The Fed minutes released yesterday, on April 6th did not offer anything new to the markets. If anything the minutes simply reiterated what Fed officials were saying. Global risks are simply too much to warrant another rate hike under the current circumstances. Weighing on inflation, the Fed minutes showed that while members argued for an April rate hike, only one FOMC member dissented voting in favor of a rate hike.

The minutes indeed wasn’t anything much to talk home about, especially after Janet Yellen’s speech just a week before where her dovish comments saw the markets scaling back the rate hike bets expecting the Fed to continue forward with its current stance. With April being ruled out for any policy changes, focus shifts to the economic data between now and June.

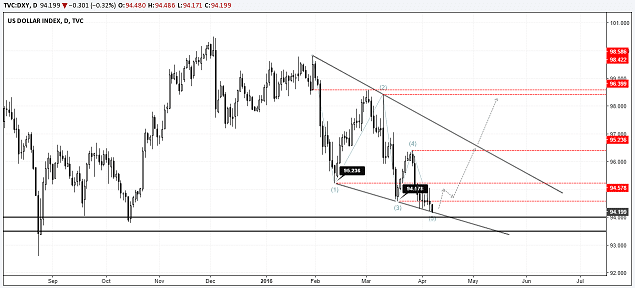

The US dollar has weakened quite a bit and shows no respite of giving up the declines. However, technical charts point to a bullish descending edge pattern, from where an upside breakout could see the dollar attempt to regain some of its declines.

At the time of writing, the US Dollar Index is trading close to 94.187, just 187 points shy of the 94.0 critical support zone with the lower bound at 94.5. A break below this level will of course send the dollar on a longer term correction. While the pattern is still evolving, it does alert traders to the potential move to the upside.

If one looks at the market reaction in the currencies yesterday, it was clear that there were no significant movements, of course, GBPUSD and USDJPY being the exceptions. EURUSD simply moved around but didn’t make any major gains, an indication that perhaps the upside momentum is weakening.

Should the US dollar manage to find support near the 94.0 – 93.5 level and starts to show signs of a reversal near this support, we could expect a longer term retracement to the upside. Price will of course need to rally above 94.5 and establish support to confirm the move to the upside, subsequently breaking out to the upside from the descending wedge pattern.

US Dollar Index – Descending wedge pattern

In this scenario, the US dollar index could see steady gains, retracing towards 98.58 – 98.42 levels, which sits just a few points above the 61.8% fib retracement level plotted against the highs at 100.51 on 2nd December 2015 and the currently evolving lows of 94.171.

From a fundamental point of view, the weeks ahead will see some important fundamentals coming out including the monthly consumer price index for March ahead of the FOMC meeting on April 27th. The only first major release will be the advance GDP estimates for the first quarter. According to the Atlanta Fed’s GDPNow model, the first quarter US GDP is currently estimated to be around 0.40% on April 7th, down from 0.70% previously. Anything below 0.50% could be seen as dovish for the US dollar, following the Q4 2015 data which saw the US GDP rise to 1.40%

In any case, the first quarter GDP in the US is seasonally weak and this time it should be no exception. The focus for traders going ahead is to look forward to the unfolding economic data from the US which usually gains traction into the second quarter of the year. While the timing might differ, we expect to see a short term retracement in the US dollar which should provide some long term investors to add to their existing short positions on the USD, at least until the advance GDP report comes out.

Guest post by Andreas Pavli of http://www.allfxbrokers.com