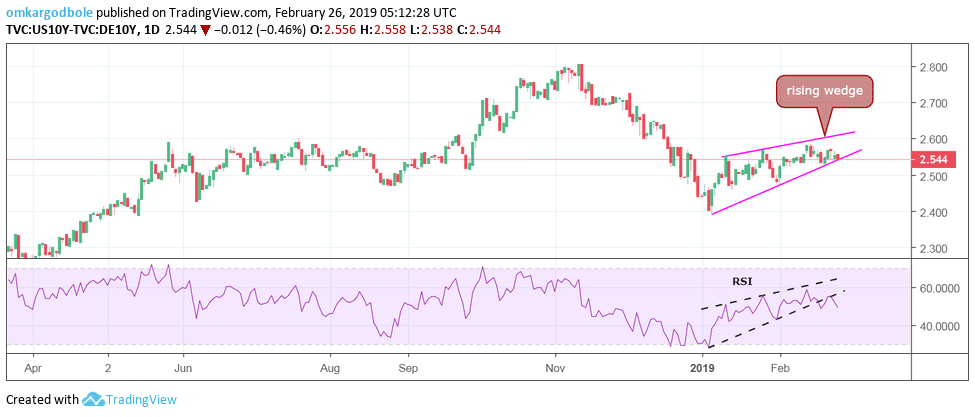

The spread between the 10-year US government bond yield and its German counterpart is probing the lower edge of the rising wedge, currently at 254 basis points.

Acceptance below that level would open the doors to 239 basis points (Jan. 4 low).

The US treasury yields will likely nosedive, triggering a rising wedge breakdown on the yield spread daily chart, if Fed’s Powell sounds dovish during his Congressional testimony despite the recent trade optimism.

The narrowing of yield differential after a potential wedge breakdown would be EUR-positive.

US-DE 10-year yield spread daily chart