- Manufacturing Sales: Tuesday, 12:30. This key manufacturing indicator posted a sharp gain of 1.6% in May, matching the forecast. The markets are braced for a sharp drop in June, with an estimate of -1.8%.

- Inflation Data: Wednesday, 12:30. CPI contracted by 0.2% in June, its first decline in six months. A small gain of 0.1% is projected in July. Core CPI, which excludes the most volatile items in CPI, slowed to zero. Will we see an improvement in inflation in the July release?

- Retail Sales Data: Friday, 12:30. Retail sales is the primary gauge of consumer spending. The indicator declined in May by 0.1%, well below the market forecast of a 0.3% gain. Another decline is expected in June, with an estimate of -0.3%. Core retail sales fell by 0.3%, and the markets are braced for a decline of 0.1% in the upcoming release.

* All times are GMT

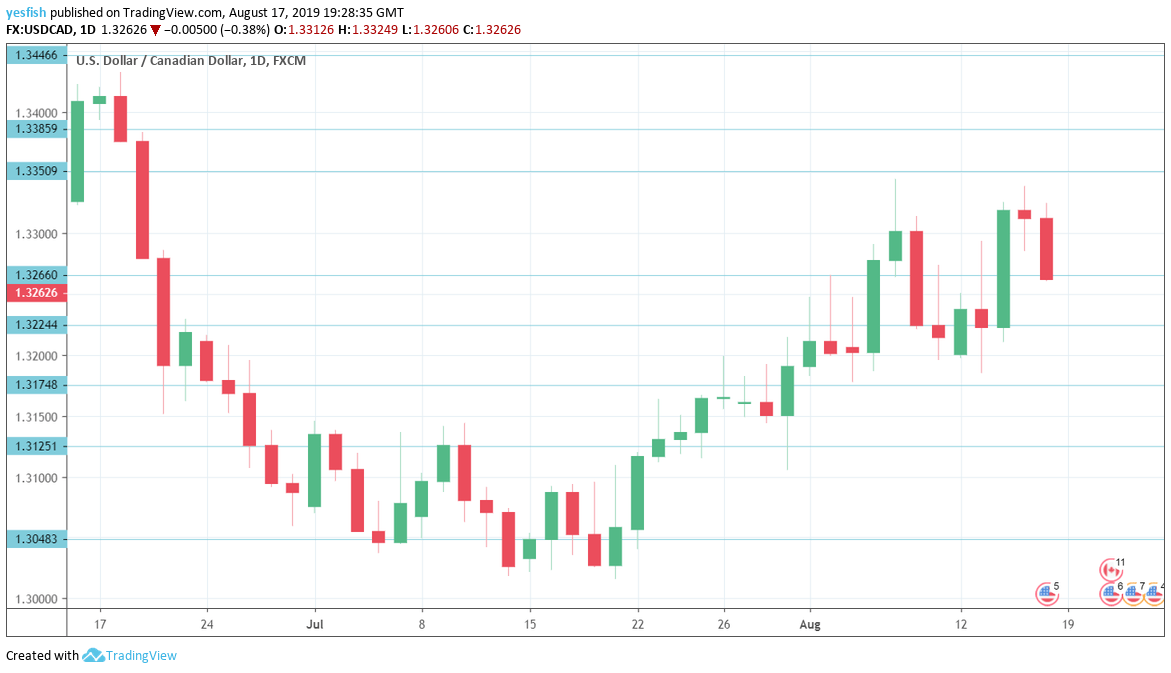

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3665, which was the high for 2018. 1.3565 is next.

1.3445 has held in resistance since the first week of June. This is followed by 1.3385.

1.3350 has held steady since mid-June.

1.3265 switched to a support role in mid-week as USD/CAD posted strong gains.

1.3175 is the next line of support.

1.3125 (mentioned last week) is next.

1.3048 has held since mid-July.

1.2916 is the final support level for now.

I remain bearish on USD/CAD

The Canadian dollar continues to struggle and more headwinds could be in store for the currency. Wall Street suffered its worst day of the year last week and trade tensions between the U.S-China remain high. With investor risk appetite under pressure, the Canadian dollar will have a tough time holding its own against the U.S. dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!