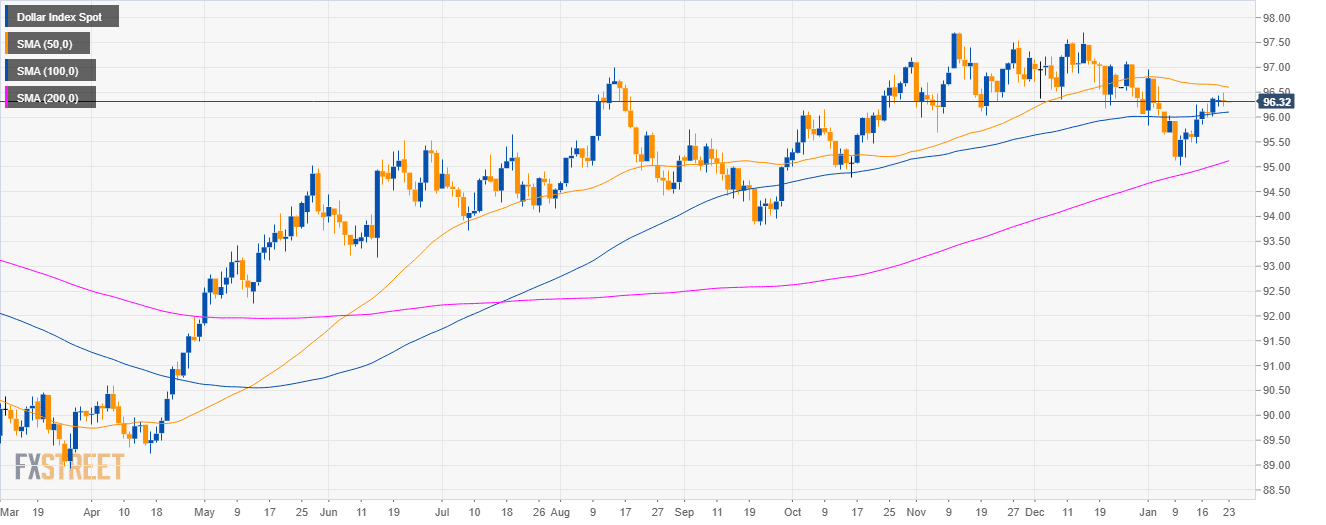

DXY daily chart

- DXY is trading in a bull trend above the 100 and 200-day simple moving average (SMA).

- As forecast, DXY bulls reached the 96.50 level but were unable to continue their rally above that level.

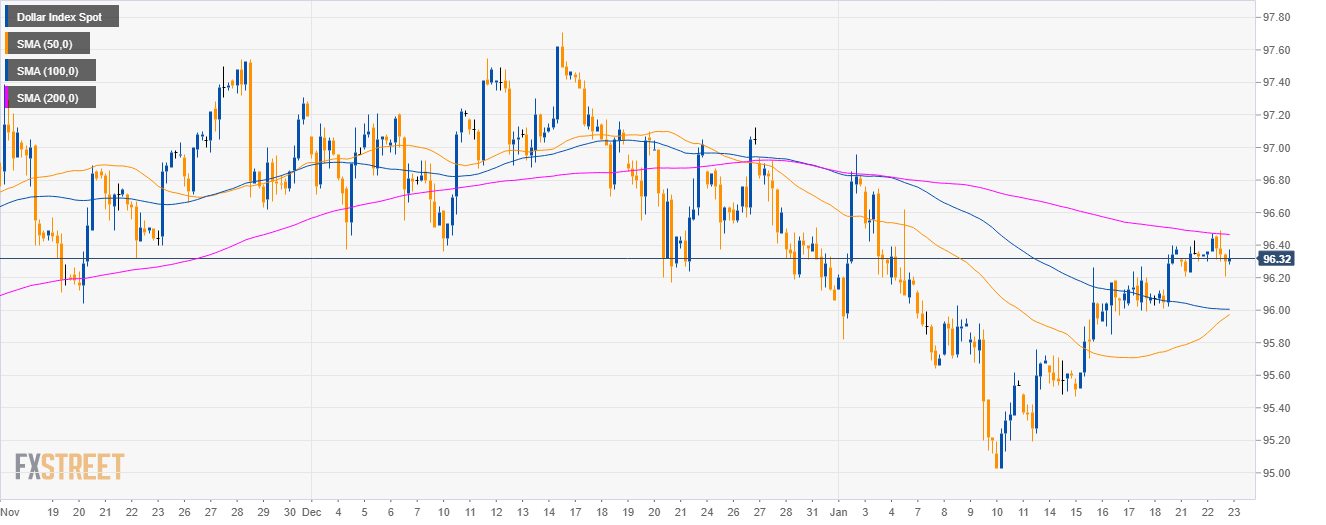

DXY 4-hour chart

- DXY bulls have broken above the 50 and 100 SMA but they need to jump above the 200 SMA.

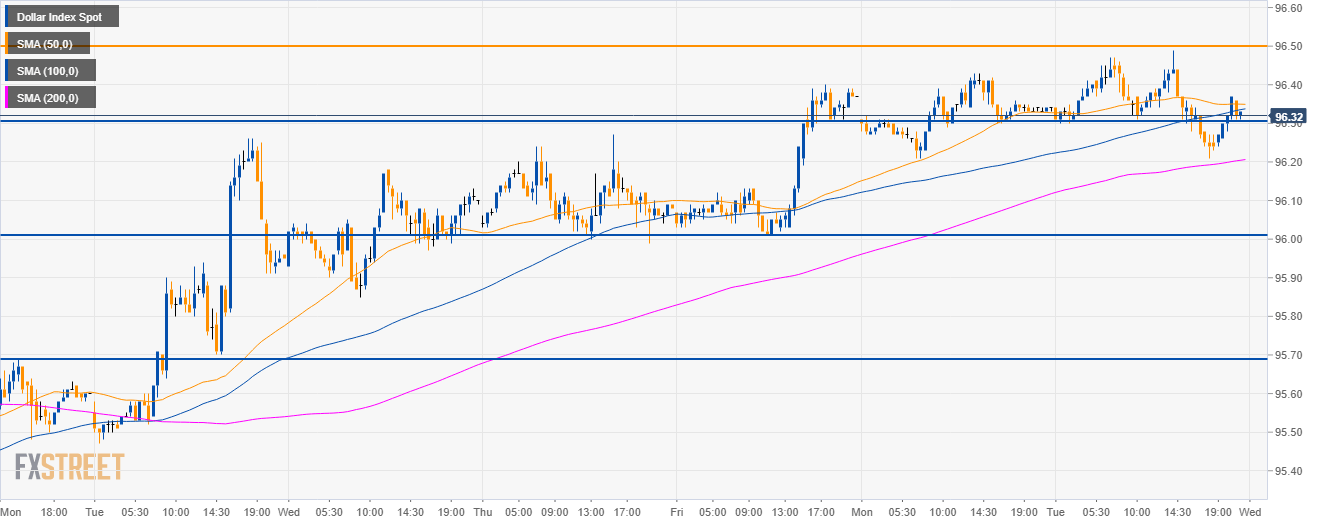

DXY 30-minute chart

- Now that the 96.50 level has been tested, bears are likely to take control and drive the market to 96.00 the figure.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.32

Today Daily change: -0.02 pips

Today Daily change %: -0.02%

Today Daily Open: 96.34

Trends:

Daily SMA20: 96.15

Daily SMA50: 96.64

Daily SMA100: 96.08

Daily SMA200: 95.05

Levels:

Previous Daily High: 96.43

Previous Daily Low: 96.21

Previous Weekly High: 96.4

Previous Weekly Low: 95.47

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 96.35

Daily Fibonacci 61.8%: 96.29

Daily Pivot Point S1: 96.22

Daily Pivot Point S2: 96.11

Daily Pivot Point S3: 96

Daily Pivot Point R1: 96.44

Daily Pivot Point R2: 96.55

Daily Pivot Point R3: 96.66