- USD/CAD remains neutral above 1.2420.

- Fed’s dovish stance risk-on sentiment weigh on the US Dollar.

- WTI can fall amid pandemic spread that can weigh on Loonie.

The USD/CAD analysis suggests a neutral stance as long as it stays above the 1.2420. The USD/CAD pair could not capitalize on the modest recovery posted on Friday from the two- and half-week lows. The pair is witnessing subdued price action on Monday.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Investors look convinced that the Fed will continue with the very loose monetary policy for a longer span of time. This factor combined with the generally positive tone in equities dragged the Greenback lower towards one-month lows. These variables acted as headwinds for the USD/CAD pair.

The lingering worries stemming from spreading Delta variant can weigh on the crude oil prices which in turn can undermine the Canadian Dollar because of correlation with WTI. Investors are also worried that the spread of pandemics can slow down the global economic recovery. Moreover, the recent fall of US Treasury yields, closing towards lows of several months and the risk-on sentiment have dented the Greenback.

The US IMS manufacturing PMI for July came at 59.9 against June’s figures of 60.6. The estimate was missed by 1.1. The construction spending for July came at 0.1% against the expected 0.4%. However, it was better than June’s -0.2%.

Market participants are keenly waiting for the US NFP data as it can provide fresh impetus and directional bias to the market.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

USD/CAD technical analysis: Where to find buyers?

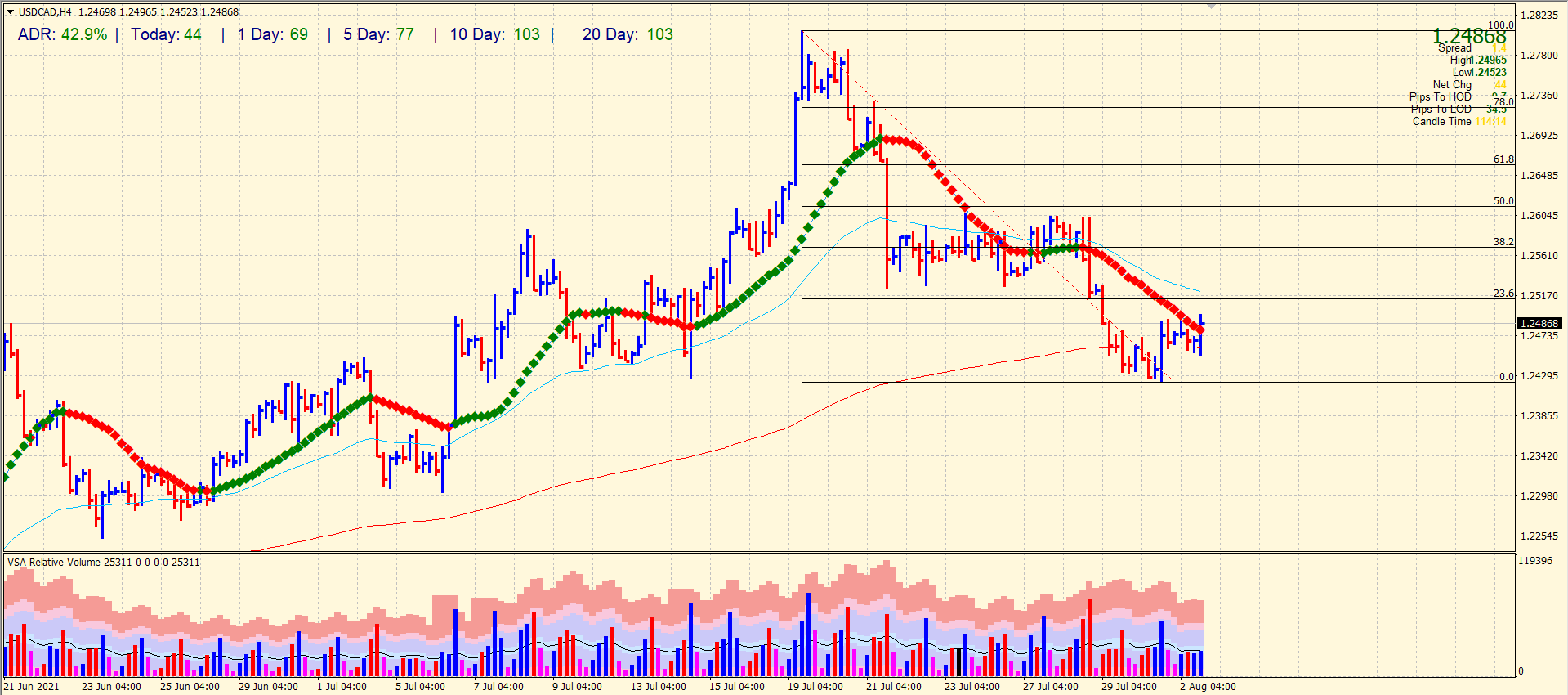

The USD/CAD pair is well supported by the 200-period SMA on the 4-hour chart. The price is now coinciding with the 20-period SMA just below the 1.2500 mark. Technically, it seems like the pair has created a strong bases near the 1.2440-50 area and is now awaiting catalyst to trigger strong buying momentum. The pair has done only 40% average daily range for the pair today. Hence, there is more potential for today and tomorrow to post gains.

The upside target lies at 50% Fibonacci and resistance level of 1.2600 handle followed by 1.2660 (61.8 Fibonacci retracement level). The downside target lies at initial support of 1.2450 followed by 1.2420.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.