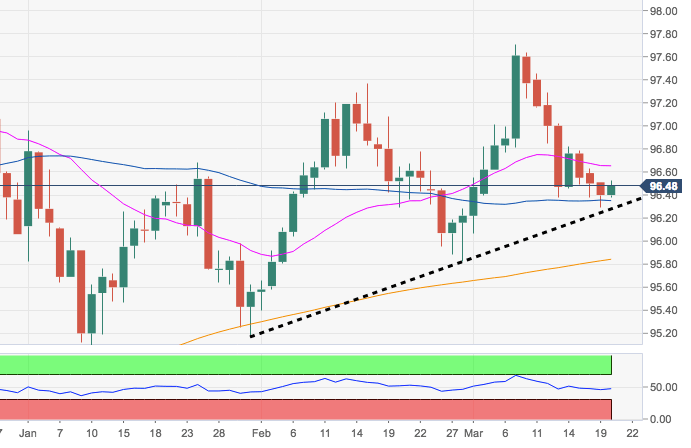

- Despite the ongoing rebound, the index stays depressed this week, meeting contention in the 96.30 for the time being, where emerges the short-term support line.

- A breach of this support line could open the door for a deeper retracement to the 95.80/85 band, where coincide the 200-day SMA and late February lows.

- On the other hand, a reversion of the current leg lower remains on the cards as long as this support line holds the downside.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.47

Today Daily change: 15 pips

Today Daily change %: 0.07%

Today Daily Open: 96.4

Trends:

Daily SMA20: 96.66

Daily SMA50: 96.38

Daily SMA100: 96.57

Daily SMA200: 95.83

Levels:

Previous Daily High: 96.51

Previous Daily Low: 96.29

Previous Weekly High: 97.45

Previous Weekly Low: 96.38

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 96.37

Daily Fibonacci 61.8%: 96.43

Daily Pivot Point S1: 96.29

Daily Pivot Point S2: 96.18

Daily Pivot Point S3: 96.07

Daily Pivot Point R1: 96.51

Daily Pivot Point R2: 96.62

Daily Pivot Point R3: 96.73