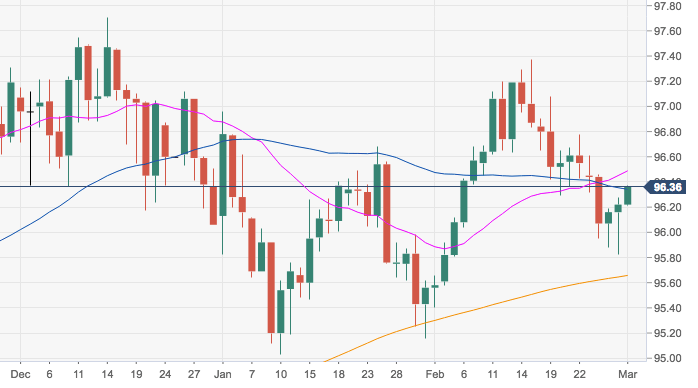

- The index has managed to bounce off recent 3-week lows in the 95.80 region and has regained the 96.00 handle and above.

- Extra gains should meet a moderate hurdle in the 96.40/50 band, where converge the 10-, 100- and 21-say SMAs.

- Provided the greenback stays above the critical 200-day SMA at 95.65, the likeliness of the continuation of the up move remains well on the cards.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.37

Today Daily change: 16 pips

Today Daily change %: 0.16%

Today Daily Open: 96.22

Trends:

Daily SMA20: 96.49

Daily SMA50: 96.27

Daily SMA100: 96.44

Daily SMA200: 95.64

Levels:

Previous Daily High: 96.28

Previous Daily Low: 95.82

Previous Weekly High: 97.08

Previous Weekly Low: 96.29

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 96.1

Daily Fibonacci 61.8%: 96

Daily Pivot Point S1: 95.93

Daily Pivot Point S2: 95.65

Daily Pivot Point S3: 95.47

Daily Pivot Point R1: 96.39

Daily Pivot Point R2: 96.57

Daily Pivot Point R3: 96.85