- DXY loses further momentum and tests 92.80 on Thursday.

- The ECB sounded less dovish than expected at its meeting.

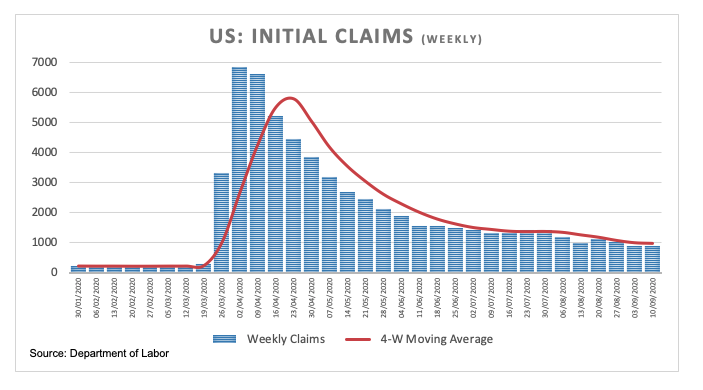

- US Initial Claims rose by 884K during last week, more than expected.

The greenback is now accelerating the downside and drags the US Dollar Index (DXY) to new multi-day lows in the 92.80 region.

US Dollar Index depressed on risk appetite

The index is navigating in multi-day lows near 92.80 following the persistent better mood in the risk-associated universe. Investors preference for riskier assets was exacerbated on Thursday after the ECB left unchanged its monetary conditions and sounded less dovish than initially predicted.

In fact, the ECB suggested that markets should not overreact to the recent gains in the European, although it also noted that the exchange rate will be under the microscope and Board members discussed the recent appreciation of the currency. In addition, the ECB revised a tad lower its forecasts for economic growth in the next couple of years, while it now sees inflation rising at a somewhat faster pace. The risk-on mood also picked up pace after ECB’s Lagarde said the economy in the region is going trough a strong rebound.

In the US data space, Initial Claims rose by 884K during last week, coming in short of expectations. On a brighter side, Producer Prices rose 0.3% inter-month during August, surpassing prior estimates.

What to look for around USD

The rally in the dollar failed near 93.70 earlier in the week, exposing the index to the resumption of the bearish trend. The ongoing recovery from 2020 lows near 91.70, while strong, is still considered as corrective only amidst the broad bearish stance surrounding the dollar. Supporting this view is located of a (more) dovish Fed, the unremitting progress of the coronavirus pandemic and political uncertainty ahead of the November elections. On the supportive side of the buck emerge occasional bouts of US-China tensions and the resumption of the risk aversion among investors.

US Dollar Index relevant levels

At the moment, the index is losing 0.43% at 92.84 and faces the next support at 91.75 (2020 low Sep.1) seconded by 89.23 (monthly low April 2018) and then 88.94 (monthly low March 2018). On the other hand, a break above 93.66 (monthly high Sep.9) would open the door to 93.99 (monthly high Aug.3) and finally 94.20 (38.2% Fibo of the 2017-2018 drop).