- US inflation expectations drop below the Fed’s target of 2 percent.

- Market-based measures are sensitive to oil price movements.

- Fed tends to look past the volatile energy component of inflation and focus on core values.

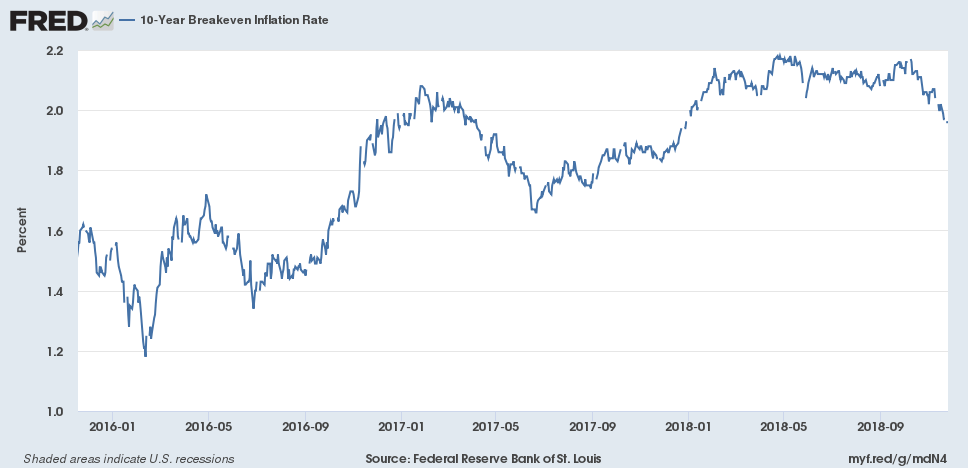

The US inflation expectations have dropped below the Fed’s target of 2 percent for the first time in 11 months.

The 10-year breakeven inflation rate – the difference between the yield on the US 10-year treasury note and the 10-year treasury inflation protected securities – fell to 1.96 percent, its lowest level since Dec. 29, 2017.

That has prompted many to scale back expectations of an extended Fed tightening cycle. St. Louis Fed President James Bullard took note of the drop in the breakeven rate last week and said there is need to slow down rate hikes.

The market-based measures of inflation, however, closely following the action in oil prices and go against the Fed’s policy of focusing on core values.

Simply put, the Fed may not abandon the gradual tightening path just because market-based measures of inflation expectations have dropped below 2 percent.