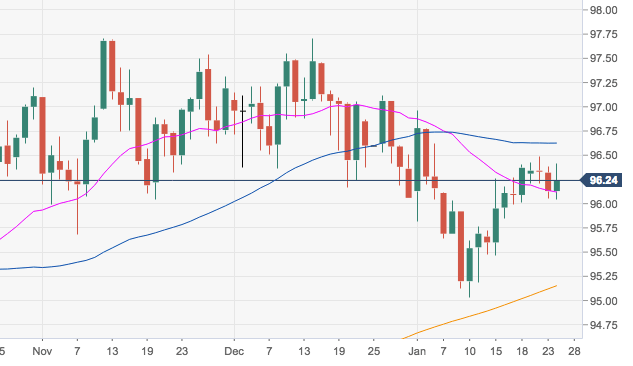

- The greenback is coming up after briefly testing fresh weekly lows in the 96.00 handle, although a clear breakout of the key resistance area in the mid-96.00s still remains elusive.

- DXY still needs to overcome the 96.50/80 band, where are located recent peaks, the key 55-day SMA and the 23.6% Fibo retracement of the September-December up move.

- A move higher should put the YTD highs around 97.00 back on the investors’ radar.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.25

Today Daily change: 0.12 pips

Today Daily change %: 0.12%

Today Daily Open: 96.13

Trends:

Daily SMA20: 96.11

Daily SMA50: 96.6

Daily SMA100: 96.1

Daily SMA200: 95.12

Levels:

Previous Daily High: 96.38

Previous Daily Low: 96.05

Previous Weekly High: 96.4

Previous Weekly Low: 95.47

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 96.18

Daily Fibonacci 61.8%: 96.25

Daily Pivot Point S1: 95.99

Daily Pivot Point S2: 95.86

Daily Pivot Point S3: 95.66

Daily Pivot Point R1: 96.32

Daily Pivot Point R2: 96.52

Daily Pivot Point R3: 96.65