US non-farm payrolls for August are expected by economists to see the jobs build-up ease off a touch from last month’s 943,000 reading, to come in at 750,000 for August. Still, unemployment will improve, falling from 5.4% to 5.2%.

The dollar continues to weaken in the wake of Fed chairman Jerome Powell’s dovish Jackson Hole speech, as forex traders liquidate dollar longs.

Most major currencies are trading higher against the dollar, but will Friday’s non-farm payrolls data bring the rally to a halt or keep on the dollar index on a declining track?

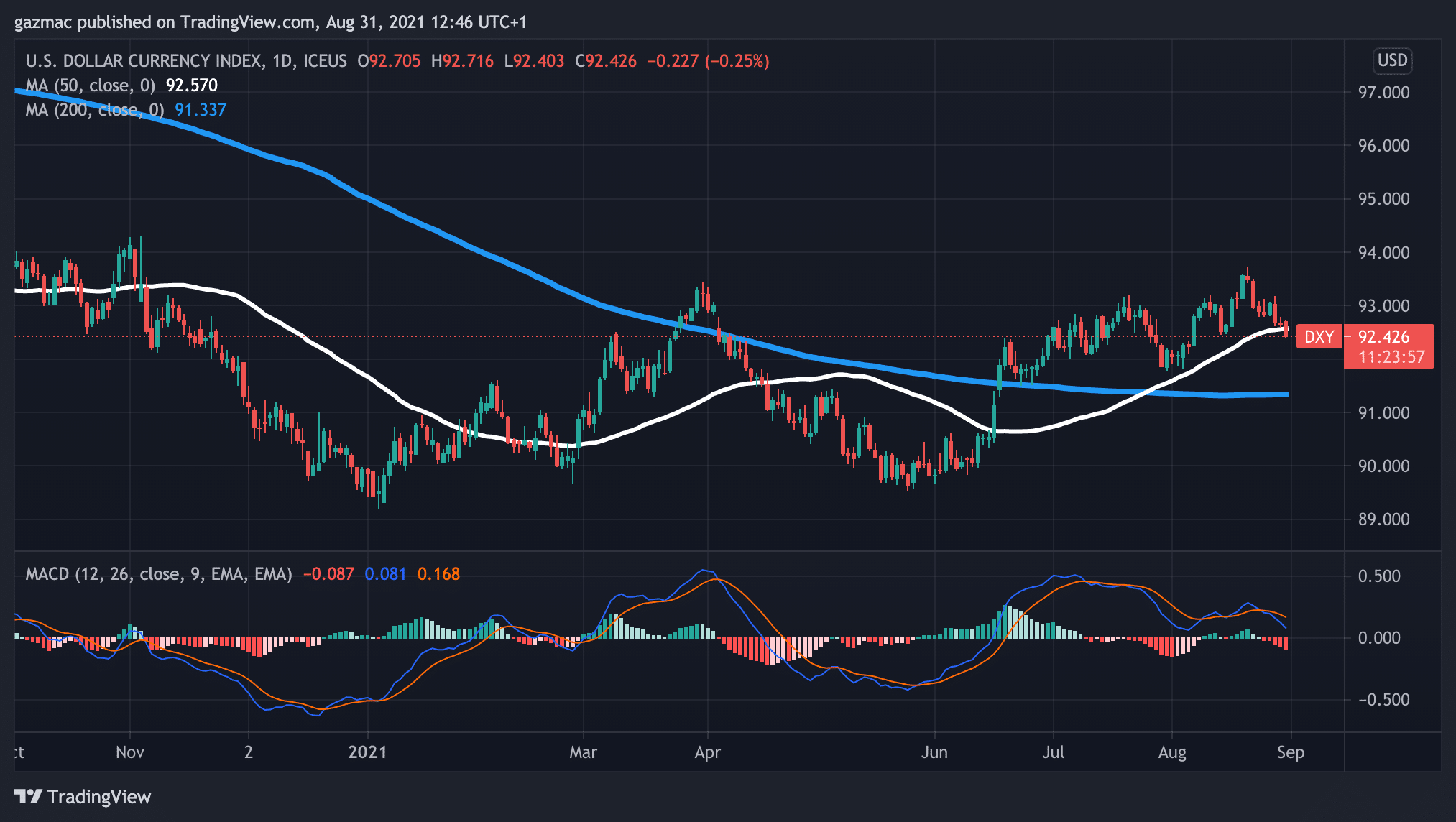

DXY is down 0.23% in the European session at 92.43 and has violated the 50-day moving average that it has traded above since mid June.

Powell signalled that he was not in a rush to start tapering asset purchases, when he said “ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired”.

3 Free Forex Every Week – Full Technical Analysis

Non-farm payrolls could determine Fed decision on tapering

However, if the NFP data is strong, that could mean that tapering of bond purchases may happen as soon as September, given that he said that the “substantial further progress” test had been met as far as inflation goes.

Although the Fed’s test for inflation of 2% or moderately higher for an extended period having been met in Powell view, any possible hawkish interpretation was balanced by his comments on sequencing of tapering and rate hikes, where he indicated that the timing of tapering and any increase in the federal funds rate were not connected.

Instead, Powell strongly reiterated that an interest rate liftoff would be dependent on the extent to which the economy the “maximum employment” goal.

“We have said that we will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment, and inflation has reached 2% and is on track to moderately exceed 2% for some time,” Powell said.

He added: “We have much ground to cover to reach maximum employment, and time will tell whether we have reached 2% inflation on a sustainable basis.”

If you are following the forex markets and want to profit from market-moving news like the non-farm payrolls, then check out our guide to forex day trading.

Will there be “substantial further progress” on jobs front?

Always an important event on the economic calendar, the NFP release takes on even greater import this month as it will directly impact on the thinking around the timing of rate increases.

If the numbers turn out to be another blowout like last month, which saw the largest monthly jump in a year, then that could be interpreted by forex traders as indicative of a move on rates earlier than currently expected, in other in H1 2022 not H2 2022.

Your capital is at risk

It all comes down to whether the economy is securely on the road to more employment gains as the recovery broadens and deepens, or whether it could be thrown off course by Covid and the Delta variant.

Analysts at ING reckon there are signs of the infection rate topping out in certain hotspots, and with many FOMC members in favour of tapering starting sooner rather than later – i.e. this year, the current dollar weakness could prove short-lived if the jobs number beats expectations strong.

“Jerome Powell’s softer tone relative to his colleagues has given the market food for thought. The resurgence of Covid certainly poses risk to the outlook, but the general commentary from other Fed officials is that the economy is proving to be resilient thanks to the success of the vaccination programme. It is also important to point out that there is evidence that Covid cases are topping out in some of the hot spots such as Florida and Missouri.”

Manufacturing PMI clues tomorrow, plus Covid and Ida hurricane worries

There may be more clues today on the state of the US economy when CB consumer confidence is released and tomorrow’s manufacturing PMI could also throw some light on the matter.

Then there’s the impact of hurricane Ida to throw into the mix, too, depending on how severe the damage is – New Orleans appears to have the dodged the bullet on flooding but the power grid may be the bigger problem with early talk of outages for weeks to come.

Also, nearly half of the country’s refining capacity is located along the gulf coast, not to mention possible damage to offshore platforms in the Gulf of Mexico, so the impact on oil prices could be significant, helping to stoke the energy component of the prices basket.

But at the time of writing WTI crude futures are down 0.75% at $68.69.

What if the Fed is behind the curve on inflation risks?

Powell’s dovish caution is seemingly predicated on the understanding that disinflationary processes are still at play in the same way as they have been up until now, but what if they are wrong about that? That’s the worry of former governor of the Reserve Bank of India Raghuram Rajan and currently a professor of economics at Chicago University.

“My worry is that if they don’t fully account for these new forces, they may be behind the curve,” Rajan said in an interview on Bloomberg TV. “And that may, as everyone says, necessitate stronger tightening down the line.”

Rajan has in mind disinflationary factors such as globalisation, ageing and automation and wonders if their power to dampen price pressure is waning.

The substantive risk as Rajan sees it is an underestimation of the impact of the huge fiscal spending by the US government – a factor that was not previously in play post the 2008 financial crisis.

Also in the financial crisis China took up the slack and helped keep inflation in line. Today’s Chinese manufacturing PMI was only fractionally above 50 at 50.1 as factory activity continues to slow, compounding last week’s data on factory profits, which also saw growth slowing.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.