- USD/CAD is correcting the BoC move but runs into resistance.

- Bears are seeking run to monthly demand area.

USD/CAD is trading at 1.2637 between a low of 1.2588 and a high of 1.2647, picking up some ground following the prior day’s losses from the 1.27 area.

A rate cut was avoided this week at the Bank of Canada that the market had been increasingly pricing in until the start of the year. Hence, we saw a massive repositioning move in spot FX during the event.

The BoC portrayed a more optimistic medium-term outlook combined with ongoing fiscal support that will reduce the need for additional monetary policy stimulus.

The Canadian dollar’s rise was attributed to higher commodity prices (reflecting improving economic prospects) and a broadly weaker US dollar.

CAD net long positions moved lower at the start of January but had been holding in positive territory for the past four weeks having bounced sharply in late December.

Meanwhile, investors have been seeking out higher-yielding currencies this week as risk-on sentiment prevails and a relief that a smooth transition at the White House enables investors to get on with business as usual.

With that being said, a slew of better-than-expected US data has supported the greenback on Thursday after printing a fresh low in the DXY mind week.

Continued optimism about a massive stimulus package has spurred hopes of a recovery in the world’s largest economy.

USD/CAD technical analysis

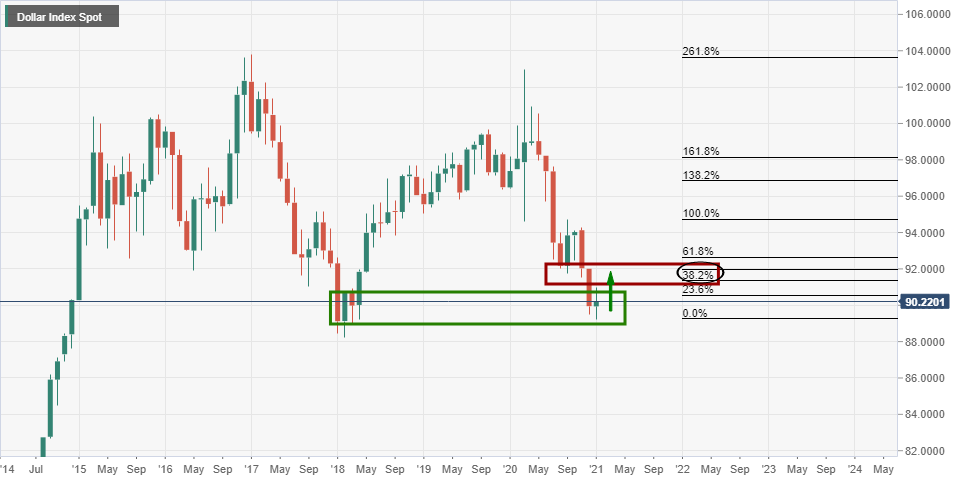

The US dollar is establishing a low on the euro’s rise post the European Central Bank on Thursday, but there is a technical case for the upside in the DXY as follows:

The monthly chart offers an upside corrective bias towards a 38.2% Fibonacci retracement and to test the prior lows.

Meanwhile, USD/CAD is approaching a familiar support line/ pivot point around 1.2515.

The weekly outlook is also bearish while the price is below resistance:

The 4-hour chart offers resistance at the 10 moving average and in a 38.2% Fibonacci retracement level:

-637468503431842526.png)

-637468504250507153.png)

-637468507154788450.png)