Idea of the Day

Let’s take a broader look at the dollar. The dollar index itself is near a 6 week low, just above the 80.0 level. This happening after what was meant to be a better payrolls number and as a budget agreement in the US looks to be possible before the year end (and possibly this week). On top of his, we are approaching a Fed meeting in two week where tapering is a real possibility. Some of the Fed’s more hawkish voices were speaking yesterday, with long-term hawk Fisher saying “we should get started as soon as possible”. So why is the dollar weaker? There are two principle reasons for this. Firstly, as we’ve mentioned before, the Fed has successfully split the difference between tapering and tightening, convincing markets that if they reduce monthly asset purchases, it does not mean that higher rates are just around the corner. Secondly, the fact is that the euro has been relatively strong, for reasons that we have highlighted before. But risks remain, not least on the possibility of tapering which we put at 40% for this month.

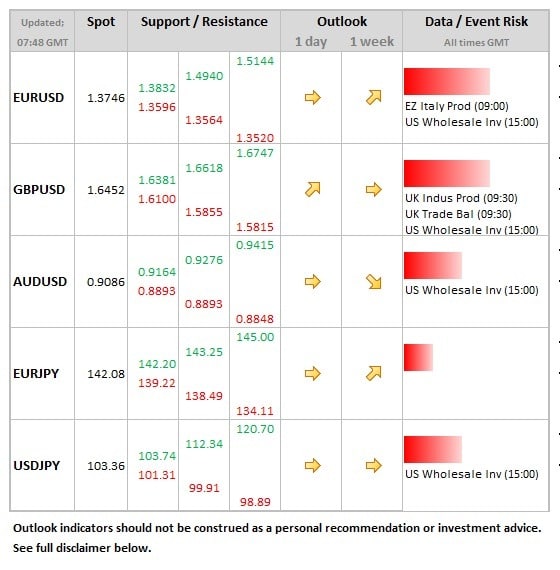

Data/Event Risks

GBP: The latest manufacturing PMI data surprised to the upside and although today’s data is for October, it does nevertheless set up a positive backdrop for the production sector in the fourth quarter. Markets expect today’s data to rise 0.4% MoM. Notably stronger numbers (above 1.0%) would allow sterling to take on the highs made in the Asia session.

Latest FX News

GBP: Upbeat comments from BoE governor Carney helping sterling, the BoE governor sounding bullish on longer-term growth prospects, but warning against early interest rate increases. Cable high of 1.6466 overnight.

EUR: Creeping higher during Asia trade against the backdrop off a broadly weaker dollar, EURUSD high of 1.3768. The reasons for euro strength that we’ve highlighted remain valid but becoming more stretched at these levels.

JPY: Slightly firmer yen emerging at the start of the European session, but coming back after further weakness against the euro which has seen EURJPY move briefly above the 142 level overnight.

Further reading:

Euro bears’ last stand, rough road for GBP, tapering chances and more [Video]

EURUSD: Builds On Bullish Strength