- Treasury yield curve is flattest since 2007, could invert next week.

- An inverted yield curve will likely weigh over the US dollar.

The US Treasury yield curve continues to flatten and could invert as early as next week.

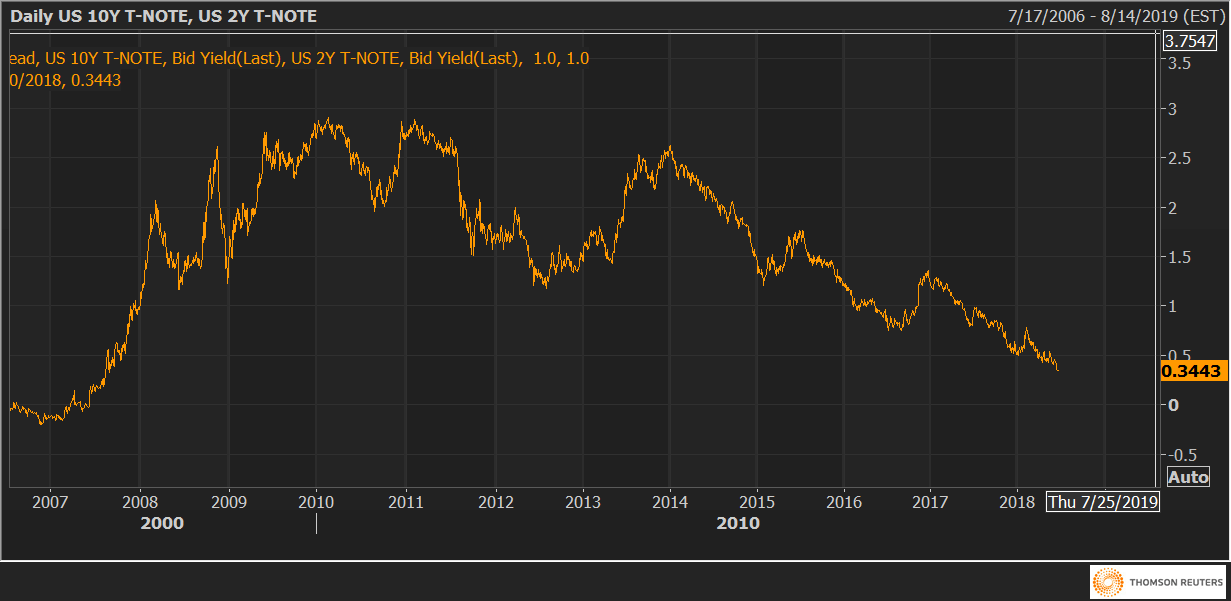

The spread between the 10-year yield and the 2-year yield fell to 34 basis points today – the lowest level since August 2007.

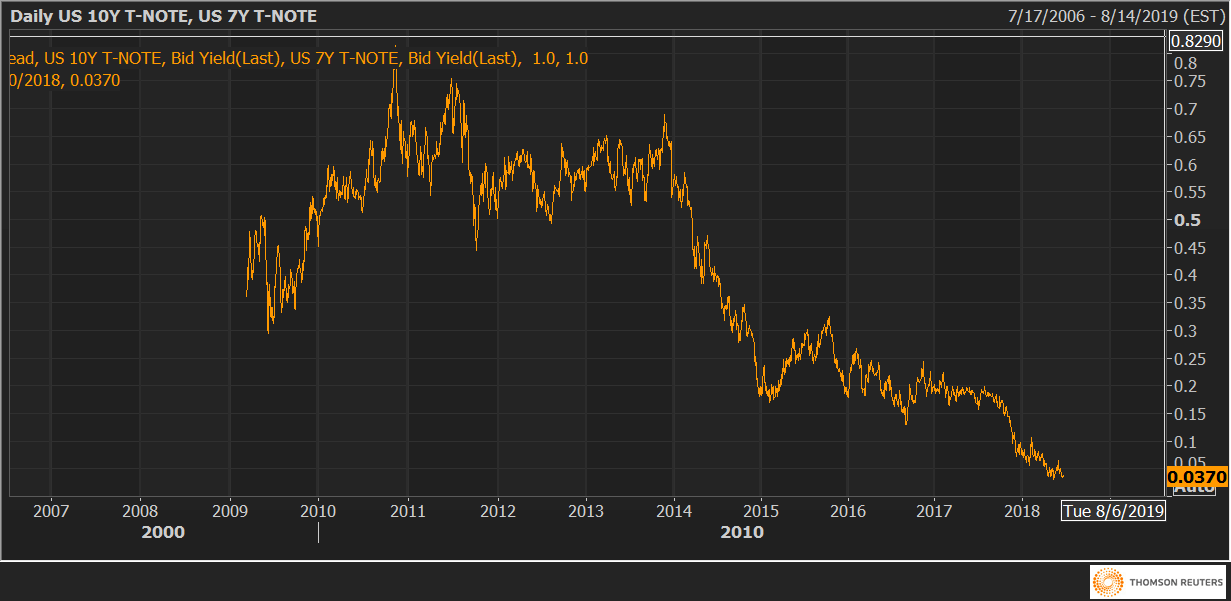

Meanwhile, the spread between the 10-year yield and the 7-year yield has dropped to three basis points and could drop below last month’s low of two basis points – the smallest gap since 2009.

Also, the spread could turn negative or invert next week if the US-China trade war escalates. An inverted yield curve is viewed by many as the sign the US economy is heading for recession and could push the greenback lower, especially against haven/funding currencies like JPY.

Spread between 10y and 2y

Spread between 10y and 7y