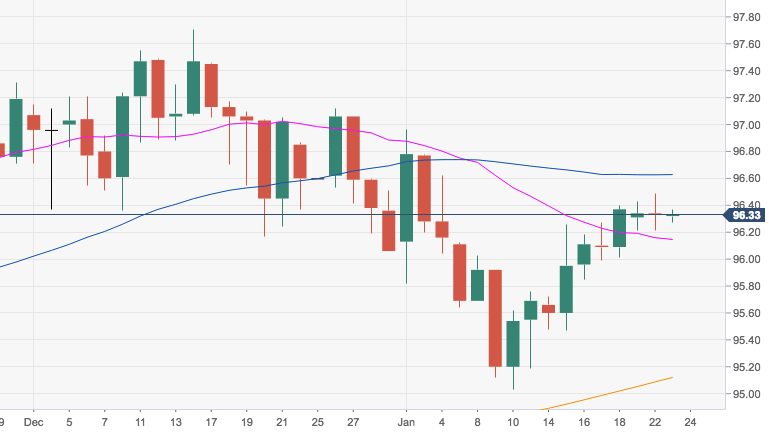

- DXY has faded Tuesday’s up move to the mid-96.00s, clinching at the same time fresh 3-week highs, and has now returned to the new comfort zone around 96.30.

- The greenback now needs to surpass the 96.60 level, where sits the 55-day SMA, and the 23.6% Fibo retracement of the September-December up move at 96.79 to allow for a re-test of 2019 highs in the boundaries of 97.00 the figure.

- On the downside, the 96.10/96.00 band emerges as a key support, where converge the 21-, 100- and 10-day SMAs

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.3

Today Daily change: -0.03 pips

Today Daily change %: -0.03%

Today Daily Open: 96.33

Trends:

Daily SMA20: 96.14

Daily SMA50: 96.62

Daily SMA100: 96.09

Daily SMA200: 95.09

Levels:

Previous Daily High: 96.49

Previous Daily Low: 96.21

Previous Weekly High: 96.4

Previous Weekly Low: 95.47

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 96.32

Daily Fibonacci 61.8%: 96.38

Daily Pivot Point S1: 96.2

Daily Pivot Point S2: 96.06

Daily Pivot Point S3: 95.92

Daily Pivot Point R1: 96.48

Daily Pivot Point R2: 96.62

Daily Pivot Point R3: 96.76