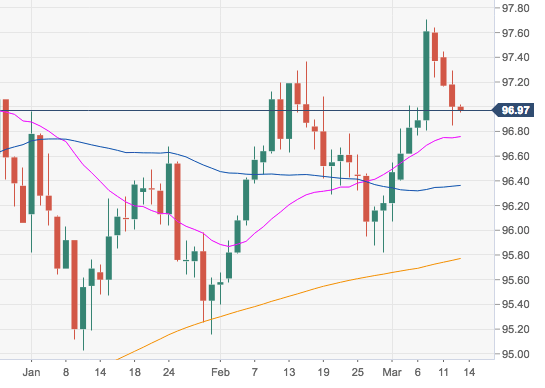

- The greenback remains under pressure so far this week, although the downside seems to have found contention in the 96.90 region, where is located the key 10-day SMA.

- Further south, the 96.74/33 band should offer interim support, home of the 21-day, 100-day and 55-day SMAs.

- Looking at the broader scenario, another test of 2019 highs around 97.70 remains well on the cards while underpinned by the 200-day SMA at 95.77 and 95.82 (late February low).

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.97

Today Daily change: 7 pips

Today Daily change %: -0.03%

Today Daily Open: 97

Trends:

Daily SMA20: 96.75

Daily SMA50: 96.34

Daily SMA100: 96.57

Daily SMA200: 95.76

Levels:

Previous Daily High: 97.29

Previous Daily Low: 96.85

Previous Weekly High: 97.71

Previous Weekly Low: 96.4

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 97.02

Daily Fibonacci 61.8%: 97.12

Daily Pivot Point S1: 96.8

Daily Pivot Point S2: 96.61

Daily Pivot Point S3: 96.36

Daily Pivot Point R1: 97.24

Daily Pivot Point R2: 97.49

Daily Pivot Point R3: 97.68