- Oversold RSI triggered the DXY bounce.

- Early-month low, 23.6% Fibo. limit the latest pullback.

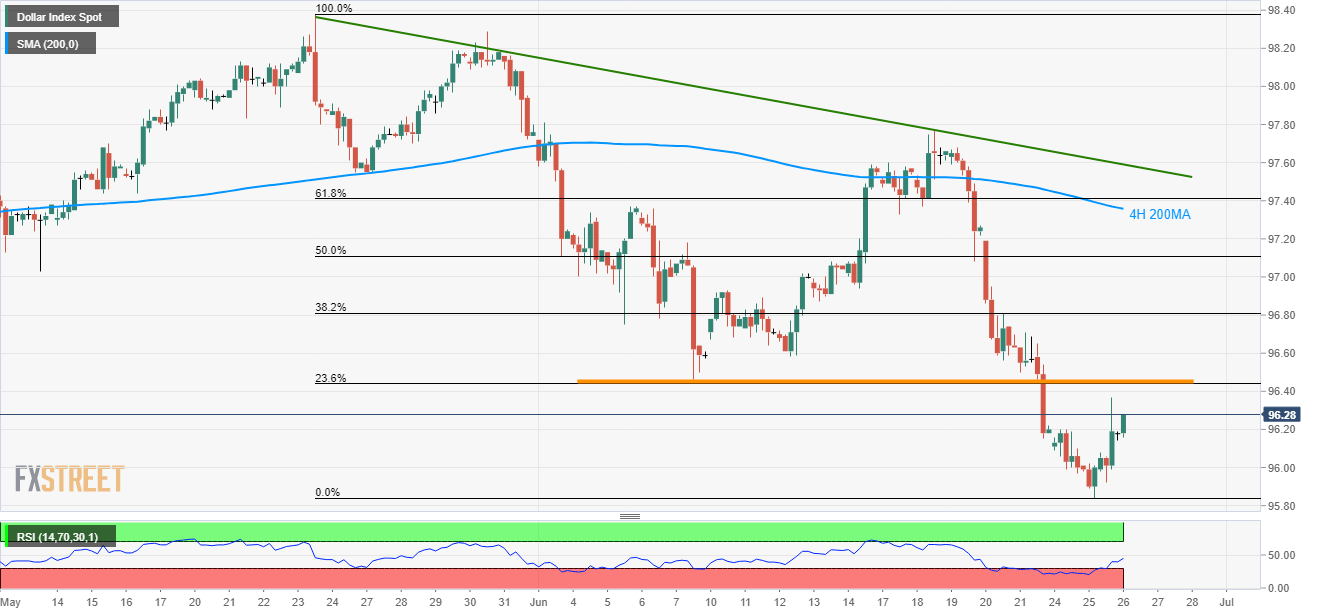

Even if a less negative rhetoric from the US Federal Reserve policymakers triggered the US Dollar Index (DXY) pullback observing oversold RSI, the greenback gauge still remains under short-term key resistance as it takes the rounds to 96.24 on early Wednesday.

Not only June 07 bottom but 23.6% Fibonacci retracement level of May – June downpour and 200-day simple moving average (200-day SMA) on the daily chart, around 96.44/46, also restricts the quote’s immediate upside.

As a result, the pullback towards 96.00 and then to a recent low of 95.84 can’t be ruled out.

Also, additional declines below 95.84 can push bears towards 95.17 and 95.00 afterward.

On the contrary, sustained break of 96.46 may escalate the recovery towards 38.2% and 50% Fibonacci retracement levels of 96.81 and 97.11 ahead of highlighting 200-bar moving average (4H 200MA) level of 97.36 as the key resistance.

DXY 4-hour chart

Trend: Pullback expected