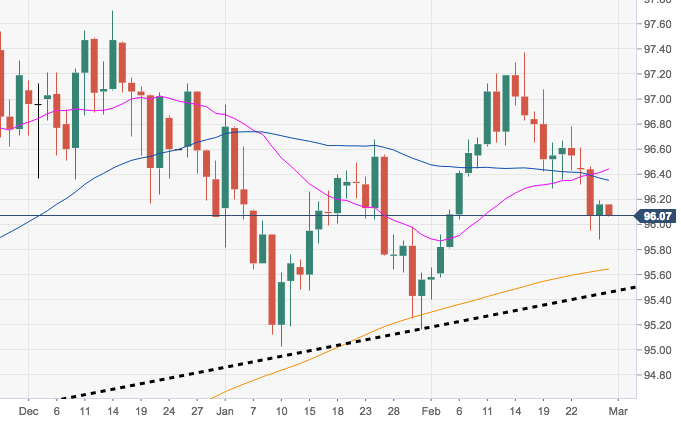

- The weekly pullback in DXY appears to have met decent contention in the 95.90/80 band, just ahead of the 50% Fibo retracement of the September-December up move at 95.76.

- The current bearish note carries the potential to visit the critical 200-day SMA, today at 95.64.

- On the broader picture, as long as the 200-day SMA holds the downside, the constructive outlook should persist. This view is also reinforced by the short-term support line at 95.45.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.09

Today Daily change: 9 pips

Today Daily change %: -0.07%

Today Daily Open: 96.16

Trends:

Daily SMA20: 96.46

Daily SMA50: 96.29

Daily SMA100: 96.44

Daily SMA200: 95.63

Levels:

Previous Daily High: 96.19

Previous Daily Low: 95.88

Previous Weekly High: 97.08

Previous Weekly Low: 96.29

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.07

Daily Fibonacci 61.8%: 96

Daily Pivot Point S1: 95.96

Daily Pivot Point S2: 95.77

Daily Pivot Point S3: 95.65

Daily Pivot Point R1: 96.27

Daily Pivot Point R2: 96.39

Daily Pivot Point R3: 96.58