- USD/CAD plummeted to fresh lows on Friday from where the correction is gathering pace.

- The US dollar is accumulating bids in the makings of a significant correction.

- Fundamentally, the bets remain stacked against the US dollar bulls.

- Bulls are stepping in at a newly formed hourly support structure.

A couple of milestones have been reached for financial and commodity markets as well as the loonie.

USD/CAD has been the product of a risk-on environment which has weighed on the greenback ever since the rubber-hit-the-road-vaccine-news penetrated its way through into the forex space.

The current sentiment is that the Food and Drug Administration, FDA, is set to approve the Pfizer/BioNTech vaccine when it meets on Thursday.

Meanwhile, in more recent developments, there is some support coming through for the loonie on the back of oil prices.

The OPEC+ group of producers finally reached an agreement to ease oil-production cuts next year, although more slowly than previously planned.

”Ultimately, the plan gives traders confidence that gradual increases in demand will allow the market to absorb the additional output, while draining excess inventories,” analysts at TD Securities explained.

As for positioning, the CAD’s net short positions had bounced back to mid-November levels which leave scope for a positive correction in long positions, tieing up with a bearish spot market.

Bullish correcting in USD underway

However, there is scope for an upside technical correction in the US dollar as well as USD/CAD.

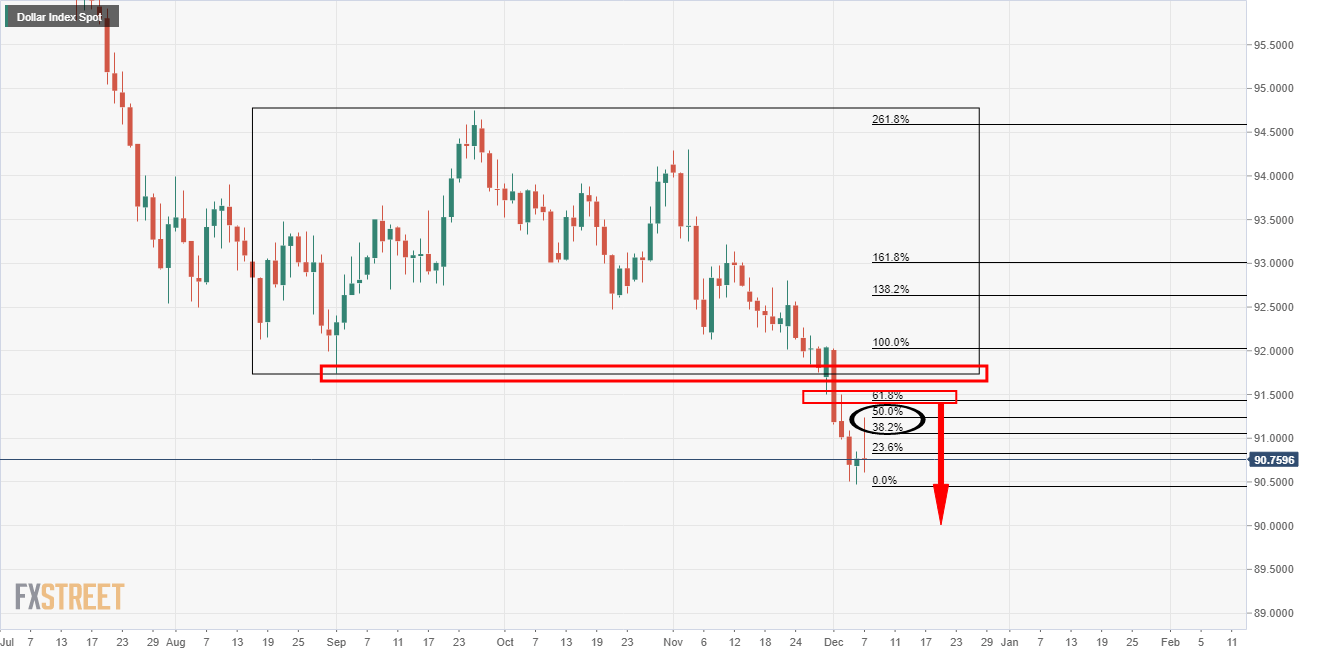

The DXY fell below key support level, and further US dollar weakness is likely amid vaccine hopes and expectations of further monetary and fiscal stimulus boost in the US.

With that being said, uncertainty and profit-taking can help support the greenback from falling into the abyss for the meanwhile.

In the above chart, we can see that the DXY, on a daily basis, is attempting to correct.

The index has already spiked in a 50% mean reversion. However, it would be expected to chart a more meaningful correction which would give rise to a deeper correction in USD/CAD.

USD/CAD technical analysis

The daily chart offers bullish prospects towards a key confluence level where old support meets a confluence of weekly and daily Fibonaccis.

Meanwhile, from an hourly perspective, the price is forming a W-formation and is supported on a new structure with bulls in control.

-637429644821964524.png)

-637429645729508877.png)