Idea of the Day

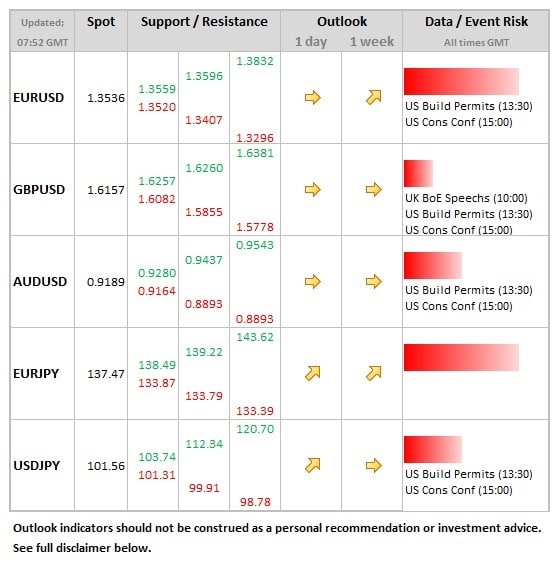

Monday was a day of drift for FX markets, but not one to be ignored because it still told us something about underlying sentiment towards the majors. The dollar was generally dominant over the course of the day, with sterling and the Swissie losing the most ground. Meanwhile the Aussie and kiwi held up pretty well, with the yen retaining the weaker tone gained at the outset of the Asia session. For now at least, there was a reluctance to push the trends of last week, namely weaker Aussie, generally resilient euro and a stronger pound. The key levels to watch today are the 1.3579 level on EURUSD (last week’s high), together with 1.3566, previous trendline support which has offered decent upside resistance on closing basis. Note that oil has closed the opening gap seen yesterday on the Iran news, with gold also more than recovering from the early losses, reflecting the fact that there is a long way to go and many hurdles along the way before we can start thinking about a sustained impact on risk and oil prices.

Data/Event Risks

GBP: Members of the MPC appear in front of the Parliamentary Treasury Select Committee, answering questions on the Inflation Report. This pushed sterling higher, as the time by which unemployment was seen reaching the 7% ‘threshold’ was bought forward by more than a year. But their ‘forward guidance’ strategy and views on the housing market are likely to come under most scrutiny. If anything, sterling risks are to the downside should the Bank try to clarify or adjust the market reaction to the report 2 weeks ago.

USD: Consumer confidence data will be the main focus for the dollar today. Last month’s release saw a fall down to 71.2, partly on the impact of the government shut-down, with just small bounce back to 72.6 anticipated today. The dollar would benefit from such a stronger than expected bounce.

Latest FX News

AUD: There was a slightly heavy feel to the Aussie for most of the yesterday, but a softer tone to the US dollar in the Asia session today has allowed for some recovery back to the 0.92 level. The market is still wary of further comments from the RBA, which could well serve to limit the upside from here.

EUR: The trendline for the rally mid-year onwards continues to act as decent resistance to the upside, although it has not been broken on a closing basis during this time. Still, despite this, the single currency remains on just below levels prevailing ahead of the easing earlier this month and continues to trader firmer against the yen.

JPY: The weaker tone remained from the offset of the Asia session, although there was some short-covering towards the end of Monday.

Further reading: