- DXY bulls note the monthly support and potential of a daily double bottom.

- Positioning data is skewed to the downside for the US dollar.

We have an interesting scenario for the US dollar index, DXY.

DXY is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies.

It is a weighted geometric mean of the dollar’s value relative to following select currencies:

- Euro (EUR), 57.6% weight.

- Japanese yen (JPY) 13.6% weight.

- Pound sterling (GBP), 11.9% weight.

- Canadian dollar (CAD), 9.1% weight.

- Swedish krona (SEK), 4.2% weight.

- Swiss franc (CHF) 3.6% weight.

Looking at the latest positioning of the US dollar, compared to the components of the DXY, we can see that net short USD positions climbed for a third consecutive week.

The move is consistent with the softer tone of the greenback in the spot market of late. (The index has lost 12.25% in 2020).

Looking across the board of the DXY, we can see that positioning data has also moved more positive, apart from CHF, across the spectrum of currencies.

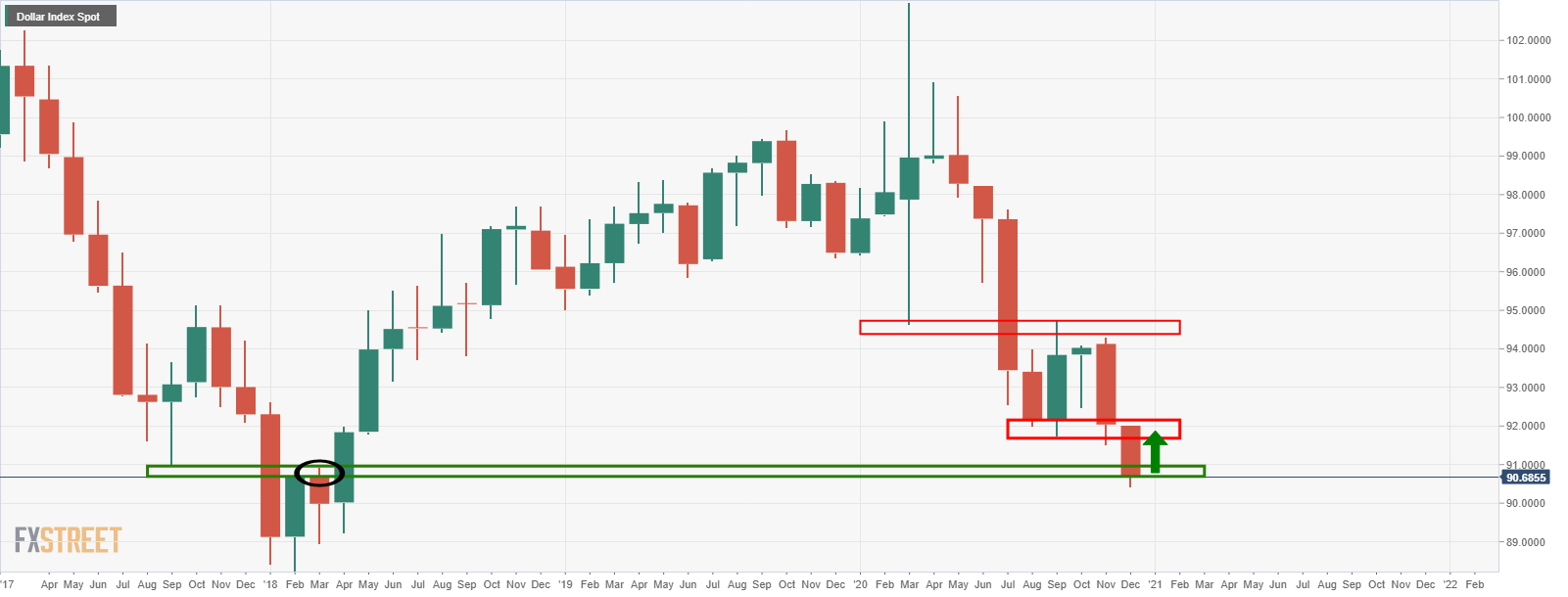

However, at 90.42 the low, the price is meeting what could be a strong level of support for DXY from a monthly basis.

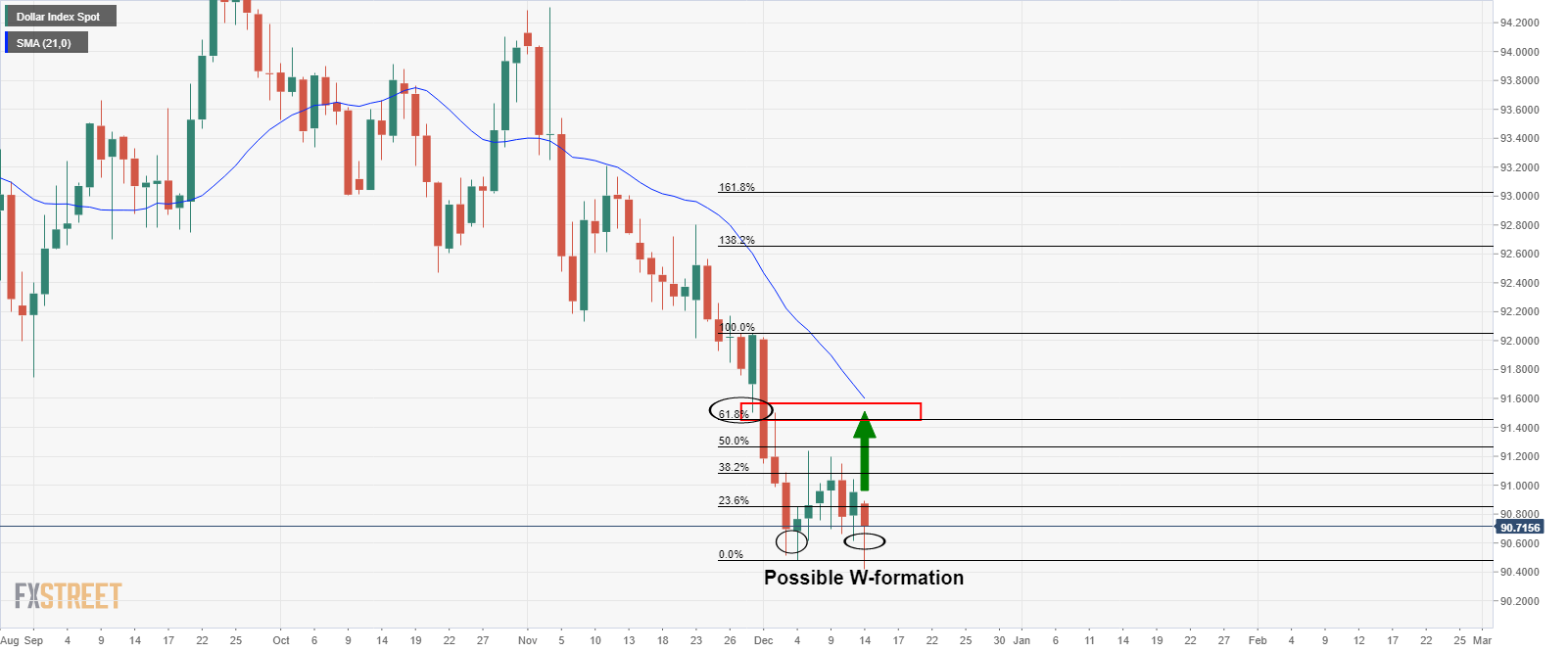

Moving down to the daily chart, if there is stabilisation here and a subsequent bid, we could see the price complete a bullish W-formation which brings 91.50 into scope:

However, the positive vaccine news and the perception that the Fed will lean on the yield curve if necessary continue to support risk appetite which is a longer-term weight for the US dollar.

With that being said, the fate of the US dollar is not a foregone conclusion.

”Going forward it is possible that risk appetite could be kept in check by the realisation that economic data are likely to worsen before they improve,” analysts at Rabobank argued, explaining in particular that further news on a US fiscal stimulus bill remains a risk.

However, given the weighting of the euro over the DXY, the analysts also explained that while net positions of EUR are elevated from a historical perspective they remain well below this year’s highs.

The euro is threatening a continuation to the upside for which is illustrated within the following technical analysis:

-

EUR/USD Price Analysis: Conflicting weekly and daily outlook, bulls in driving seat