- The US dollar is stronger on Monday and this has lifted USD/CAD back above the 1.2800 level.

- Technically speaking, having broken above a key long-term downtrend, USD/CAD appears to have a somewhat more bullish bias.

USD/CAD is higher by around 0.4% on Monday, having rallied from late Asia Session lows in the 1.2760s to current levels in the 1.2820s, up around 50 pips from last Friday’s closing levels in the 1.2670s.

The market’s broad appetite for risk is mixed and thus not giving the loonie much to trade off of; stocks and commodities (including crude oil) are mostly higher (a sign of risk appetite), but bond yields are broadly lower (a sign of risk aversion) and the US dollar is the best performing G10 currency on the day (another sign of risk aversion). Given mixed signals from other asset classes, CAD is broadly trading as a function of US dollar flows and was not too responsive to Markit Manufacturing PMI data for January.

Manufacturing activity growth moderates in January according to IHS Markit

Canadian Markit Manufacturing PMI dropped to 54.4 in January from 57.9 in December, a fall that Markit attributes to Covid-19 linked economic restrictions; “r. Ongoing restrictions and border closures continue to pose a threat to exports and factory operations. At the same time, higher material prices and transportation costs added to the rate of input price inflation” said IHS Markit economist Shreeya Patel. “Until vaccines are widely administered the sector can expect to see measures extend in pursuance of controlling case numbers.”

That said, a reading of 54.4 still indicates a healthy rate of MoM expansion in economic activity; the “latest data signalled another month of expansion in the Canadian manufacturing sector with a solid uptick registered in January… Both output and new order volumes rose for a seventh successive month and firms continued to increase their purchasing activity,” said Patel.

USD/CAD bullish bias?

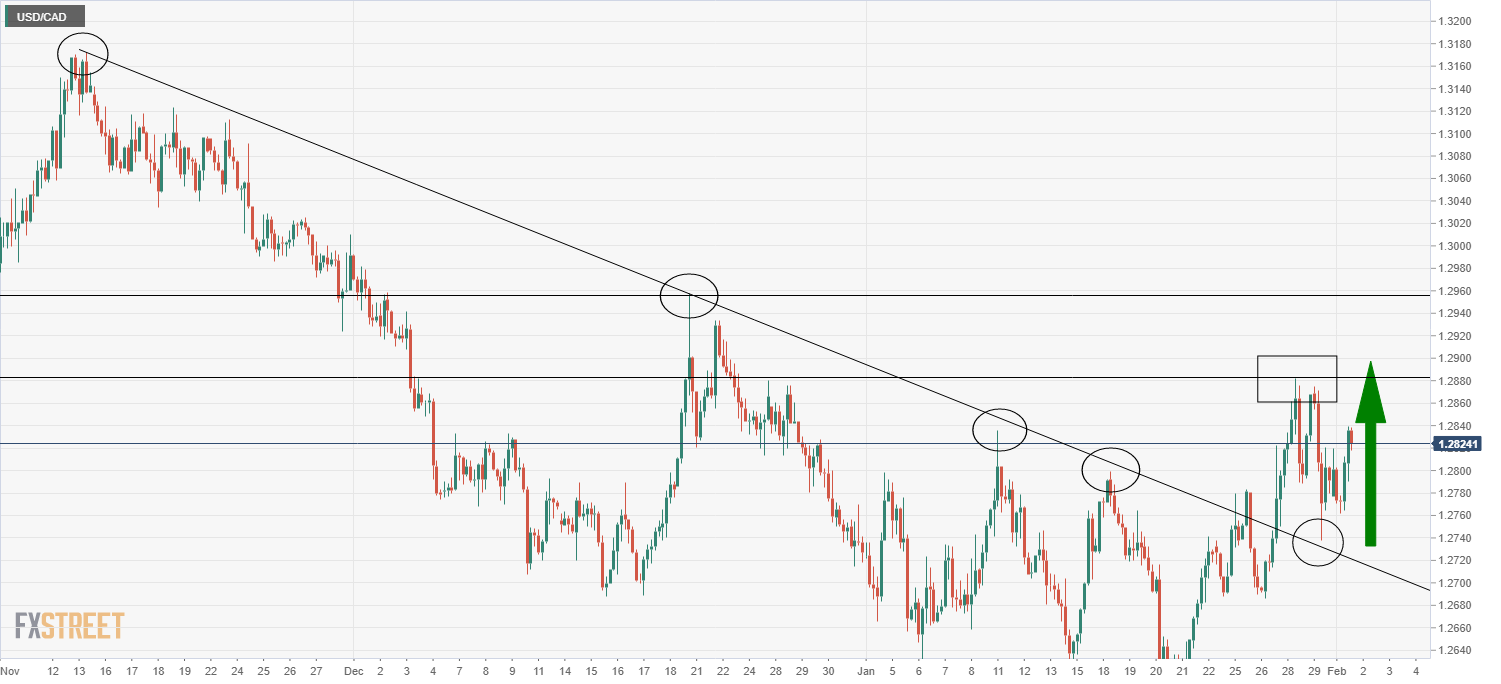

Last Wednesday, USD/CAD broke above a key long-term downwards trend channel; the pair broke above a downtrend linking the 13 November, 21 December, 18 and 25 January highs and surged to fresh highs for 2021 at not too far from the 1.2900 level, a decent reversal from multi-year lows set earlier on in the month of just below 1.2600. Last Friday, the currency pair fell back towards this long-term downtrend, tested it, found support and has since been moving back towards 2021 highs again. The fact that this previous key downtrend resistance has now become support is a bullish signal; USD/CAD traders will now be eyeing further gains over the coming days/weeks and may target a retest of 2021 highs in the 1.2880s and then perhaps onto December highs in the mid-1.2900s.

USD/CAD four-hour chart