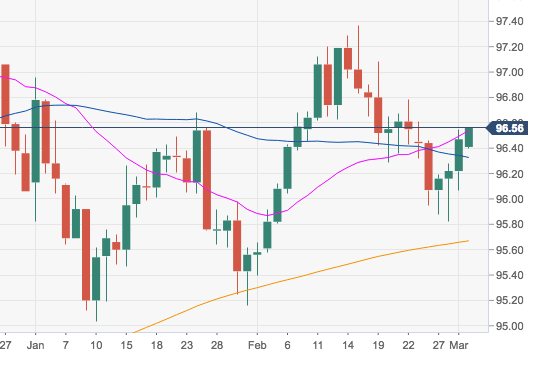

- DXY is extending the rally for yet another session today, advancing to fresh tops in the mid-96.00s.

- As long as the 200-day SMA holds the downside, today at 95.67, the greenback is expected to attempt another test of the 97.00 handle and above.

- The resumption of the down move should meet interim support in recent lows near 95.80 ahead of the critical 200-day SMA.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.54

Today Daily change: 26 pips

Today Daily change %: 0.07%

Today Daily Open: 96.47

Trends:

Daily SMA20: 96.54

Daily SMA50: 96.27

Daily SMA100: 96.46

Daily SMA200: 95.66

Levels:

Previous Daily High: 96.55

Previous Daily Low: 96.07

Previous Weekly High: 96.61

Previous Weekly Low: 95.82

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 96.37

Daily Fibonacci 61.8%: 96.25

Daily Pivot Point S1: 96.18

Daily Pivot Point S2: 95.88

Daily Pivot Point S3: 95.7

Daily Pivot Point R1: 96.66

Daily Pivot Point R2: 96.84

Daily Pivot Point R3: 97.14