- USD/CAD trades within a 1.2940-1.2980ish intra-day range at present, having backed off Monday highs above 1.3000.

- Loonie traders shrugged off weak GDP data and continue to focus on OPEC+/crude oil market developments.

USD/CAD is consolidating within a 1.2940-1.2980ish intra-day range at present, after a bout of Tuesday’s Asia session USD weakness brought the pair back below the 1.3000 level. At present, the pair currently trades with losses of around 0.3% or just over 30 pips on the day.

CAD shrugs off soft Canadian GDP numbers, eyes on OPEC+ developments

Soft Canadian GDP numbers released at 13:30GMT, which showed the economy growing at a slower than expected MoM rate of 0.8% in September (exp. 0.9%) and a slower than expected annualised QoQ rate of 40.5% in Q3 (exp. 47.6%), did little to dent sentiment towards CAD.

Indeed, USD/CAD continues to trade with a downside bias amid a continued softening of the USD vs the majority of its G10 counterparts. In fact, CAD is actually one of the laggards within the G10 on Tuesday, and is underperforming NOK, CHF, EUR, SEK and NZD, as well as most EM currencies.

USD/CAD traders appear to be cautiously eyeing developments in energy markets; WTI crude recently slipped below the bottom of its recent $44.50-$45.50 range of the last few days, as the crude complex awaits the outcome of the ongoing OPEC+ discissions.

The formal OPEC+ meeting was reportedly delayed until Thursday to allow for more time for negotiations, with the UAE at present signalling that it is not on board with the otherwise widely supported proposal for a three-month extension of current output cuts. Meanwhile, Saudi Arabia is reportedly considering stepping down as the co-chair of the OPEC+ JMMC, which could signal that the country is unhappy with how things are going. That, some suggest, raises the risk of another price war, although this is just speculation.

If OPEC+ can deliver on market expectations for a three-month oil output cut, this ought to be enough to support oil and by extension CAD. If the cartel underwhelms, then oil prices (and again by extension CAD) could come under pressure.

Aside from focus on oil markets, USD dynamics and broad risk appetite, CAD traders should also consider Canadian labour market numbers which are set for release at 13:30GMT on Friday; the economy is seen adding a modest 27.5K jobs, leaving the unemployment rate unchanged at 8.9%. CIBC note that “the labour market was able to outrun the pickup in virus cases for longer than anticipated, but it’s likely that Covid-19 caught up with Canadian employment in November”. The bank explains that their below consensus forecast for the economy shed roughly 10K jobs in November “takes into account public health restrictions implemented in late October and early November, but does not include the latest lockdowns in parts of the country, as they occurred after the survey’s reference period”.

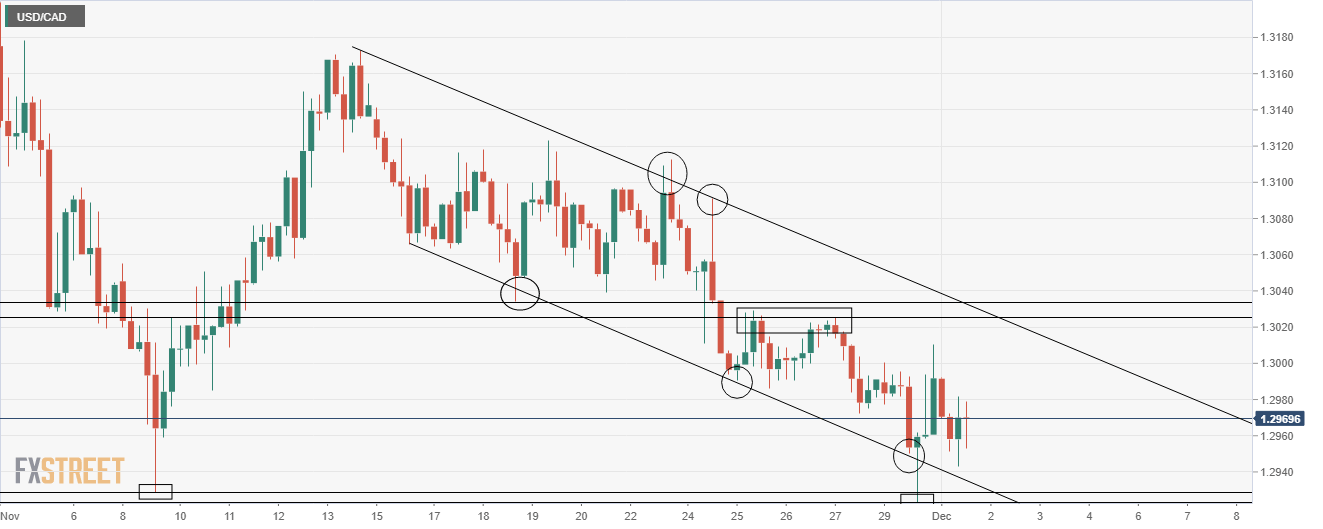

USD/CAD continues south within bearish trend channel

USD/CAD continues to trade within the confines of a downwards trend channel; to the downside, this trendline linked 16, 18 and 24 November lows and to the upside it linked the 13, 19, 23 and 24 November highs.

Should this trend channel should come into play as resistance around the 1.3030 level, which also coincides roughly with last Wednesday, Thursday and Friday’s highs. If USD/CAD takes the path of least resistance, which would be to continue its grind lower within the confines of this trend channel, then another test of multi-year lows at just under 1.2930 is likely. Once this level goes, the next key area of support comes in more than two big figures away at just below the 1.2800 mark.

USD/CAD four hour chart