- US Retail Sales are expected to rise by moderate levels in February.

- Previous reports have been quite confusing, and this may serve as a return to reality.

- The USD may fall without a significant surprise.

The US releases its Retail Sales report for February on Monday, April 1st, at 12:30 GMT. The publication has been delayed due to the government shutdown.

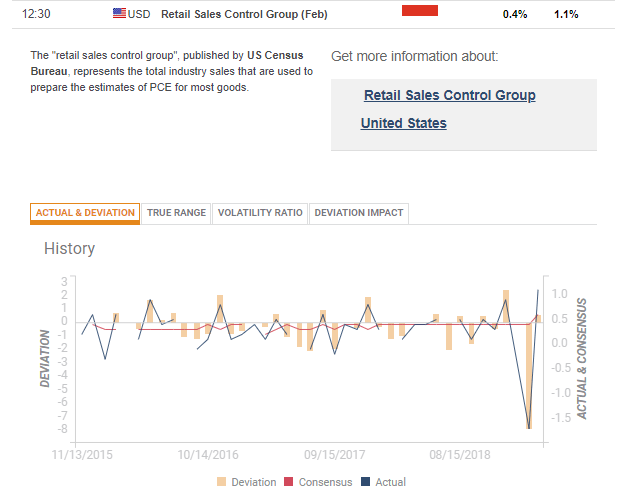

Back in January, headline retail sales advanced by a modest 0.2%, sales excluding autos increased by 0.9%, and the all-important Control Group considered the “core of the core,” jumped by a whopping 1.1%.

The leap in core numbers is quite unusual and came after an even more unusual plunge in December. The Control Group fell by no less than 1.7%.

The chart shows how abnormal the past two months have been:

Many economists raised their eyebrows on the devastating December data, and this includes Fed officials. The revisions for December’s data were no less surprising as they were to the downside. Reports from significant retailers suggested a robust Christmas shopping season.

Consumption is critical to the US economy, and the confusion triggered chopping trading. The upcoming report will likely see choppy trading as well. However, if expectations are met, we may see a return to normality next time.

Expectations and the case for a weaker USD

Headline sales are projected to rise by 0.3% in February, sales excluding cars by 0.3% as well, and the Control Group is forecast to advance by 0.4%, which is well within the normal ranges.

A return to known consumption patterns in much needed so that confidence will return. A healthy US consumer is, in theory, good for the US Dollar.

However, we are not in normal times as fears of a recession have gripped markets following the bond yield curve inversion.

A moderate increase in sales and a robust US economy go hand in hand with a dovish Fed that has removed any rate hikes from the agenda for this year.

An upbeat US economy with a Fed sitting on the sidelines is a perfect combination for stocks. And what is right for shares for risk sentiment, is not that great for safe-haven assets: the Japanese Yen and also the US Dollar.

So, meeting expectations may be detrimental for the USD.

If the data miss with weaker than expected increases or outright falls, the atmosphere could worsen. And this could be USD-positive.

And what happens if we get another big beat of projections? On the one hand, some may dismiss the data as being flawed, and markets may ignore it. On the other hand, it would be similar to the baseline scenario of a return to normality after a one-off plunge in December.

Conclusion

All in all, a return to moderate gains is needed to restore confidence in the data and also to show that the US consumer is doing well. The resulting risk-on mood may weigh on the USD. The same applies to a positive surprise. A miss on the data may dampen the spirit and send the greenback higher.