- Post-Labor Day polls show Biden leading over Trump, yet the race remains open.

- Deadlocked fiscal relief talks play a growing part in shaping the reaction in gold.

- An inconclusive election is gaining ground as an outcome to consider.

There are less than two months until election day – but the results may fully be known only a month later. Slow counting – a result of a high volume of mail-in votes due to the pandemic – may result in a contested outcome and considerable consternation.

Challenger Joe Biden has a four out of five chance of beating incumbent President Donald Trump after the dust from the party conventions settled and the long Labor Day weekend has passed. Little has changed in recent months.

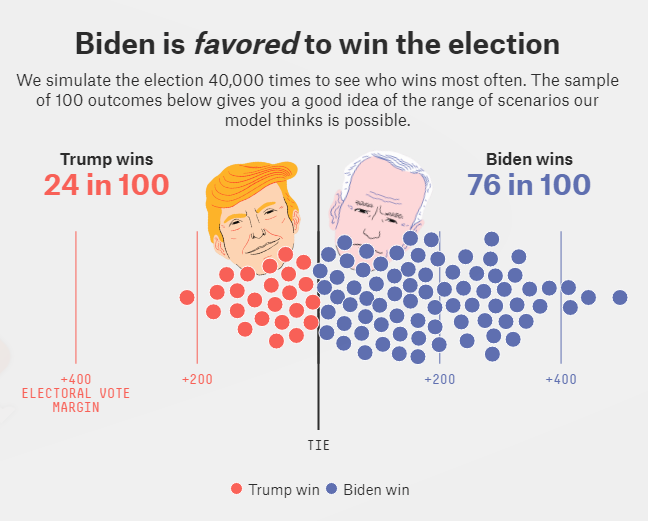

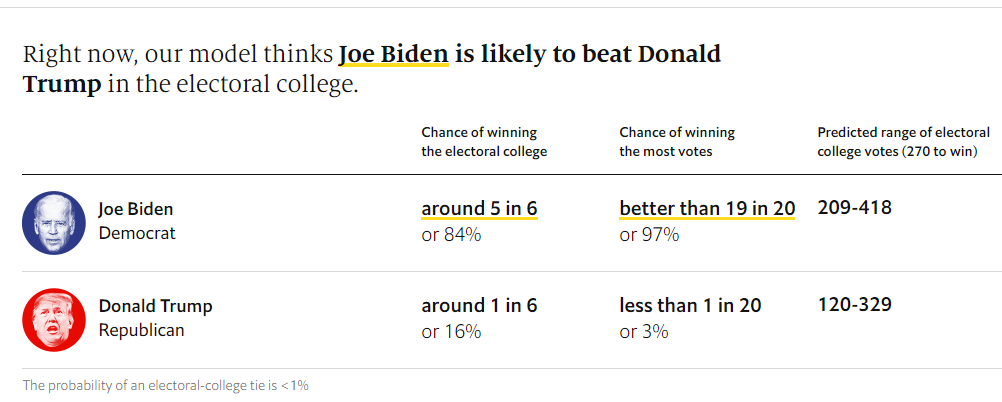

Nate Silver’s FiveThirtyEight model is showing a 76% chance of a Biden victory while the Economist’s forecast is at 84% for the Democrat, who is around seven points ahead of Trump in various averages of the national vote. Margins are tighter in crucial battleground states that determine the outcome, so anything is possible.

Source: FiveThirtyEight

Source: The Economist

What has changed over the summer

Little has changed in polling – and the same applies to talks between Republicans and Democrats on the next relief package. Several emergency programs lapsed in late July, and that “fiscal cliff” may be hurting the economy. However, the recent upbeat jobs report may have emboldened Republicans‘ to oppose further spending.

The fate of trillions of dollars of stimulus will likely be decided by the next President and Congress, making it a factor for markets and especially for gold. The precious metal has room to run on further spending but may drop if Uncle Sam keeps its wallet closed.

One factor that has changed is the chance of a contested election. Investors already knew that counting would take a long time due to an influx of mail-in votes. The virus has already prompted a surge of requests to vote from afar in primary contests early this year – and the national competition will likely be similar.

Polls of voting intentions have shown that there is a deep partisan divide – Republicans lean toward in-person voting while Democrats tend to cast their choices by mail.

That could result in early results showing Trump leading, prompting him to declare premature victory. Later on, the picture could shift toward Biden while the president would refuse to accept the change, calling it a fraud. Trump – who asked to vote by mail in Florida – consistently casts doubts about the integrity of remote voting. He also rejects injection funds to the US Postal Service to enable smoother elections.

Here are four scenarios, starting from that nightmare one. Hopefully, a long process is avoided – or at least followed by a clear outcome. That is where the other three scenarios apply.

1) Contested election

In case both Biden and Trump claim victory, courts would become overwhelmed with lawsuits in all contested states with markets suffering from their worst enemy – uncertainty. Stocks would tumble amid the ongoing political paralysis as the clock ticks down toward January 20 – inauguration day.

A growingly divided nation poses a risk to the economy and would send stocks tumbling down. Gold will also probably follow equities lower. The precious has not proved a safe-haven in recent months, but rather as trading in tandem with equities – or as having an inverse correlation with the dollar.

The greenback and also the yen would likely be the biggest beneficiaries in this scenario.

Given a close race, there is a high probability of this outcome materializes.

2) Biden win, Republicans hold Senate

This is probably the most likely scenario given current opinion polls and could unfold once all votes are counted and accepted. In this case, shares have room to enjoy a relief rally as Biden would pursue more trade-friendly policies while those to his left would be unable to enact their agenda.

The safe-haven dollar would likely lose its shine – especially if this result is reached after several tense weeks – while gold would have limited room for relief. The lack of new fiscal relief means less money to fund the precious metal’s rally.

3) Clean sweep for Democrats

In case Biden wins the presidency and Democrats flip the Senate – they are projected to hold onto the House easily – stocks would also fall. The reason is that markets would fear that left-leaning lawmakers such as Elisabeth Warren, Bernie Sanders, and Alexandra Ocasio Cortez would push for regulation and tax hikes.

While equities would fear market-unfriendly policies, gold would cheer the prospects of massive fiscal stimulus, especially if Democrats approve a broad “Green New Deal” to fight climate change. The mix of cash from the government and the Federal Reserve would likely send XAU/USD higher.

The US dollar would drop in this scenario of massive spending. Some of the funds would find themselves leaving the US for other markets.

This scenario has a medium probability, as the battle for the Senate is close. The Vice President – Kamala Harris in this projection – has the right to break a tie if a Senate vote results in a draw.

4) Trump wins

In case the president repeats his 2016 victory – hitting 270 electoral college votes despite losing the popular vote – stocks would rise””markets like the status quo, which is business-friendly.

It could also turn positive for gold, as Trump would feel reinvigorated to push his fellow Republicans to provide further fiscal stimulus after receiving a mandate from the people. House Democrats would probably go along with more spending.

For the dollar, it would be adverse, as fears would subside. Once again, the greenback’s decline would be from the higher ground if the process takes a long time.

The probability is low as Trump is trailing in the polls.

Conclusion

There is a growing chance that America will know who the president is only in late November. The tense period could be dollar-positive before unwinding once the results are clear. Gold depends on fiscal stimulus, which would come in a Biden landslide or a Trump win. A change in the White House without one in Congress would be adverse for the precious metal yet positive for stocks.

More