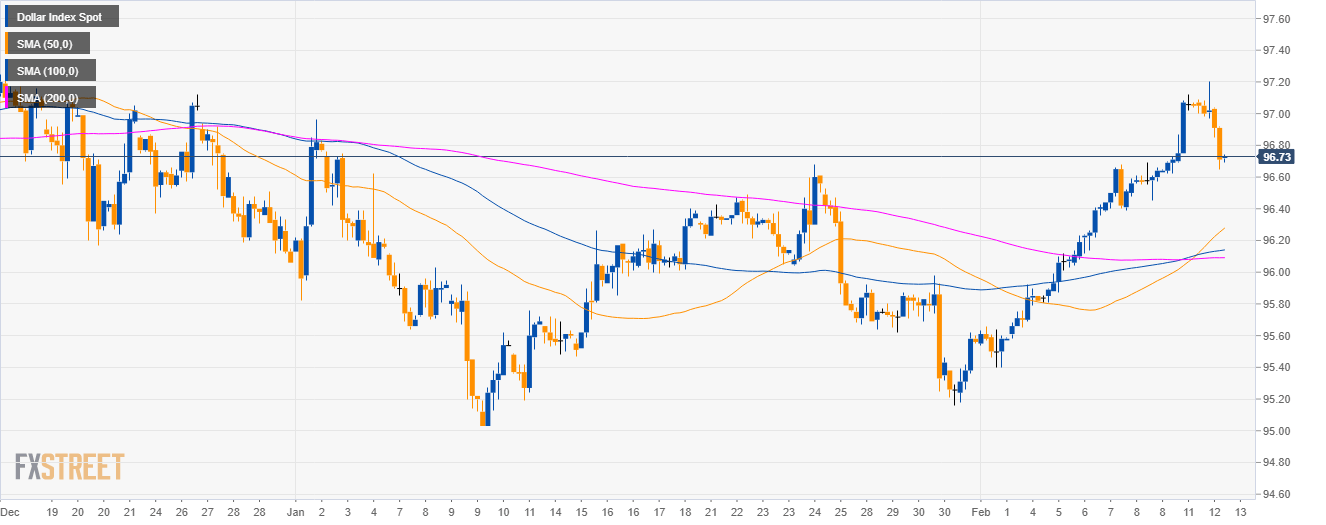

DXY 4-hour chart

- DXY is trading above its main SMAs suggesting bullish momentum in the medium-term.

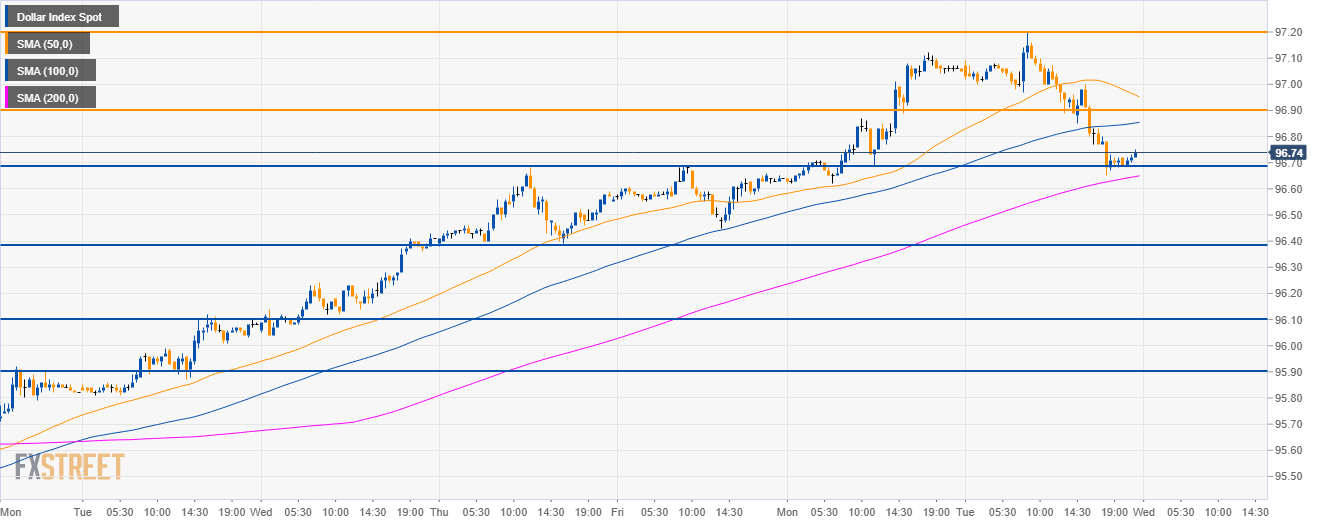

DXY 30-minute chart

- DXY is trading between the 100 and 200 SMAs suggesting a sideways market in the short-term.

- Bulls will try to recapture 96.90 and 97.20 to the upside.

- On the flip sside, a break below 96.70 on a daily closing basis could lead to a decline 96.40 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.74

Today Daily change: -32 ticks

Today Daily change %: -0.33%

Today Daily Open: 97.06

Trends:

Daily SMA20: 96.12

Daily SMA50: 96.4

Daily SMA100: 96.27

Daily SMA200: 95.43

Levels:

Previous Daily High: 97.12

Previous Daily Low: 96.62

Previous Weekly High: 96.69

Previous Weekly Low: 95.58

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.93

Daily Fibonacci 61.8%: 96.81

Daily Pivot Point S1: 96.75

Daily Pivot Point S2: 96.43

Daily Pivot Point S3: 96.25

Daily Pivot Point R1: 97.25

Daily Pivot Point R2: 97.43

Daily Pivot Point R3: 97.75